Question: I need help completing the consolidated worksheet in table 4 Assessment 2: Consolidations Exercise 1 Worksheet: Consolidated Balances On January 1, 2015, the Prather Company

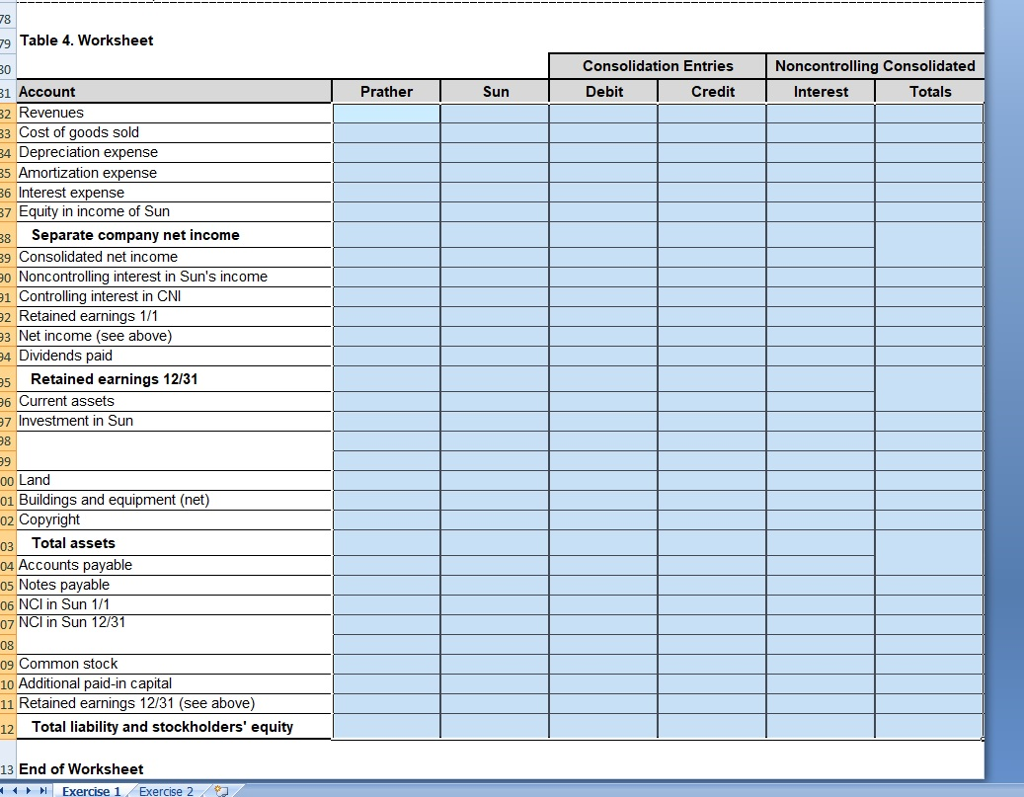

I need help completing the consolidated worksheet in table 4

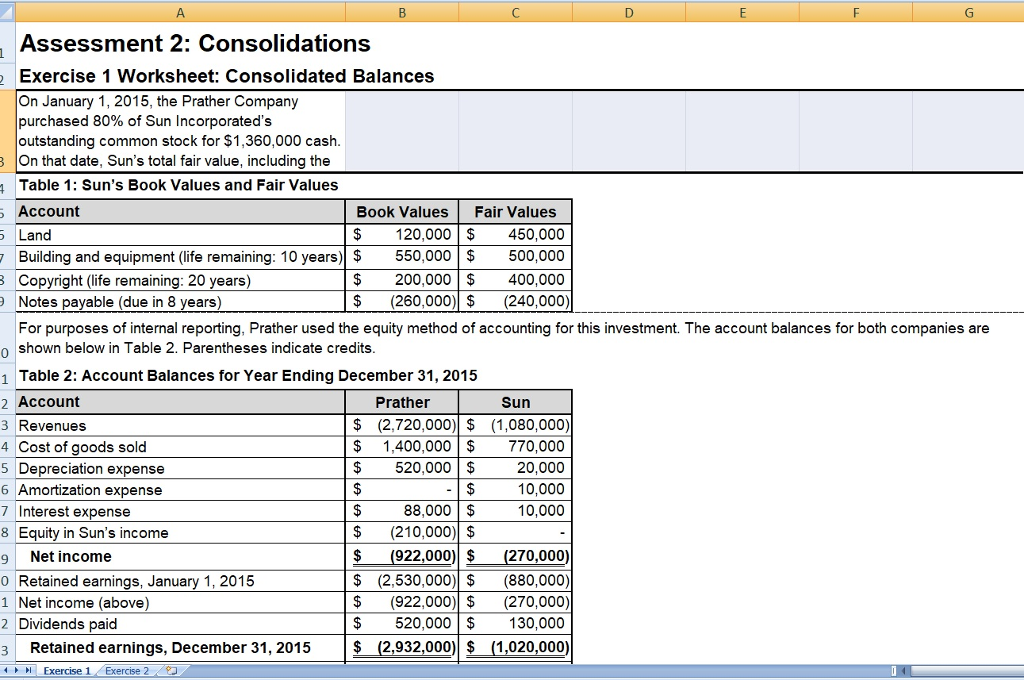

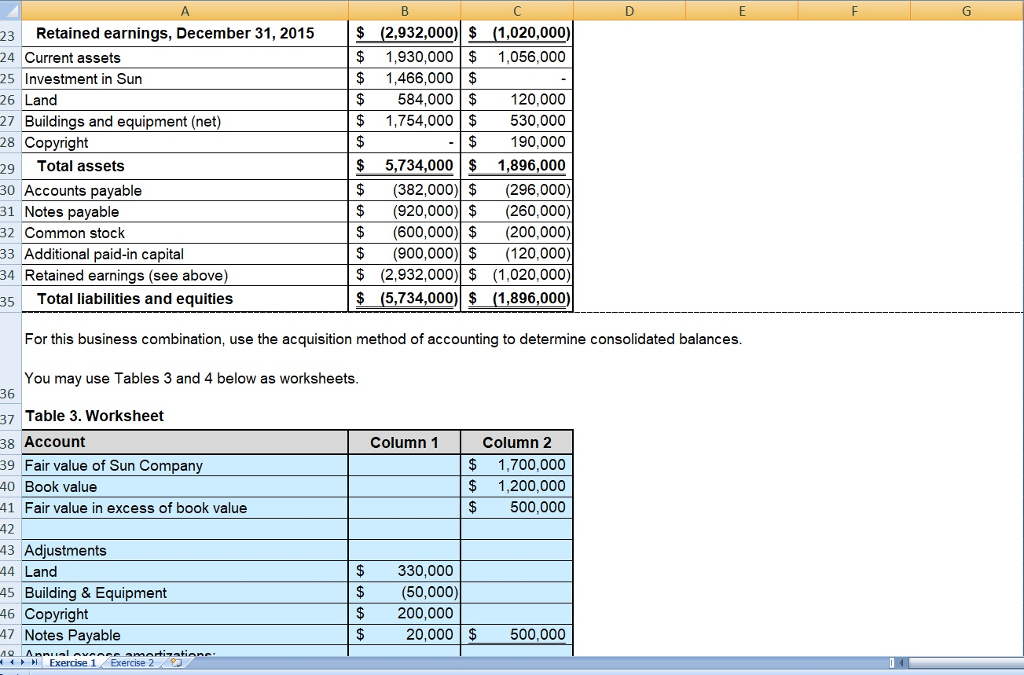

Assessment 2: Consolidations Exercise 1 Worksheet: Consolidated Balances On January 1, 2015, the Prather Company purchased 80% of Sun Incorporated's outstanding common stock for $1,360,000 cash On that date, Sun's total fair value, including the Table 1: Sun's Book Values and Fair Values Account Land Building and equipment (life remaining: 10 years) $550,000$500,000 Copyright (life remaining: 20 years) Notes payable (due in 8 years) For purposes of internal reporting, Prather used the equity method of accounting for this investment. The account balances for both companies are shown below in Table 2. Parentheses indicate credits Book Values Fair Values $120,000$ 450,000 $200,000$ 400,000 $(260,000)$(240,000) 0 1 Table 2: Account Balances for Year Ending December 31, 2015 2 Account 3 Revenues 4 Cost of goods sold S Depreciation expense 6 Amortization expense 7 Interest expense 8 Equity in Sun's income 9 Net income 0 Retained earnings, January 1, 2015 1 Net income (above) 2 Dividends paid 3 Retained earnings, December 31, 2015 4 H Exercise 1 Exercise 2 Prather Sun $ (2,720,000) $ (1,080,000) $1,400,000$ 770,000 $520,000 $ 20,000 10,000 10,000 88,000 S (210,000) $ $(922,000) $ (270,000) $ (2,530,000) $(880,000) $ (922,000$(270,000) $ 520,000$ 130,000 $ (2,932,000) (1,020,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts