Question: I need help creating and LP or GRG model for the testing of a portfolio as per attached word file or instructions below. Excel file

I need help creating and LP or GRG model for the testing of a portfolio as per attached word file or instructions below. Excel file contains the dataset for modelling purposes.Data from excel is also below. Conceptual Understanding:

A "6-pack portfolio" typically refers to a diversified investment portfolio consisting of six different asset classes, securities, or investment types. The idea is to balance risk and return by spreading investments across various sectors or categories.

Objective:

- Develop an optimal trading strategy leveraging Linear or nonlinear programming techniques to maximize risk-adjusted expected returns while adhering to specific constraints.

Data Collection:

- Obtain historical returns data for a selection of assets and TSX index serving as benchmark:

- SPTSX Index (benchmark)

- Financial - RY CN Equity

- Utility - FTS CN Equity

- Telecom - T CN Equity

- Industrial - CNR CN Equity

- Real Estate - IIP-U CN Equity

- Energy - ENB CN Equity

Model Formulation:

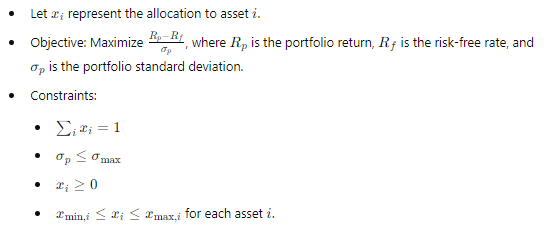

- Define the decision variables: Allocation percentages for each asset class.

- Objective function: Maximize the Sharpe ratio (risk-adjusted return).

- Constraints:

- Budget constraint: Sum of allocation percentages = 100%.

- Risk tolerance: Define a maximum acceptable portfolio variance.

- Non-negativity: Allocation percentages must be non-negative.

- Diversification constraints: Set minimum and maximum allocation limits for each asset class to ensure diversification.

Mathematical Representation:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts