Question: I need help determining the information to put on the 941. I am unable to determine the Gross wages for line 2. I thought it

I need help determining the information to put on the 941. I am unable to determine the Gross wages for line 2. I thought it was supposed to be Total gross wages - 401K - section 125. But its telling me that's wrong. Can you help me determine the correct amount. Also I need help determining the correct amount for the taxable social security wages. Here is the information I am reviewing below to find my answer.

4th Qtr YTD SUTA Payments for Employees

Chinson $3630

Wayland $3466.67

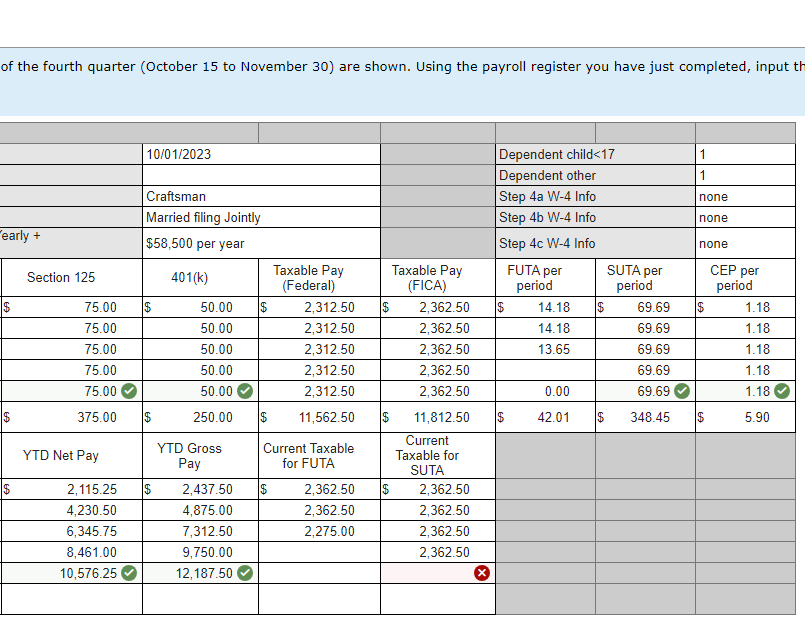

Peppinico $2362.50

Cooper $2751.93

Hissop $2103.85

Success $1817.79

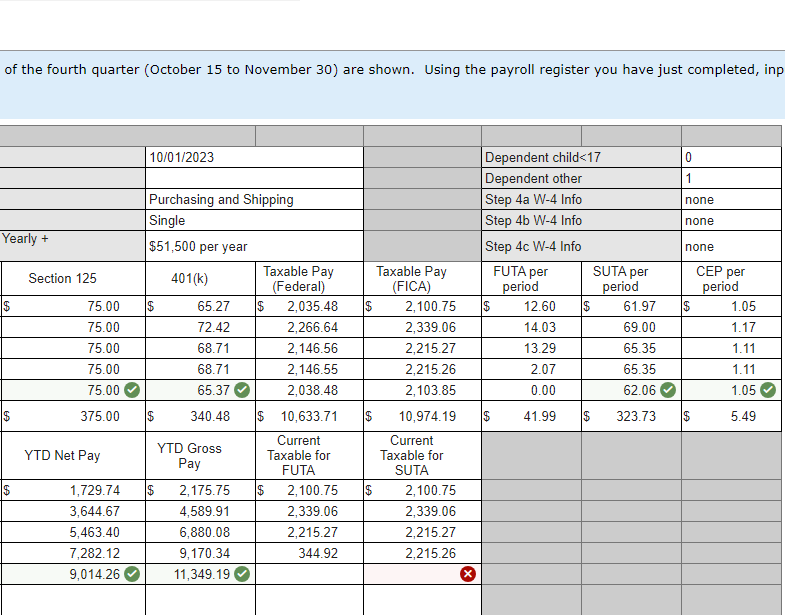

of the fourth quarter (October 15 to November 30) are shown. Using the payroll register you have just completed, inp 10/01/2023 Dependent child=17 0 Dependent other 1 Purchasing and Shipping Step 4a W-4 Info none Single Step 4b W-4 Info none Yearly + $51,500 per year Step 4c W-4 Info none Section 125 401(k) Taxable Pay Taxable Pay FUTA per SUTA per CEP per Federal) (FICA) period period period $ 75.00 $ 65.27 $ 2,035.48 $ 2, 100.75 12.60 61.97 $ 1.05 75.00 72.42 2,266.64 2,339.06 14.03 69.00 1.17 75.00 68.71 2, 146.56 2,215.27 13.29 65.35 1.11 75.00 58.71 2,146.55 2,215.26 2.07 65.35 1.11 75.00 65.37 2,038.48 2,103.85 0.00 62.06 1.05 $ 375.00 340.48 $ 10,633.71 10,974.19 $ 41.99 $ 323.73 $ 5.49 Current Current YTD Net Pay YTD Gross Pay Taxable for Taxable for FUTA SUTA 1,729.74 2, 175.75 2, 100.75 $ 2, 100.75 3,644.67 4,589.91 2,339.06 2,339.06 6,463.40 6,880.08 2,215.27 2,215.27 7,282.12 9, 170.34 344.92 2,215.26 9,014.26 11,349.19 Xay periods of the fourth quarter (October 15 to November 30) are shown. Using the payroll register you have just completed 10/01/2023 Dependent child