Question: I need help figuring out how this problem was solved. Can you please post an excel file with the same layout as the answer provided,

I need help figuring out how this problem was solved. Can you please post an excel file with the same layout as the answer provided, and show a screenshot with all the formulas used to calculate the answers. Thanks.

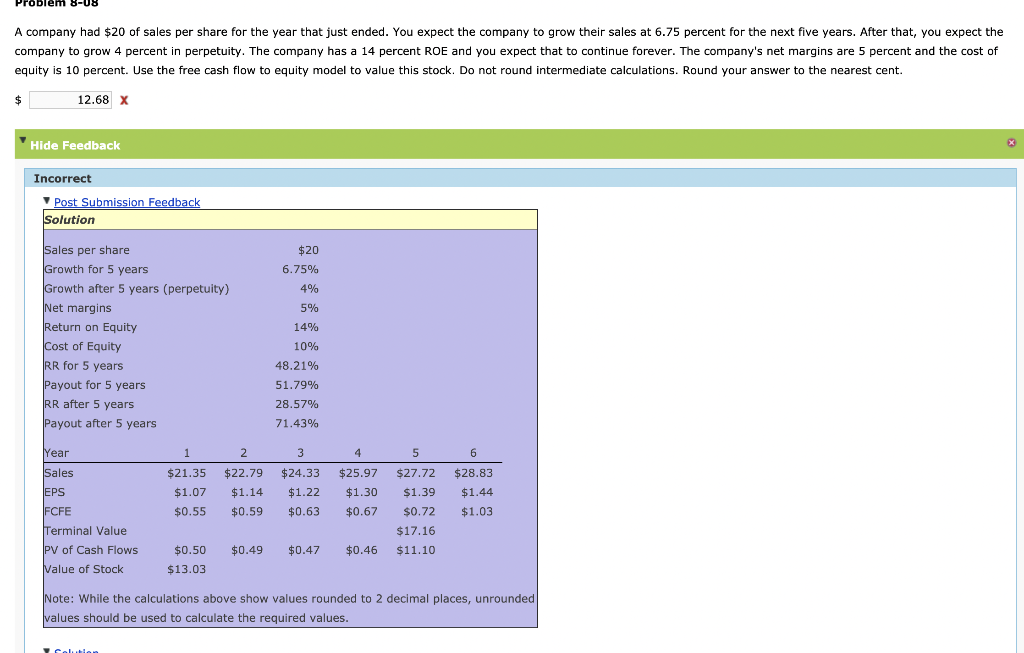

oblem 8-08 A company had $20 of sales per share for the year that just ended. You expect the company to grow their sales at 6.75 percent for the next five years. After that, you expect the company to grow 4 percent in perpetuity. The company has a 14 percent ROE and you expect that to continue forever. The company's net margins are 5 percent and the cost of equity is 10 percent. Use the free cash flow to equity model to value this stock. Do not round intermediate calculations. Round your answer to the nearest cent. $ 12.68 x Hide Feedback Incorrect Post Submission Feedback Solution $20 6.75% 4% 5% Sales per share Growth for 5 years Growth after 5 years (perpetuity) Net margins Return on Equity Cost of Equity RR for 5 years Payout for 5 years RR after 5 years Payout after 5 years 14% 10% 48.21% 51.79% 28.57% 71.43% Year 1 2 3 4 5 6 $27.72 Sales EPS $21.35 $1.07 $0.55 $22.79 $1.14 $0.59 $24.33 $1.22 $0.63 $25.97 $1.30 $0.67 $28.83 $1.44 $1.03 FCFE $1.39 $0.72 $17.16 $11.10 Terminal Value PV of Cash Flows Value of Stock $0.49 $0.47 $0.46 $0.50 $13.03 Note: While the calculations above show values rounded to 2 decimal places, unrounded values should be used to calculate the required values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts