Question: I need help creating a balance sheet! your comment was incomplete. I don't know what to add. Catherine Yang raced back to her apartment after

I need help creating a balance sheet!

your comment was incomplete. I don't know what to add.

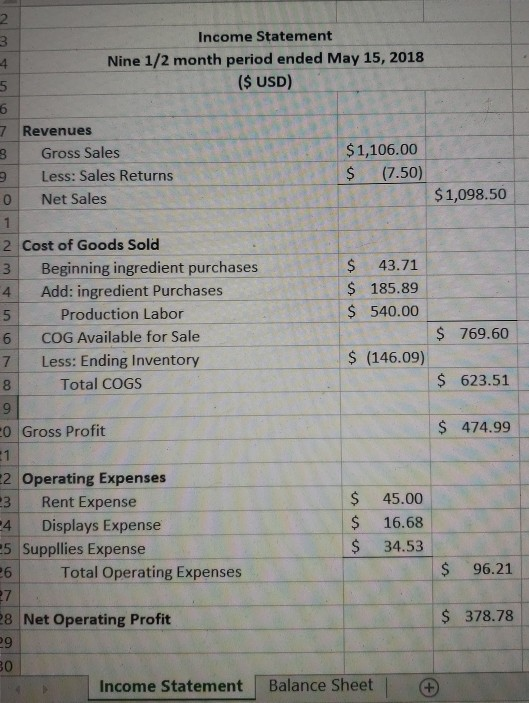

Catherine Yang raced back to her apartment after her morning classes. She'd been using all of her spare time lately (outside of recruiting, her club activities and football games) to work on her plans for Catherine's Canine Cookies. She still hadn't decided exactly what type of business she wanted to open, but she had decided to start with thinking about a small craft bakery with an online presence and some local retail customers. This was a natural extension of what she'd been doing and so it seemed a logical place to start The first thing she wanted to do was figure out whether the informal way she'd been running her business was profitable. She'd been talking to her Accounting professor from second year, who had reminded her about the construction of income statements and balance sheets. This was her plan for the afternoon. Catherine decided to take the last year as her starting year for the business. She had begun by asking her mom to loan her $100 for baking supplies (ingredients for the raw ingredients, baking bowls, cookie cutters and baking sheets). She'd kept receipts for those things, and it turned out she had spent $43.71 at Safeway for the ingredients plus $34.53 at Walmart for the tools. From her first purchases, she'd made 10 dozen treats: 5 dozen were the large peanut butter bones, which she sold for $6.50/dozen, 4 dozen were carob chip cookies ($7.25/dozen), and 1 dozen were birthday treats that sold for $2.50 each. She'd made and sold these to friends and friends of friends over the course of about 8 months. Excited by this first year success, Catherine had decided to set up at the Moscow Farmer's Market for one day on a Saturday in early May. It was the start of the market and the end of her school year so the timing was good. The market managers charged her $30 for a table for the day (plus a registration fee of $15) and advised her that the average market Saturday saw about 8,000 people. They couldn't tell her how many of those people would purchase dog treats but suggested that she could easily see 1,000 if she made her selections well. Getting ready for that many potential customers was a daunting task for Catherine. She decided to hire a couple of her friends for a week to help her bake. They worked out of her apartment kitchen (and living room and every other inch of space they could manage). Both Steve and Asha worked with her all week for $10/hour earh Thev mostly worked in the evenines they all sent a total of 27 hours baking week, for $10/hour each. They mostly worked in the evenings, they all spent a to for the weekend. Catherine had purchased additional ingredients for this round of baking, from Winco this time instead of Safeway because she knew it would be cheaper. She bought 15 pounds of whole wheat flour, 8 pounds of peanut butter, 9 pounds of apple sauce, 32 ounces of chicken stock, 40 ounces of baking powder, 4.5 pounds of carob chips, 72 ounces of oats, 5.5 pounds of pumpkin puree, 48 ounces of vegetable oil, 3 dozen eggs, 10 pounds of carrots, and 6 pounds of cream cheese. The total bill from Winco was $178.20, she was able to save by buying from the bulk bins and she used up pretty much all of the ingredients she purchased to make her cookies. She and her friends prepared 36 dozen peanut butter bones, 72 dozen mini carob chip cookies, 144 individual birthday treats, and 1,000 duck/cranberry hearts, a new addition to her baking lineup, to be sold in packages of So. She also bought goodie bags to put the treats in-she found a great deal on Amazon - 100 bags for $7.69, in total she purchased 300 bags. On market day, Catherine set up her table (she used an old folding table and lawn chair loaned from her mom) with a cloth that she'd also bought on Amazon for $8.70 and then stitched her company name on with basic embroidery floss ($2.98 at loanne's Fabrics). She'd picked up some baskets to display her products at the Dollar Store for $5.00. All in all, the display looked pretty good. By 9am, Catherine had sold $100 worth of treats. By the end of the day, she'd sold most of what she brought. She sold her treats at the same prices she had sold to friends. The individual treats sold best, but she'd also done well with the carob chip cookies and peanut butter bones. The duck/cranberry hearts which she thought would make great training treats sold for $6.00 for a package of 50. She'd sold half of what she brought, so she had 10 packages leftover at the end of the day. She also sold 28 dozen peanut butter bones, 60 dozen mini carob chip cookies, and 135 individual birthday treats, making her total sales for the day $1,014.50, though she later had 3 customers return one individual birthday treat each, they mistook them for iced cookies and told her they tasted terrible. Catherine tried not to laugh as she refunded their money. She decided the funny story was worth the lost revenue. After noting all of this down on paper Catherine thought she was ready to start constructing her income statement and balance sheet. She thought she had most of the information she needed, though she wondered if she should be keeping track of how she used her apartment. She knew her mom did this for taxes each year but wasn't exactly sure what to do about it so she decided to proceed with just this information. 2 3 Income Statement 4 Nine 1/2 month period ended May 15, 2018 5 ($ USD) 6 7 Revenues 3 Gross Sales $1,106.00 Less: Sales Returns $ (7.50) 0 Net Sales 2 $1,098.50 $ 769.60 $ 623.51 $ 474.99 2 Cost of Goods Sold 3 Beginning ingredient purchases $ 43.71 4 Add: ingredient Purchases $ 185.89 5 Production Labor $ 540.00 6 COG Available for Sale 7 Less: Ending Inventory $ (146.09) 8 Total COGS 9 C0 Gross Profit 1 E2 Operating Expenses 23 Rent Expense $ 45.00 24 Displays Expense $ 16.68 25 Suppllies Expense 34.53 26 Total Operating Expenses 27 28 Net Operating Profit 29 30 Income Statement Balance Sheet $ $ 96.21 $ 378.78

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts