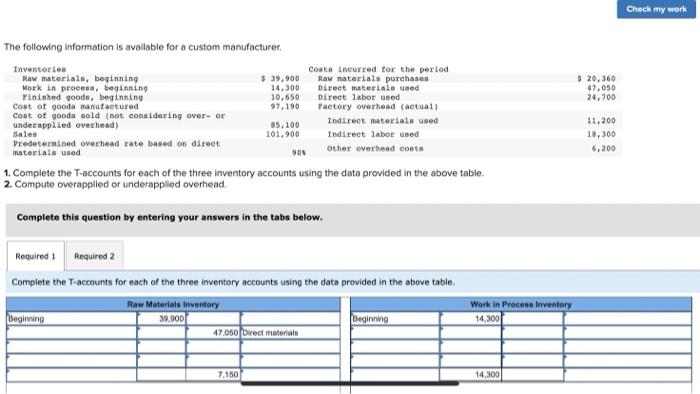

Question: I need help completing these charts. I have done as much as I could. It is due tonight please help! Check my work $ 20,360

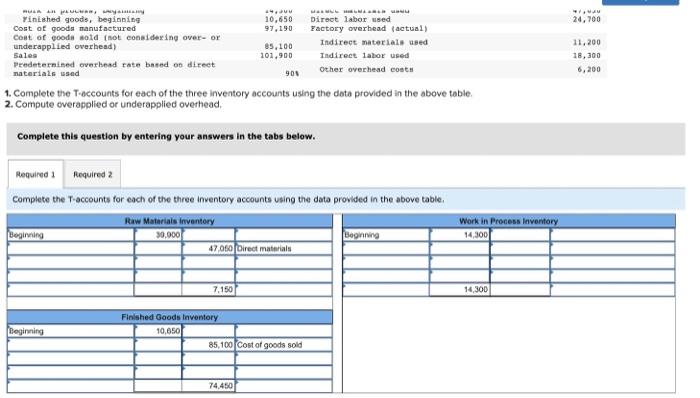

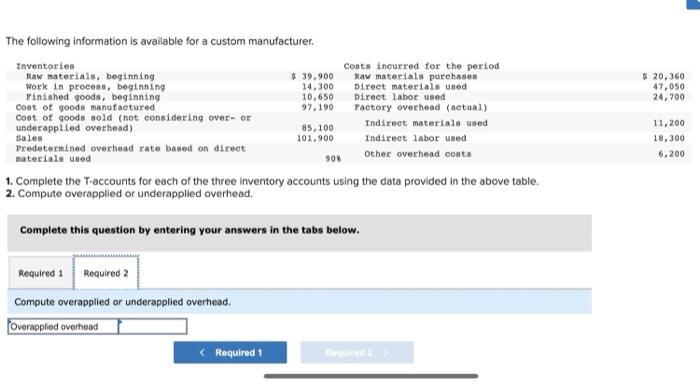

Check my work $ 20,360 47,050 24,700 The following information is available for a custom manufacturer Inventories Coate incurred for the period Raw materials, beginning $ 39,900 Raw materials purchases Work in process, beginning 14.300 Direct materials used Pinished goods, beginning 10,650 Direct laborened coot of good manufactured 97, 190 Factory overhead (actual cost of goods sold (not considering over- or underappi Led overhead) 85,100 Indirect materials used Sales 101,900 Indirect labor used predetermined overhead rate based on direct materials used 90 Other overhead conse 1. Complete the T-accounts for each of the three inventory accounts using the data provided in the above table. 2. Compute overapplied or underapplied overhead 11,200 18,300 6.200 Complete this question by entering your answers in the tabs below. Required: Required 2 Complete the Taccounts for each of the three inventory accounts using the data provided in the above table Raw Materials inventory Beginning 39.900 Beginning 47.050 Direct materials Work in Process Inventory 14,300 7.150 14,300 M 24,700 Sales RUE ANUARY WARNA Yinished goods, beginning 10,650 Direct laborused Cost of goods manufactured 97.190 Factory overhead (actual) cont of goods sold (not considering over or underapplied overhead 85,100 Indirect materials used 101,900 Indirect labor used Predetermined overhead rate based on direct materials used 900 Other overhead coats 1. Complete the T-accounts for each of the three inventory accounts using the data provided in the above table 2. Compute overapplied or underapplied overhead. 11,200 18,300 6,200 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the T-accounts for each of the three Inventory accounts using the data provided in the above table. Raw Materials inventory Beginning Work in Process Inventory Beginning 30,000 14,300 47,050 (Direct materials 7.150 14,300 Beginning Finished Goods Inventory 10,050 85,100 Cost of goods sold 74,450 $ 20,360 47,050 24,700 The following information is available for a custom manufacturer. Inventories Conts incurred for the period Raw materials, beginning $ 39,900 Raw materiale purchases Work in process, beginning 14,300 Direct materials used Tinished goods, beginning 10,650 Direct labor und Coat of goods manufactured 97, 190 Tactory overhead (actual) Cost of goods sold (not considering over- or underapplied overhead) 85,100 Indirect materials used sales 101.900 Indirect labor used predetermined overhead rate based on direct materials used 904 Other overhead costs 1. Complete the T-accounts for each of the three inventory accounts using the data provided in the above table. 2. Compute overapplied or underapplied overhead. 11,200 18,300 6,200 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute overapplied or underapplied overhead. Overapplied overhead Required 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts