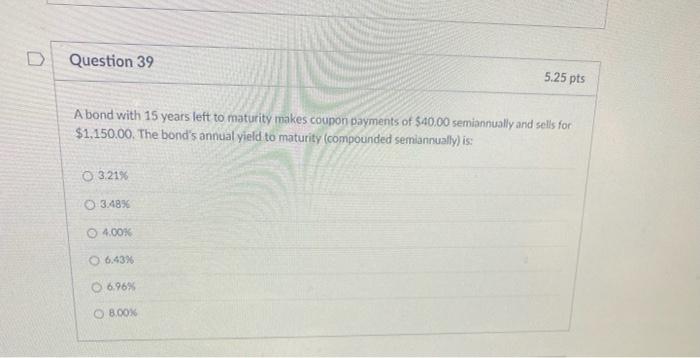

Question: I need help. D Question 39 5.25 pts A bond with 15 years left to maturity makes coupon payments of $40.00 semiannually and sells for

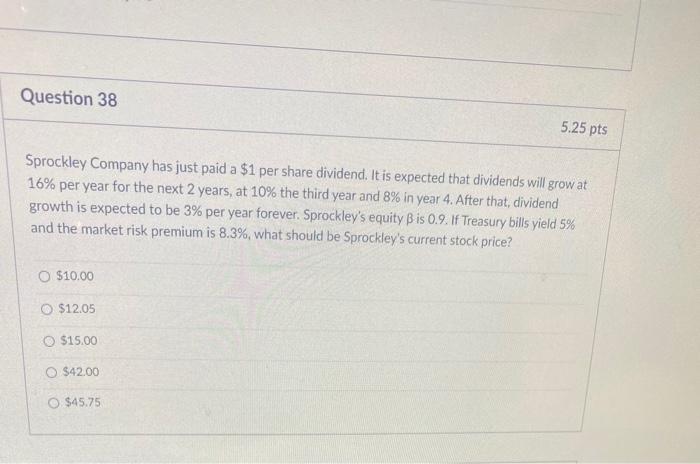

D Question 39 5.25 pts A bond with 15 years left to maturity makes coupon payments of $40.00 semiannually and sells for $1.150.00. The bond's annual yield to maturity (compounded semiannually) is: O 3.21% 3.48% 4.00% O 6.43% O 6.96% 8.00% Question 38 5.25 pts Sprockley Company has just paid a $1 per share dividend. It is expected that dividends will grow at 16% per year for the next 2 years, at 10% the third year and 8% in year 4. After that, dividend growth is expected to be 3% per year forever. Sprockley's equity B is 0.9. If Treasury bills yield 5% and the market risk premium is 8.3%, what should be Sprockley's current stock price? O $10.00 O $12.05 O $15.00 O $42.00 O $45.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts