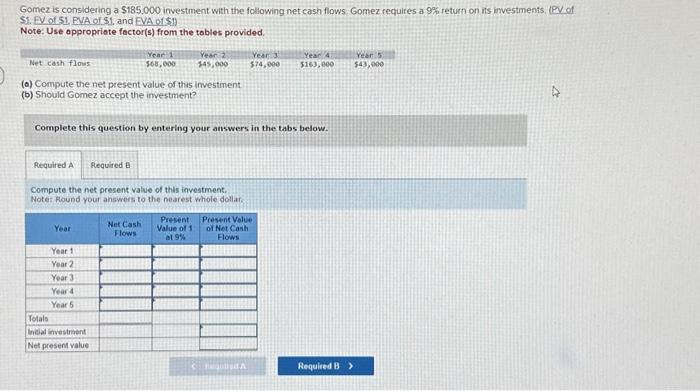

Question: I need help computing net present value of the investment and if they should accept or not. Gomez is considering a $185,000 investment with the

Gomez is considering a $185,000 investment with the following net cash flows. Gomez requires a 9% return on ins irvestments, (PV of 51. EV of S1. PVA of S1, and EVA of S1) Note: Use appropriate factor(s) from the tables provided. (o) Compute the net present value of this investment (b) Should Gomez accept the investment? Complete this question by entering your answers in the tabs below. Compute the net present value of this investment. Notet Round your answers to the nearest whole dollar. Gomez is considering a $185,000 investment with the following net cash flows. Gomez requires a 9% return on its investments. (PV of \$1. FV of \$1. PVA of $1, and EVA of \$1) Note: Use oppropriate factor(s) from the tables provided. (a) Compute the net present value of this investment. (b) Should Gomez accept the investment? Complete this question by entering your answers in the tabs below. Should Gomez accept the investment? Gomez is considering a $185,000 investment with the following net cash flows. Gomez requires a 9% return on ins irvestments, (PV of 51. EV of S1. PVA of S1, and EVA of S1) Note: Use appropriate factor(s) from the tables provided. (o) Compute the net present value of this investment (b) Should Gomez accept the investment? Complete this question by entering your answers in the tabs below. Compute the net present value of this investment. Notet Round your answers to the nearest whole dollar. Gomez is considering a $185,000 investment with the following net cash flows. Gomez requires a 9% return on its investments. (PV of \$1. FV of \$1. PVA of $1, and EVA of \$1) Note: Use oppropriate factor(s) from the tables provided. (a) Compute the net present value of this investment. (b) Should Gomez accept the investment? Complete this question by entering your answers in the tabs below. Should Gomez accept the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts