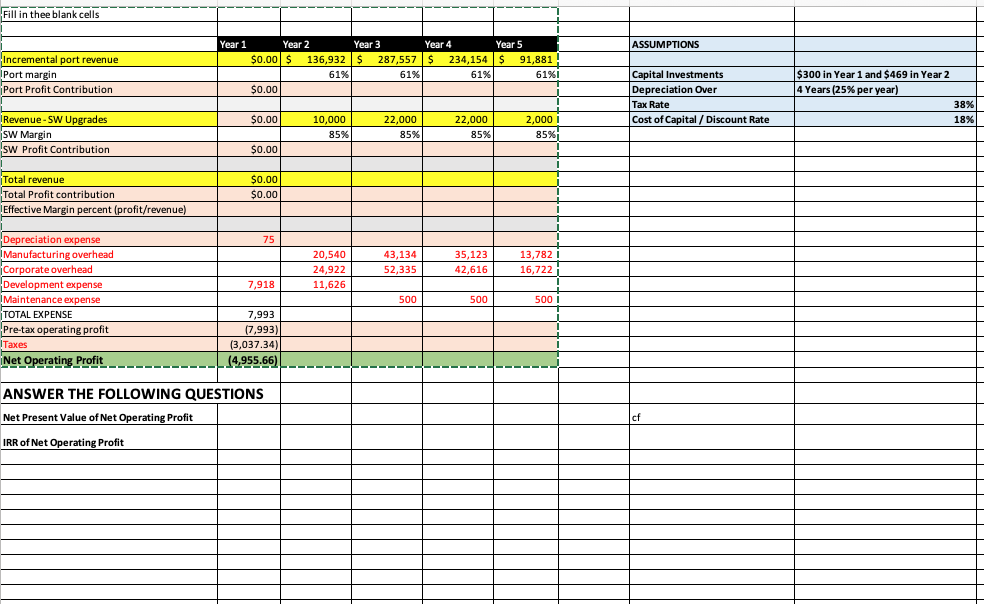

Question: I need help figuring out how to fill in the blanks I have two questions that need to be answered as well Question 1) Net

I need help figuring out how to fill in the blanks

I have two questions that need to be answered as well

Question 1) Net Present Value of Net Operating Profit

Question 2) IRR of Net Operating Profit

as a bonus if there are any assumptions I can make let me know

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | ||

| Incremental port revenue | $0.00 | $ 136,932 | $ 287,557 | $ 234,154 | $ 91,881 | |

| Port margin | 61% | 61% | 61% | 61% | ||

| Port Profit Contribution | $0.00 | |||||

| Revenue - SW Upgrades | $0.00 | 10,000 | 22,000 | 22,000 | 2,000 | |

| SW Margin | 85% | 85% | 85% | 85% | ||

| SWProfit Contribution | $0.00 | |||||

| Total revenue | $0.00 | |||||

| Total Profit contribution | $0.00 | |||||

| Effective Margin percent (profit/revenue) | ||||||

| Depreciation expense | 75 | |||||

| 20,540 | 43,134 | 35,123 | 13,782 | ||

| Corporate overhead | 24,922 | 52,335 | 42,616 | 16,722 | ||

| Development expense | 7,918 | 11,626 | ||||

| Maintenance expense | 500 | 500 | 500 | |||

| TOTAL EXPENSE | 7,993 | |||||

| Pre-tax operating profit | (7,993) | |||||

| Taxes | (3,037.34) | |||||

| Net Operating Profit | (4,955.66) |

This what the speed sheet look like

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock