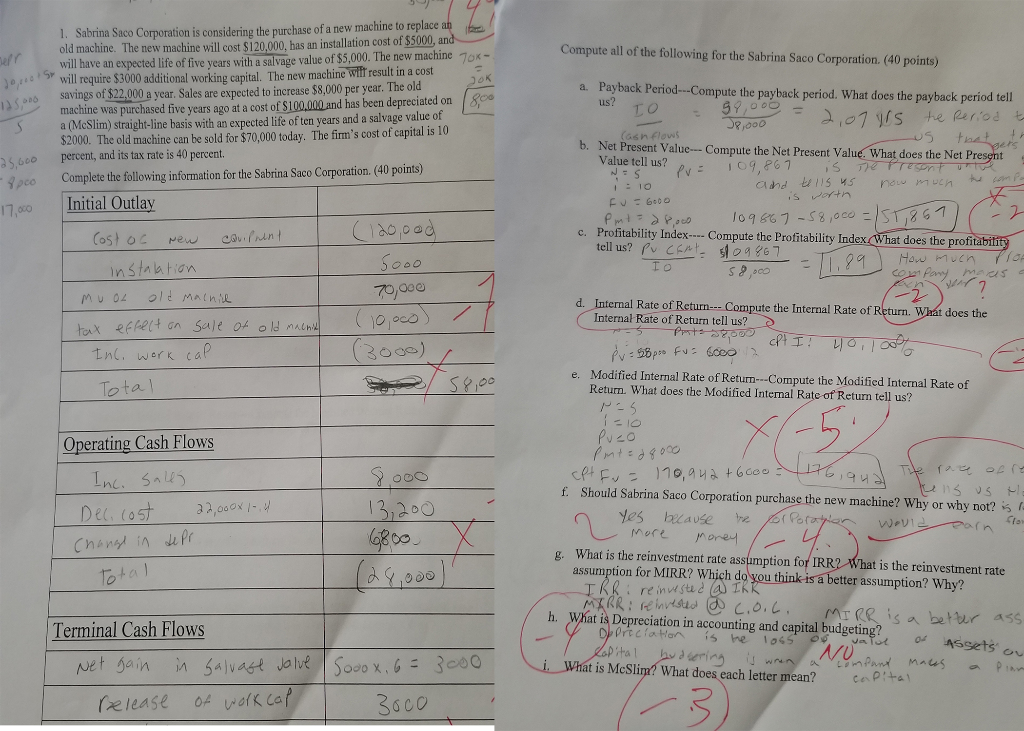

Question: I need help correcting my test total 6000 was wrong for terminal cash flows total 1. Sabrina Saco Corporation is considering the purchase of a

I need help correcting my test  total 6000 was wrong for terminal cash flows total

total 6000 was wrong for terminal cash flows total

1. Sabrina Saco Corporation is considering the purchase of a new machine to replace old machine. The new machine will cost $120,000, has an installation cost of $5000, an will have an expected life of five years with a salvage value of $5,000. The new machine 1Tox- will require $3000 additional working capital. The new machine wilf result in a cost Compute all of the following for the Sabrina Saco Corporation. (40 points) o savings of $22,000 a year. Sales are expected to increase $8,000 per year. The old Sa (McSlim) straight-line basis with an expected life of ten years and a salvage value of a. Payback Period...Compute the payback period. What does the payback period tell S he erodt machine was purchased five years ago at a cost of $100,000 and has been depreciated on $2000. The old machine can be sold for $70,000 today. The firm's cost of capital is 10 Complete the following information for the Sabrina Saco Corporation. (40 points) asn Elows b. Net Present Value- Compute the Net Present Value. What does the Net Pre Sbo percent,and its tax rate is 40 percent. 5,600 17 Initial Outlay Value tell us? pco c. Profitability Index Cost o e Compute the Profitability Index. What does the prof 67 tell us? fv C 7o,0 -7 d. Internal Rate of Return. Compute the Internal Rate of 2 Wht does the Internal Rate of Return tell us? e. Modified Internal Rate of Return--Compute the Modified Internal Rate of eta Return. What does the Modificd Intemal Rate of Return tell us? 165 Operating Cash Flows f. Should Sabrina Saco Corporation purchase the new machine? Why or why not? Mort g. What is the reinvestment rate assumption for IRR? What is the reinvestment rate To assumption for MIRR? Which do you think is a better sumtion? Why? re inustaaI h. What is Depreciation in accounting and capital budgeting? Terminal Cash Flows Assets ru cpta n 54 is McSline? What does each letter mean? 3600 1. Sabrina Saco Corporation is considering the purchase of a new machine to replace old machine. The new machine will cost $120,000, has an installation cost of $5000, an will have an expected life of five years with a salvage value of $5,000. The new machine 1Tox- will require $3000 additional working capital. The new machine wilf result in a cost Compute all of the following for the Sabrina Saco Corporation. (40 points) o savings of $22,000 a year. Sales are expected to increase $8,000 per year. The old Sa (McSlim) straight-line basis with an expected life of ten years and a salvage value of a. Payback Period...Compute the payback period. What does the payback period tell S he erodt machine was purchased five years ago at a cost of $100,000 and has been depreciated on $2000. The old machine can be sold for $70,000 today. The firm's cost of capital is 10 Complete the following information for the Sabrina Saco Corporation. (40 points) asn Elows b. Net Present Value- Compute the Net Present Value. What does the Net Pre Sbo percent,and its tax rate is 40 percent. 5,600 17 Initial Outlay Value tell us? pco c. Profitability Index Cost o e Compute the Profitability Index. What does the prof 67 tell us? fv C 7o,0 -7 d. Internal Rate of Return. Compute the Internal Rate of 2 Wht does the Internal Rate of Return tell us? e. Modified Internal Rate of Return--Compute the Modified Internal Rate of eta Return. What does the Modificd Intemal Rate of Return tell us? 165 Operating Cash Flows f. Should Sabrina Saco Corporation purchase the new machine? Why or why not? Mort g. What is the reinvestment rate assumption for IRR? What is the reinvestment rate To assumption for MIRR? Which do you think is a better sumtion? Why? re inustaaI h. What is Depreciation in accounting and capital budgeting? Terminal Cash Flows Assets ru cpta n 54 is McSline? What does each letter mean? 3600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts