Question: I need help figuring out how to solve for the above questions $150 6. Calculate and compare the accumulations from investing $150 per month for

I need help figuring out how to solve for the above questions

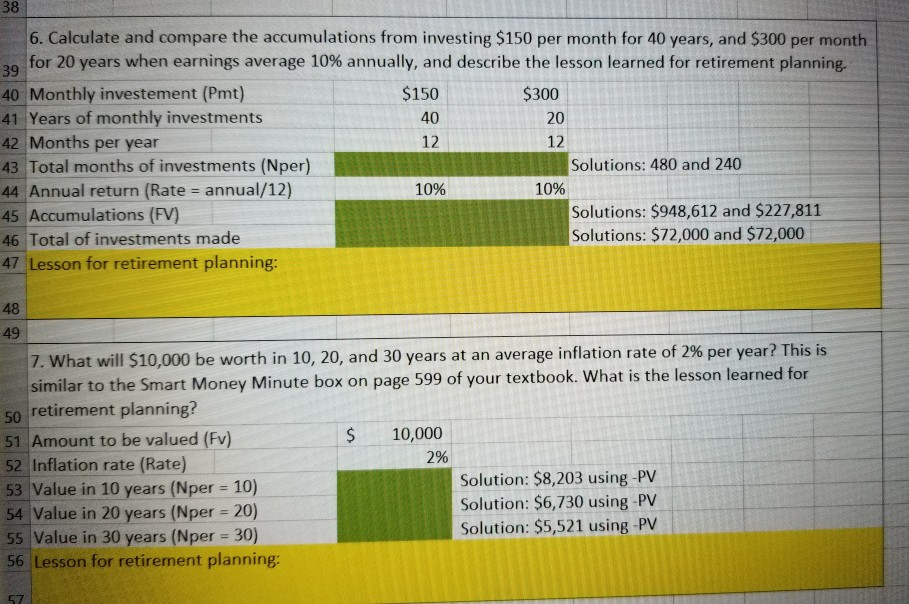

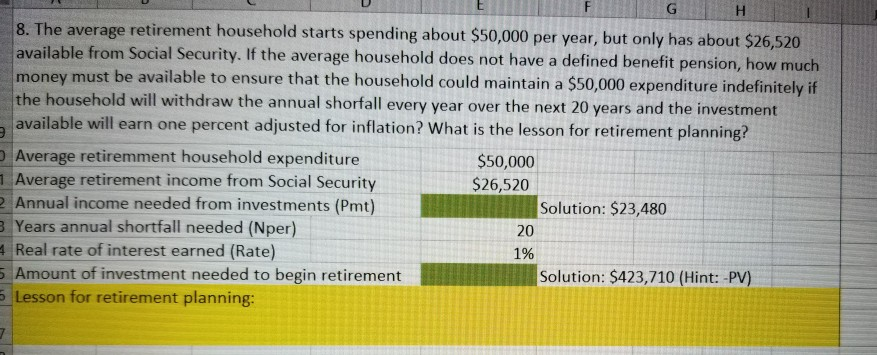

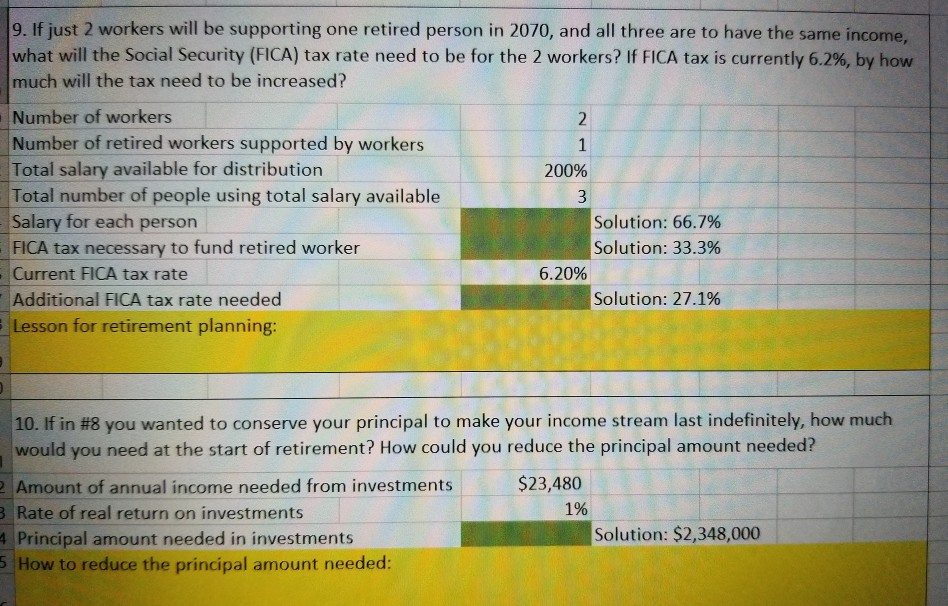

$150 6. Calculate and compare the accumulations from investing $150 per month for 40 years, and $300 per month o for 20 years when earnings average 10% annually, and describe the lesson learned for retirement planning. 40 Monthly investement (Pmt) $300 41 Years of monthly investments 20 42 Months per year 12 43 Total months of investments (Nper) Solutions: 480 and 240 44 Annual return (Rate = annual/12) 10% 10% 45 Accumulations (FV) Solutions: $948,612 and $227,811 46 Total of investments made Solutions: $72,000 and $72,000 47 Lesson for retirement planning: 48 49 7. What will $10,000 be worth in 10, 20, and 30 years at an average inflation rate of 2% per year? This is similar to the Smart Money Minute box on page 599 of your textbook. What is the lesson learned for 50 retirement planning? 51 Amount to be valued (Fv) S 10,000 52 Inflation rate (Rate) 53 Value in 10 years (Nper = 10) Solution: $8,203 using - PV 54 Value in 20 years (Nper = 20) Solution: $6,730 using - PV 55 Value in 30 years (Nper = 30) Solution: $5,521 using - PV 56 Lesson for retirement planning: 2% 8. The average retirement household starts spending about $50,000 per year, but only has about $26,520 available from Social Security. If the average household does not have a defined benefit pension, how much money must be available to ensure that the household could maintain a $50,000 expenditure indefinitely if the household will withdraw the annual shorfall every year over the next 20 years and the investment available will earn one percent adjusted for inflation? What is the lesson for retirement planning? Average retiremment household expenditure $50,000 Average retirement income from Social Security $26,520 Annual income needed from investments (Pmt) Solution: $23,480 Years annual shortfall needed (Nper) Real rate of interest earned (Rate) 1% Amount of investment needed to begin retirement Solution: $423,710 (Hint: -PV) Lesson for retirement planning: 20 9. If just 2 workers will be supporting one retired person in 2070, and all three are to have the same income, what will the Social Security (FICA) tax rate need to be for the 2 workers? If FICA tax is currently 6.2%, by how much will the tax need to be increased? Number of workers Number of retired workers supported by workers Total salary available for distribution 200% Total number of people using total salary available Salary for each person Solution: 66.7% FICA tax necessary to fund retired worker Solution: 33.3% Current FICA tax rate 6.20% Additional FICA tax rate needed Solution: 27.1% Lesson for retirement planning: 10. If in #8 you wanted to conserve your principal to make your income stream last indefinitely, how much would you need at the start of retirement? How could you reduce the principal amount needed? Amount of annual income needed from investments $23,480 3 Rate of real return on investments 1% Principal amount needed in investments Solution: $2,348,000 5 How to reduce the principal amount needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts