Question: I need help figuring out how my professor got these answers on the study guide. If you could explain or write out the equation/steps used

I need help figuring out how my professor got these answers on the study guide. If you could explain or write out the equation/steps used to get the answers, I would highly appreciate it. Thank you!!

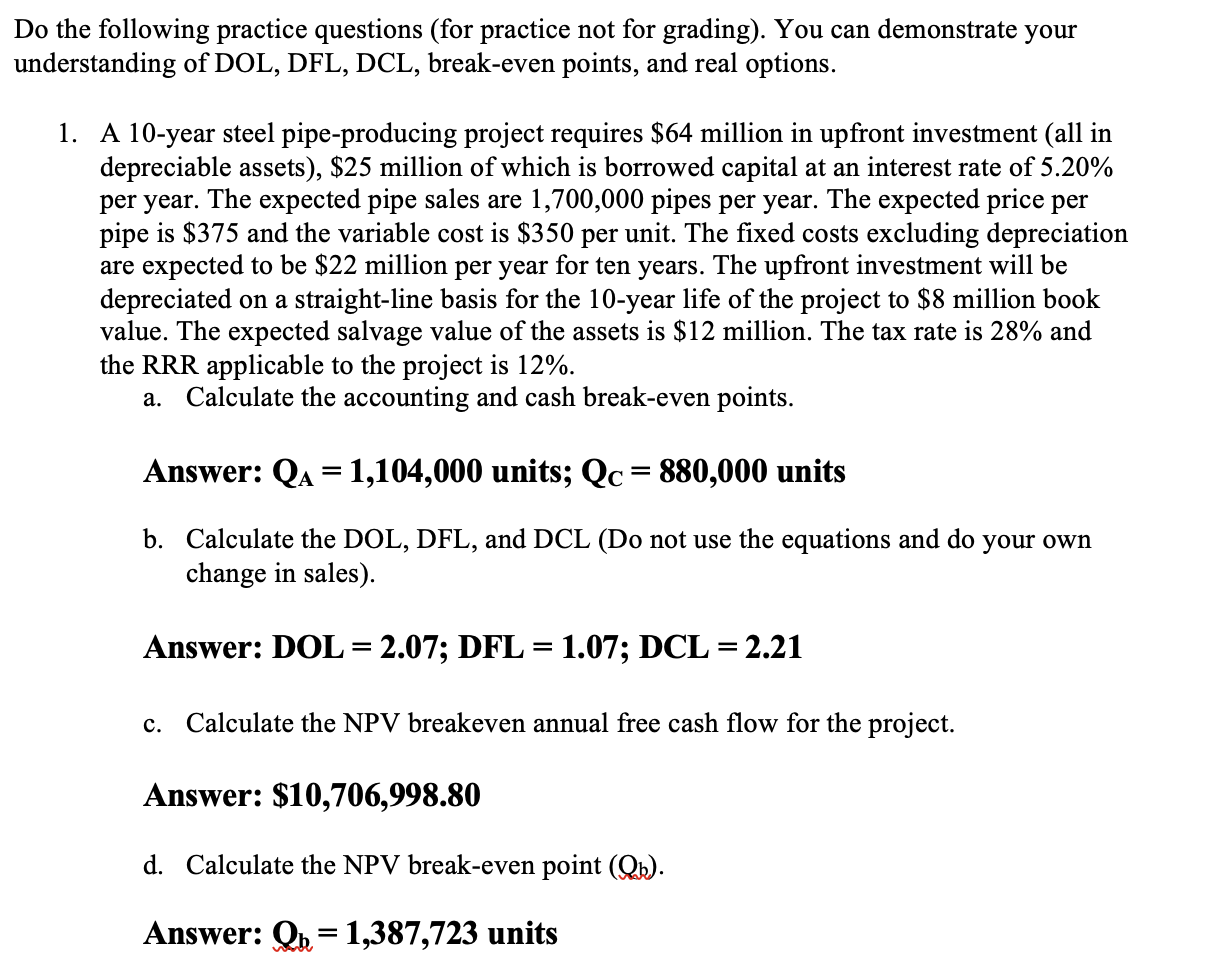

Do the following practice questions (for practice not for grading). You can demonstrate your inderstanding of DOL, DFL, DCL, break-even points, and real options. 1. A 10-year steel pipe-producing project requires $64 million in upfront investment (all in depreciable assets), $25 million of which is borrowed capital at an interest rate of 5.20% per year. The expected pipe sales are 1,700,000 pipes per year. The expected price per pipe is $375 and the variable cost is $350 per unit. The fixed costs excluding depreciation are expected to be $22 million per year for ten years. The upfront investment will be depreciated on a straight-line basis for the 10-year life of the project to $8 million book value. The expected salvage value of the assets is $12 million. The tax rate is 28% and the RRR applicable to the project is 12%. a. Calculate the accounting and cash break-even points. Answer: QA=1,104,000 units; QC=880,000 units b. Calculate the DOL, DFL, and DCL (Do not use the equations and do your own change in sales). Answer: DOL=2.07;DFL=1.07;DCL=2.21 c. Calculate the NPV breakeven annual free cash flow for the project. Answer: $10,706,998.80 d. Calculate the NPV break-even point (Qb). Answer: Qb=1,387,723 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts