Question: i need help developing this question starting January 1st, 2005, through January 1st, 2021: (i) Bid and asked exchange rates (spot and 1- and 6-month

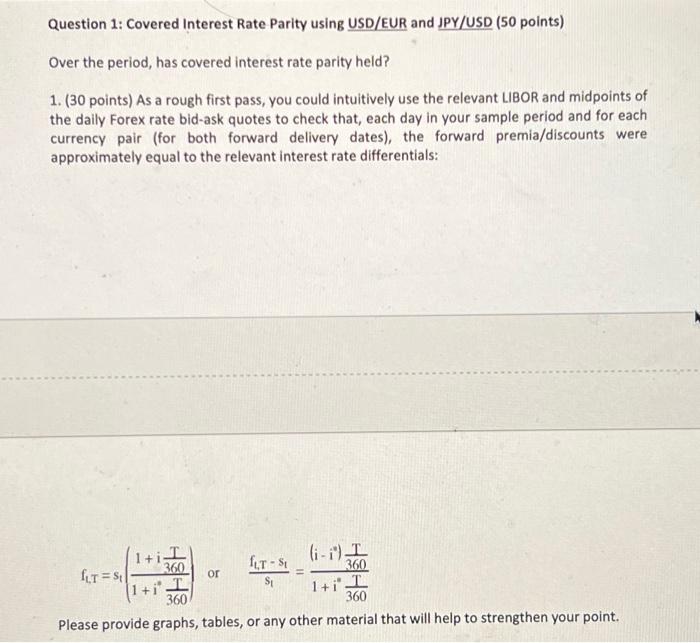

starting January 1st, 2005, through January 1st, 2021: (i) Bid and asked exchange rates (spot and 1- and 6-month forwards) for two currency pairs: USD/GBP (Euro); JPY/USD (Yen). (ii) The 1- and 6-month interbank asked interest rates (LIBOR) for the relevant three currencies: USD, GBP and JPY. (iii) The 1-month and 6-month interbank bid and asked interest rates (LIBID) for the following three currencies: USD, GBP and JPY (see note below on how to compute them if you can't find). Question 1: Covered Interest Rate Parity using USD/EUR and JPY/USD ( 50 points) Over the period, has covered interest rate parity held? 1. ( 30 points) As a rough first pass, you could intuitively use the relevant LIBOR and midpoints of the daily Forex rate bid-ask quotes to check that, each day in your sample period and for each currency pair (for both forward delivery dates), the forward premia/discounts were approximately equal to the relevant interest rate differentials: fL,T=s1(1+i360T1+i360T)ors1fL,Ts1=1+i360T(ii)360T Please provide graphs, tables, or any other material that will help to strengthen your point. starting January 1st, 2005, through January 1st, 2021: (i) Bid and asked exchange rates (spot and 1- and 6-month forwards) for two currency pairs: USD/GBP (Euro); JPY/USD (Yen). (ii) The 1- and 6-month interbank asked interest rates (LIBOR) for the relevant three currencies: USD, GBP and JPY. (iii) The 1-month and 6-month interbank bid and asked interest rates (LIBID) for the following three currencies: USD, GBP and JPY (see note below on how to compute them if you can't find). Question 1: Covered Interest Rate Parity using USD/EUR and JPY/USD ( 50 points) Over the period, has covered interest rate parity held? 1. ( 30 points) As a rough first pass, you could intuitively use the relevant LIBOR and midpoints of the daily Forex rate bid-ask quotes to check that, each day in your sample period and for each currency pair (for both forward delivery dates), the forward premia/discounts were approximately equal to the relevant interest rate differentials: fL,T=s1(1+i360T1+i360T)ors1fL,Ts1=1+i360T(ii)360T Please provide graphs, tables, or any other material that will help to strengthen your point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts