Question: I need help figuring out how to solve this using timelines. Suppose S0^$ = $1 -25/f _1, = $ 1.2/, I = 11.56, and i$

I need help figuring out how to solve this using timelines.

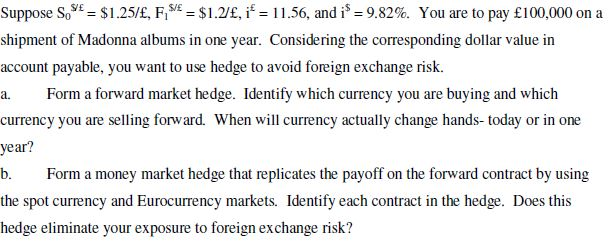

Suppose S0^$ = $1 -25/f _1, = $ 1.2/, I = 11.56, and i$ = 9.82%. You are to pay 100,000 on a shipment of Madonna albums in one year. Considering the corresponding dollar value in account payable, you want to use hedge to avoid foreign exchange risk. Form a forward market hedge. Identify which currency you are buying and which currency you are selling forward. When win currency actually change hands- today or in one year? Form a money market hedge that replicates the payoff on the forward contract by using the spot currency and Eurocurrency markets. Identify each contract in the hedge. Does this hedge eliminate your exposure to foreign exchange risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts