Question: I need help evaluating the balance sheet. AutoSave OCH H draft - Saved - Search Mariano Macon VM File Home Insert Draw Page Layout Formulas

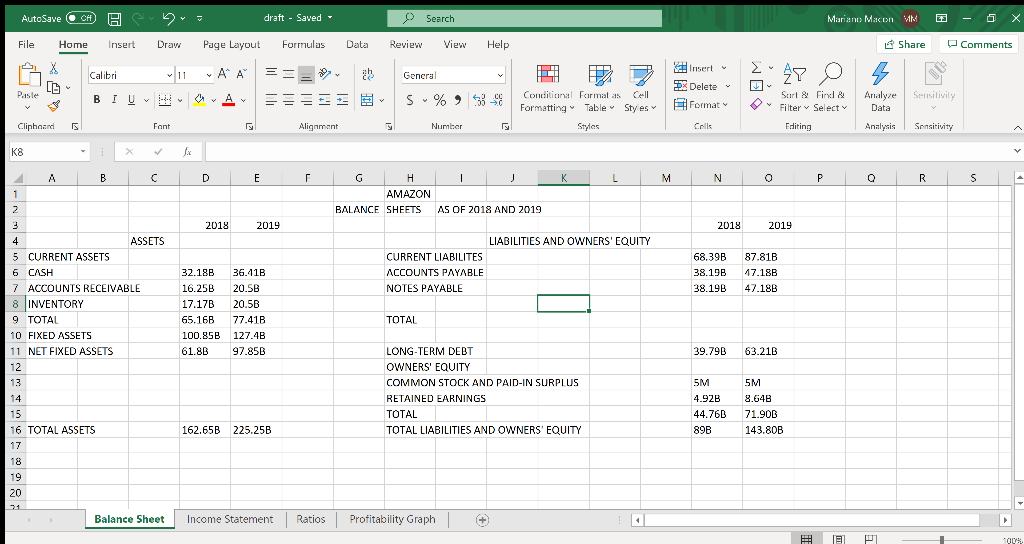

I need help evaluating the balance sheet.

I need help evaluating the balance sheet.

AutoSave OCH H draft - Saved - Search Mariano Macon VM File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments X = Calibri HAA ch General Insert 3 & Delete 27 4 Paste BIU w S - % 33 - Conditional Formalas Cell Formatting Table Sty es Styles Format Surl Find & Filter v Select Analyze Sensitivity Data Cliphaand Fant Alignment Number Colls Editing Analysis Sensitivity K8 - fa A B C D E F I j M N P R S . 1 2 G . AMAZON BALANCE SHEETS AS OF 2018 AND 2019 3 2018 2019 2018 2019 LIABILITIES AND OWNERS' EQUITY 6 CURRENT LIABILITES ACCOUNTS PAYABLE NOTES PAYABLE 68.39B 38.19B 38.19B 87.81B 17.18B 47.18B 32.18B 16.25B 17.17B 65.16B 100.85B 61.83 36.41B 20.5B 20.5B 77.41B 127.4B 97.85B TOTAL 39.79B 63.215 4 ASSETS 5 CURRENT ASSETS 6 CASH 7 ACCOUNTS RECEIVABLE 8 INVENTORY 9 TOTAL 10 FIXED ASSETS 11 NET FIXED ASSETS 12 13 14 15 16 TOTAL ASSETS 17 18 19 20 5M LONG-TERM DEBT OWNERS' EQUITY COMMON STOCK AND PAID-IN SURPLUS RETAINED EARNINGS TOTAL TOTAL LIABILITIES AND OWNERS' EQUITY 5M 4.928 44.76B 89B 8.64B 71.90B 143,80B 162.65B 225.25B Balance Sheet Income Statement Ratios Profitability Graph (+ 00 AutoSave OCH H draft - Saved - Search Mariano Macon VM File Home Insert Draw Page Layout Formulas Data Review View Help Share Comments X = Calibri HAA ch General Insert 3 & Delete 27 4 Paste BIU w S - % 33 - Conditional Formalas Cell Formatting Table Sty es Styles Format Surl Find & Filter v Select Analyze Sensitivity Data Cliphaand Fant Alignment Number Colls Editing Analysis Sensitivity K8 - fa A B C D E F I j M N P R S . 1 2 G . AMAZON BALANCE SHEETS AS OF 2018 AND 2019 3 2018 2019 2018 2019 LIABILITIES AND OWNERS' EQUITY 6 CURRENT LIABILITES ACCOUNTS PAYABLE NOTES PAYABLE 68.39B 38.19B 38.19B 87.81B 17.18B 47.18B 32.18B 16.25B 17.17B 65.16B 100.85B 61.83 36.41B 20.5B 20.5B 77.41B 127.4B 97.85B TOTAL 39.79B 63.215 4 ASSETS 5 CURRENT ASSETS 6 CASH 7 ACCOUNTS RECEIVABLE 8 INVENTORY 9 TOTAL 10 FIXED ASSETS 11 NET FIXED ASSETS 12 13 14 15 16 TOTAL ASSETS 17 18 19 20 5M LONG-TERM DEBT OWNERS' EQUITY COMMON STOCK AND PAID-IN SURPLUS RETAINED EARNINGS TOTAL TOTAL LIABILITIES AND OWNERS' EQUITY 5M 4.928 44.76B 89B 8.64B 71.90B 143,80B 162.65B 225.25B Balance Sheet Income Statement Ratios Profitability Graph (+ 00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts