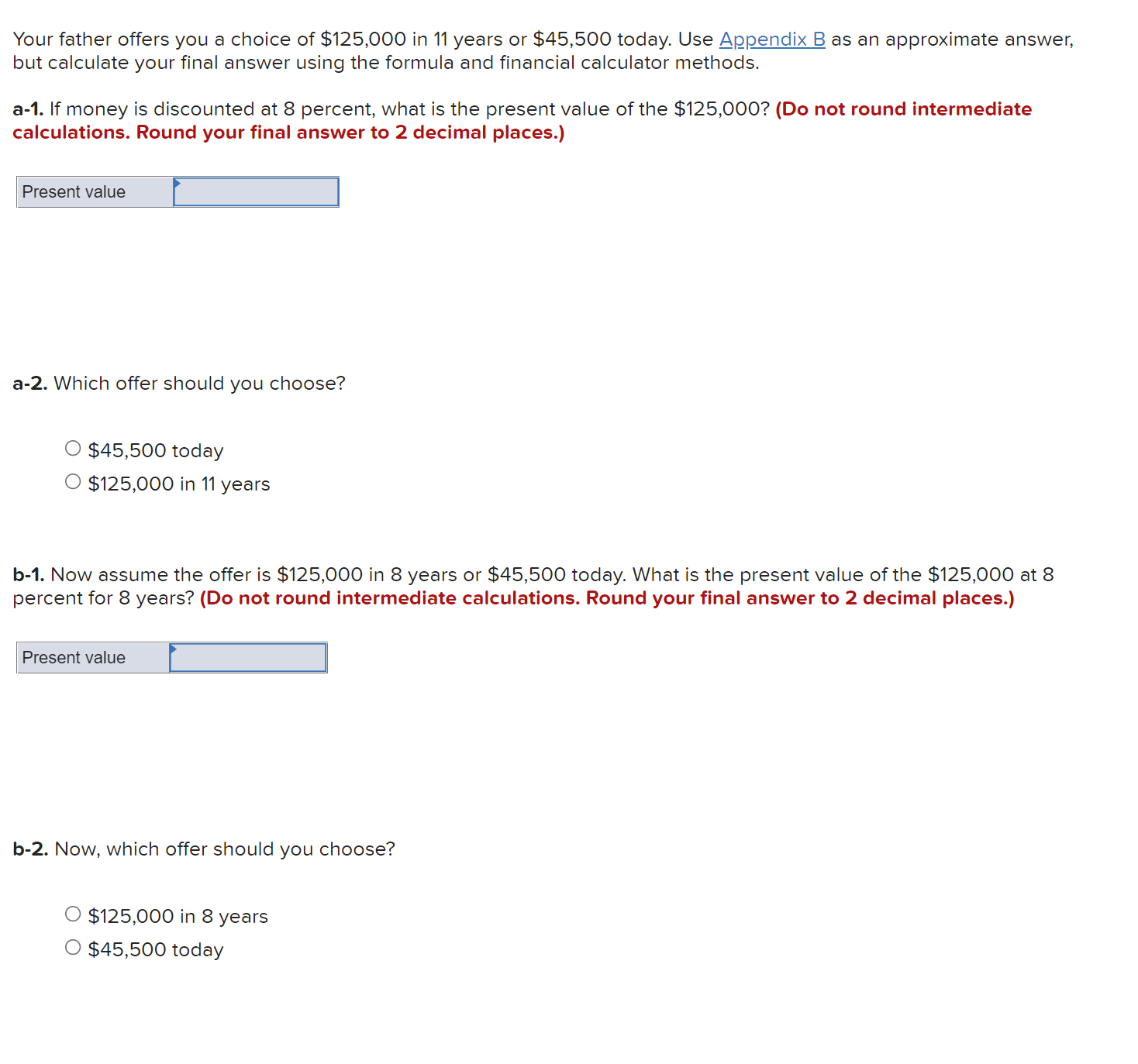

Question: I need help explaining with the correct answers these questions. Your father offers you a choice of $125,000 in 11 years or $45,500 today. Use

I need help explaining with the correct answers these questions.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock