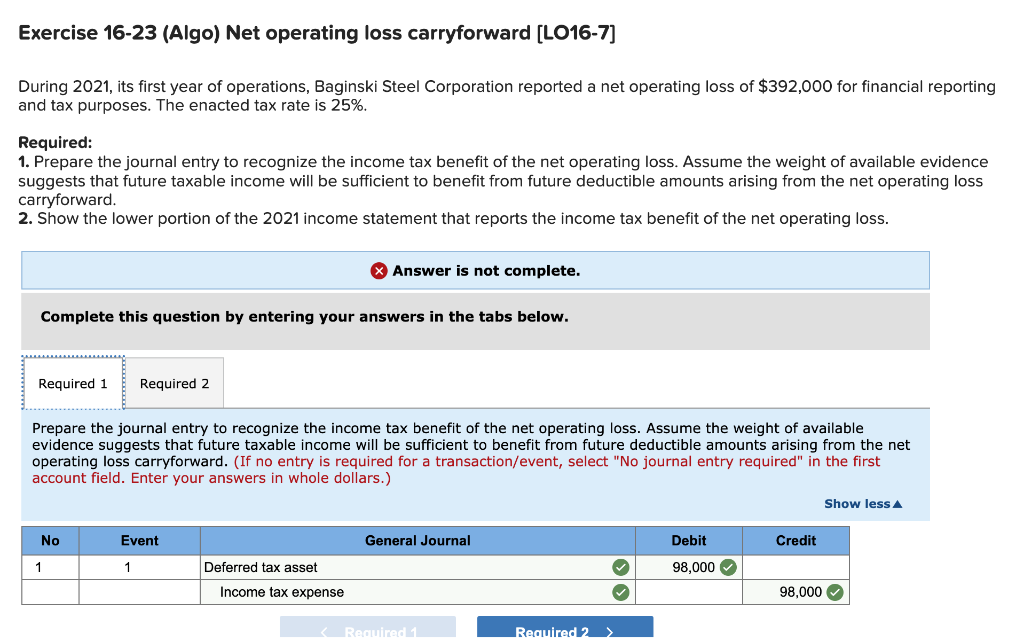

Question: I need help figuring out if something is missing from this journal entry. It's saying that the ANSWER IS NOT COMPLETE. My numbers are correct

I need help figuring out if something is missing from this journal entry. It's saying that the ANSWER IS NOT COMPLETE. My numbers are correct but something has to be missing. Please help, thank you.

Exercise 16-23 (Algo) Net operating loss carryforward [LO16-7] During 2021, its first year of operations, Baginski Steel Corporation reported a net operating loss of $392,000 for financial reportir and tax purposes. The enacted tax rate is 25%. Required: 1. Prepare the journal entry to recognize the income tax benefit of the net operating loss. Assume the weight of available evidence suggests that future taxable income will be sufficient to benefit from future deductible amounts arising from the net operating loss carryforward. 2. Show the lower portion of the 2021 income statement that reports the income tax benefit of the net operating loss. Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the journal entry to recognize the income tax benefit of the net operating loss. Assume the weight of evidence suggests that future taxable income will be sufficient to benefit from future deductible amounts arising from the net operating loss carryforward. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts