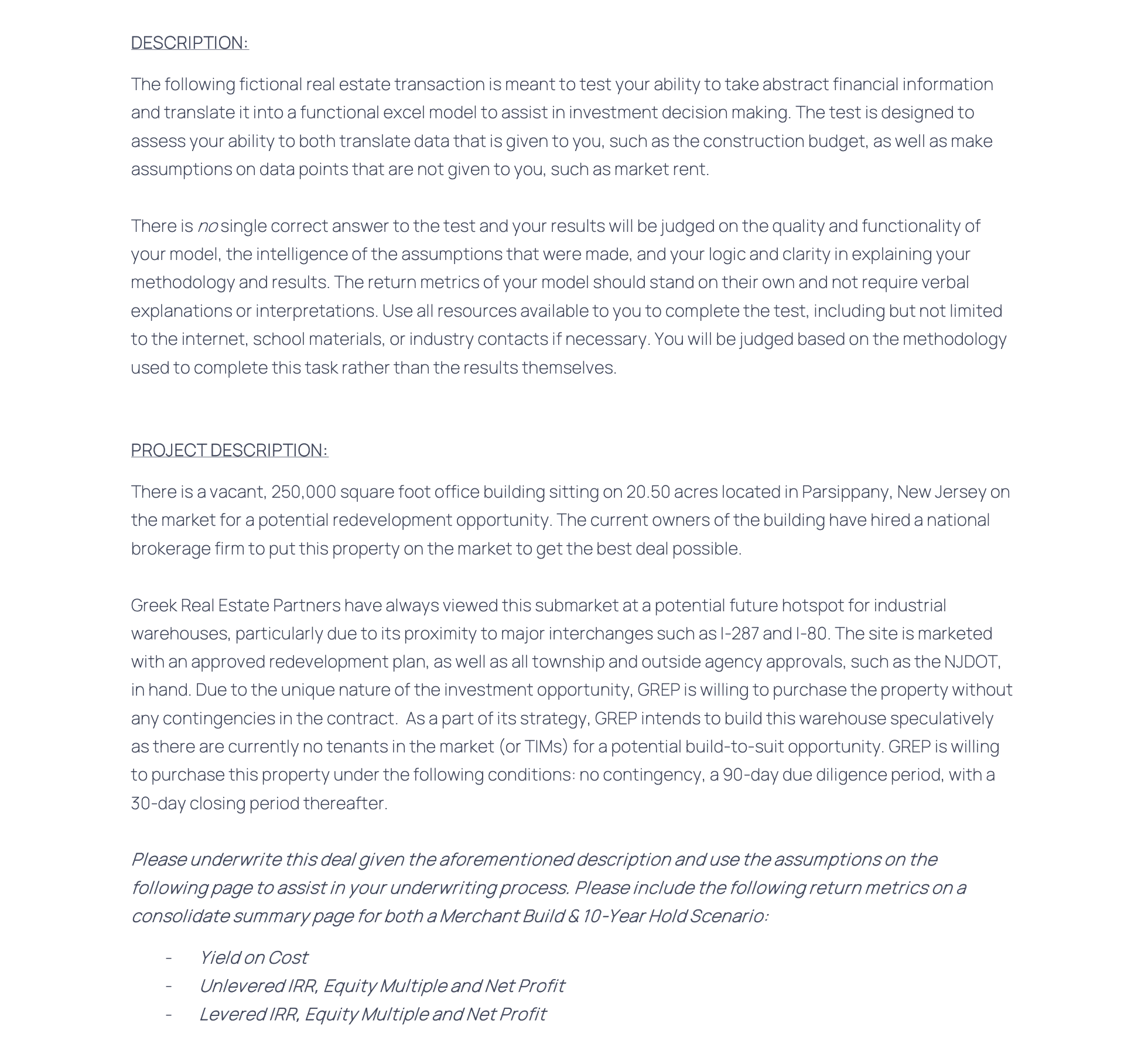

Question: I need help completing the industrial real estate underwriting assignment given in the pictures using Excel. Please underwrite this deal given the description on the

I need help completing the industrial real estate underwriting assignment given in the pictures using Excel. Please underwrite this deal given the description on the st picture and the assumptions on the other picture as well as the budget information listed below to assist in the underwriting process. It must include the following return metrics on a consolidated summary page for both a Merchant Build & Year Hold Scenario:

Yield on Cost

Unlevered IRR, Equity Multiple and Net Profit

Levered IRR, Equity Multiple and Net Profit

There should be a rd image but it won't let me upload itIts a table and it goes Budget Line, Item Cost, PSF This is what it says:

Purchase Price, $$

Diligence & Closing Costs, $$

Demolition Costs, $$

Hard Construction Costs, $$

Architectural & Engineering Costs, $$

Testing & Inspection Costs, $$

Permits & Fees Costs, $$

Legal & Closing Costs, $$

Marketing CostsTBD TBD

Financing & Interest CostsTBD TBD

Other InclGen Contingency$$

Totals, $$

Budget line item not included and will need to be determined given assumption from prior page and incorporated into budget

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock