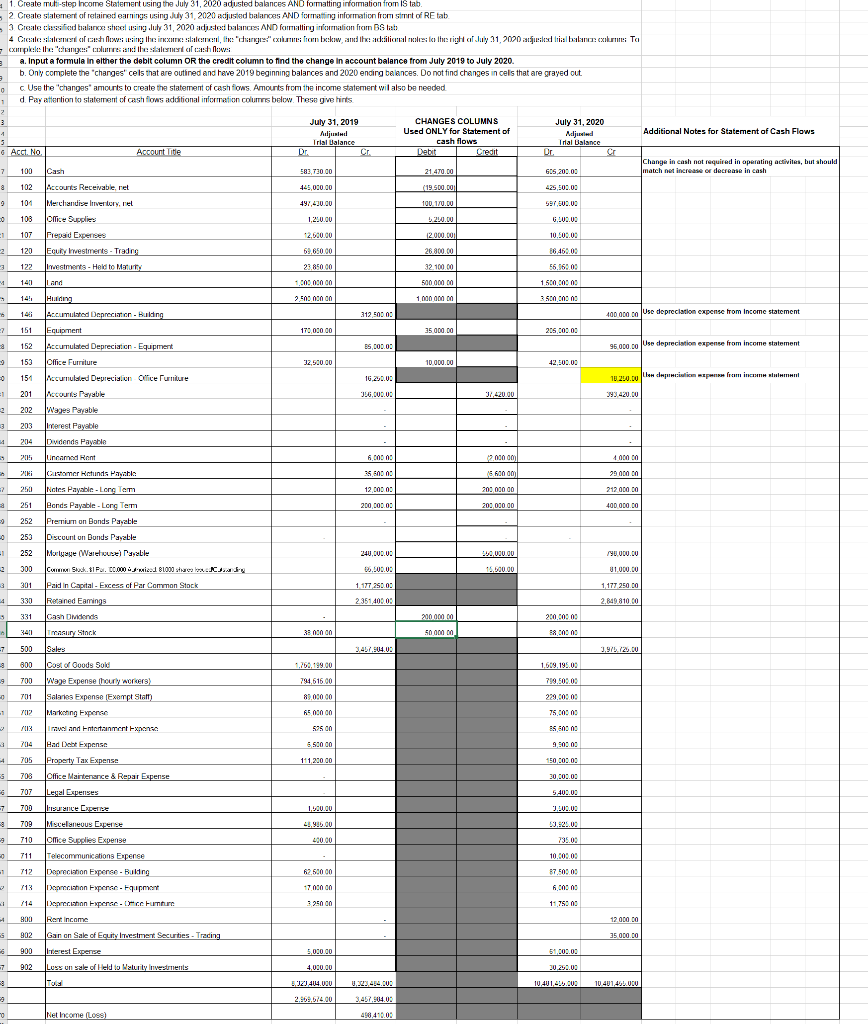

Question: I need help double checking my work using this information I had to make a Multistep Income statement, statement of retained earnings, balance sheet, and

I need help double checking my work using this information I had to make a Multistep Income statement, statement of retained earnings, balance sheet, and statement of cash flows. Thank you

Income Statement:

| Use the following format (in order): | ||

| 1. Input and list sales revenue, COGS, and calculate Gross Proft. | ||

| 2. Input and list operating expenses - these are normal expenses incurred while selling marine parts. Subtotal these amounts. Operating expenses do NOT have to be separated into selling or general and administrative expense categories. | ||

| 3. Calculate income from operations. | ||

| 4. Input and list other revenues and gains amounts - revenue earned, but NOT part of normal operations and subtotal these amounts. | ||

| 5. Input and list other expenses and losses amounts - expenses incurred, but NOT part of normal operations. Interest expense is always included in this category. Subtotal these amounts. | ||

| 6. Calculate Net Income (Loss). |

Statement of retained earnings

| Use the following format (in order): | ||

| 1. Input beginning balance (this is listed in the July, 31 2020 adjusted trial balance columns). | ||

| 2. List net income (loss) and cash dividends (if applicable). | ||

| 3. Subtotal items from #2 to calculate net increase or decrease in retained earnings. | ||

| 4. Calculate ending balance. |

Balance Sheet:

| Use the following format (in order): | |||

| 1. Input and list asset accounts in 3 categories: Current Assets; Property, Plant, and Equipment(PPE); Other Assets | |||

| 2. Each category from #1 requires a subtotal EXCEPT for Other Assets | |||

| 3. Calculate Total Assets | |||

| 4. Input and list liability accounts in 2 categories: Current Liabilities and Long-term Liabilities | |||

| 5. Each category from #4 requires a subtotal | |||

| 6. Calculate Total Liabilities | |||

| 7. Input and list Stockholder's Equity Accounts including ending balance of retained earnings from statement of retained earnings. | |||

| 8. Calculate Total Stockholder's Equity | |||

| 9. Calculate Total Liabilities and Stockholder's Equity. This amount should equal Total Assets |

Statement of Cash Flows

| TIPS PLEASE READ: | |||

| 1. Correct selection of "Increase" or "Decrease" in accounts must be used as part of the label where applicable | |||

| 2. Correct use of "cash paid" or "cash received" must be used where applicable | |||

| 3. Subtotals for each section MUST be properly identified as cash "used in" or "provided by" | |||

| 4. All changes utilize CASH. There ARE GAINS AND LOSSES from investments that must be included in operating activities | |||

| 5. Net change in cash + beginning cash balance (from a adjusted trial balance July 2019 column) must equal ending cash balance and be included at the bottom of this statement. |

1. Create multi-step Income Statement using the July 31, 2020 adusted balances ANO formatting information from IS tab 2. Create statement of retained earnings using July 31, 2020 adjusted balances AND formatting information from simt of RE tab 3 Create classified balance sheet using July 31, 2020 adjusted balances AND fcuratting information from BS lab 4 Cicle slalement est lesing the next slack, lengs" cxmes from backw, and haditional roles in the right of July 21, 2020 atbull Trial balance: exkurs Ta - xmpkile the muscles and the date of the a. Input a formula in either the debit column OR the credit column to find the change in account balance from July 2019 to July 2020. b. Only complete the changes cels that are outined and have 2019 beginning balances and 2020 ending balances. Do not find changes in cels that are grayed out Use the changes' amounts to create the statement of cash flows. Amounts from the income statement will also be needed d. Pay attention to statement of cash flows additional information columns below. These give hints 0 1 2 3 July 31, 2019 Aljusid Trial Balance Dr. Cr. Additional Notes for Statement of Cash Flows CHANGES COLUMNS Used ONLY for Statement of cash flows Debit Credit July 31, 2020 Mdljuded Trial Balance 3 G Acct. No Account Title Change in cash not required in operating activites, but should match net increase or decrease in cash 7 100 Cash 583.730.00 21.470.00 GOS 203.00 a 102 Accounts Receivable, ret 425,000.00 (19.600.00 425,505.00 9 101 497,420.00 100.170.00 587,502.02 103 1,200.00 G.202.00 107 Merchandise Inventory, rel Orice Supplies Prepaid Expenses Ecury vestments Tradne Inwestments - Hold to Marry 120000 1 -2 10.500 2,500.00 69.650.00 120 26.800.00 16.462.00 56.963.03 122 1411 And 23 850 00 1.000.00000 9.500.000 32.100.00 500 000 00 1.000 m 1 500.003 03 . 14! 3 500,00300 Hildung Accumulated Depreciation - Bulding 1921 14 312 500.00 40D OD Use depreciation expense from Income statement 151 Equipment 170 000 00 35 000.00 205 03.03 B5,000.00 95000.00 Uso depreciation expense from income statement 32,500.00 10 000.00 42.503.00 16.2.0.02 JUG,DUDU 10.200.00 depuis promican liman 393 420.00 97,420.00 152 Accumulated Depreciation Equipment . lo 153 Office Furniture 0 151 Accumuland Deprecision Office Furniture 201 Accounts Payable 2202 Wages Payable . -3 203Merest Payable .. 4 2014 pudends Payable est 2015 Uncanned Hot 6.000 200000) 1 000 00 Customer Hefunds Payabia 25,500 03 160000 2900000 2 250 12,000.00 200 000 00 212 000 DO 251 200 COD.O. 200 000 00 400 000.00 252 253 0 -1 3 252 24U.CO.US 112,000.00 190.000.CO 300 U1.000.00 301 1 17 250.00 1177 250.00 4 330 Notes Payable. Long Term Bands Payable - Long Term Premium on Bonds Payable Discount un Dunds Payable Morlaye (Warehouse ble Cm Stock. $I F..C.000 wiced 8.000 stala Paid in Capital - Excess of Par Common Stock 1 Retaned Eamings Cash Odends Treasury Stock P Sales 1 Cost of Goods Sold Wege Expense hourly workers) Salaries Expense Exempt Staff) Parking Experte 235140003 2.849.810.00 331 20000 200.000 18 3030: 33 000 00 50 000 -7 500 3.411.504.02 2.979./20.00 800 1.69.195.00 -3 -9 700 794.616.00 799.503.03 701 229.03.09 7:12 6500000 75.000 Iravel and Entertainment Expense 52500 ES 503 Had lebt Expense 6 500 00 9.500 705 11120000 150 0.0 708 30,000.00 Property Tax Expense Office Maintenance & Repar Expense Legal Expenses Leisurance Co 707 5,400.00 120.00 3.000.00 700 709 19.-20.00 9 710 400.00 711 10.000 0 -1 Miscellaneous Cape Orice suscle Expense Telecommunications Expense Deareciation Expense - Bulang Dancinn Expense. Fipment Deancan Expert Future 712 62.500.00 87.500.00 713 17 000 00 6000 117530 114 325000 4 12 000 00 800 Bu 902 | Rent Income Gan on Sale of Equity mestment Securities Trading Inrerest Expense 35 000.00 900 51,003.0; 5,000.00 4,000.00 902 Lues un sale of Held to Welurity Investments 20.250.00 G -7 2 2 512404 10.4V1.4.1.02 10 401 4.0 2.6.0/4.00 Net Income (Loss) 1. Create multi-step Income Statement using the July 31, 2020 adusted balances ANO formatting information from IS tab 2. Create statement of retained earnings using July 31, 2020 adjusted balances AND formatting information from simt of RE tab 3 Create classified balance sheet using July 31, 2020 adjusted balances AND fcuratting information from BS lab 4 Cicle slalement est lesing the next slack, lengs" cxmes from backw, and haditional roles in the right of July 21, 2020 atbull Trial balance: exkurs Ta - xmpkile the muscles and the date of the a. Input a formula in either the debit column OR the credit column to find the change in account balance from July 2019 to July 2020. b. Only complete the changes cels that are outined and have 2019 beginning balances and 2020 ending balances. Do not find changes in cels that are grayed out Use the changes' amounts to create the statement of cash flows. Amounts from the income statement will also be needed d. Pay attention to statement of cash flows additional information columns below. These give hints 0 1 2 3 July 31, 2019 Aljusid Trial Balance Dr. Cr. Additional Notes for Statement of Cash Flows CHANGES COLUMNS Used ONLY for Statement of cash flows Debit Credit July 31, 2020 Mdljuded Trial Balance 3 G Acct. No Account Title Change in cash not required in operating activites, but should match net increase or decrease in cash 7 100 Cash 583.730.00 21.470.00 GOS 203.00 a 102 Accounts Receivable, ret 425,000.00 (19.600.00 425,505.00 9 101 497,420.00 100.170.00 587,502.02 103 1,200.00 G.202.00 107 Merchandise Inventory, rel Orice Supplies Prepaid Expenses Ecury vestments Tradne Inwestments - Hold to Marry 120000 1 -2 10.500 2,500.00 69.650.00 120 26.800.00 16.462.00 56.963.03 122 1411 And 23 850 00 1.000.00000 9.500.000 32.100.00 500 000 00 1.000 m 1 500.003 03 . 14! 3 500,00300 Hildung Accumulated Depreciation - Bulding 1921 14 312 500.00 40D OD Use depreciation expense from Income statement 151 Equipment 170 000 00 35 000.00 205 03.03 B5,000.00 95000.00 Uso depreciation expense from income statement 32,500.00 10 000.00 42.503.00 16.2.0.02 JUG,DUDU 10.200.00 depuis promican liman 393 420.00 97,420.00 152 Accumulated Depreciation Equipment . lo 153 Office Furniture 0 151 Accumuland Deprecision Office Furniture 201 Accounts Payable 2202 Wages Payable . -3 203Merest Payable .. 4 2014 pudends Payable est 2015 Uncanned Hot 6.000 200000) 1 000 00 Customer Hefunds Payabia 25,500 03 160000 2900000 2 250 12,000.00 200 000 00 212 000 DO 251 200 COD.O. 200 000 00 400 000.00 252 253 0 -1 3 252 24U.CO.US 112,000.00 190.000.CO 300 U1.000.00 301 1 17 250.00 1177 250.00 4 330 Notes Payable. Long Term Bands Payable - Long Term Premium on Bonds Payable Discount un Dunds Payable Morlaye (Warehouse ble Cm Stock. $I F..C.000 wiced 8.000 stala Paid in Capital - Excess of Par Common Stock 1 Retaned Eamings Cash Odends Treasury Stock P Sales 1 Cost of Goods Sold Wege Expense hourly workers) Salaries Expense Exempt Staff) Parking Experte 235140003 2.849.810.00 331 20000 200.000 18 3030: 33 000 00 50 000 -7 500 3.411.504.02 2.979./20.00 800 1.69.195.00 -3 -9 700 794.616.00 799.503.03 701 229.03.09 7:12 6500000 75.000 Iravel and Entertainment Expense 52500 ES 503 Had lebt Expense 6 500 00 9.500 705 11120000 150 0.0 708 30,000.00 Property Tax Expense Office Maintenance & Repar Expense Legal Expenses Leisurance Co 707 5,400.00 120.00 3.000.00 700 709 19.-20.00 9 710 400.00 711 10.000 0 -1 Miscellaneous Cape Orice suscle Expense Telecommunications Expense Deareciation Expense - Bulang Dancinn Expense. Fipment Deancan Expert Future 712 62.500.00 87.500.00 713 17 000 00 6000 117530 114 325000 4 12 000 00 800 Bu 902 | Rent Income Gan on Sale of Equity mestment Securities Trading Inrerest Expense 35 000.00 900 51,003.0; 5,000.00 4,000.00 902 Lues un sale of Held to Welurity Investments 20.250.00 G -7 2 2 512404 10.4V1.4.1.02 10 401 4.0 2.6.0/4.00 Net Income (Loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts