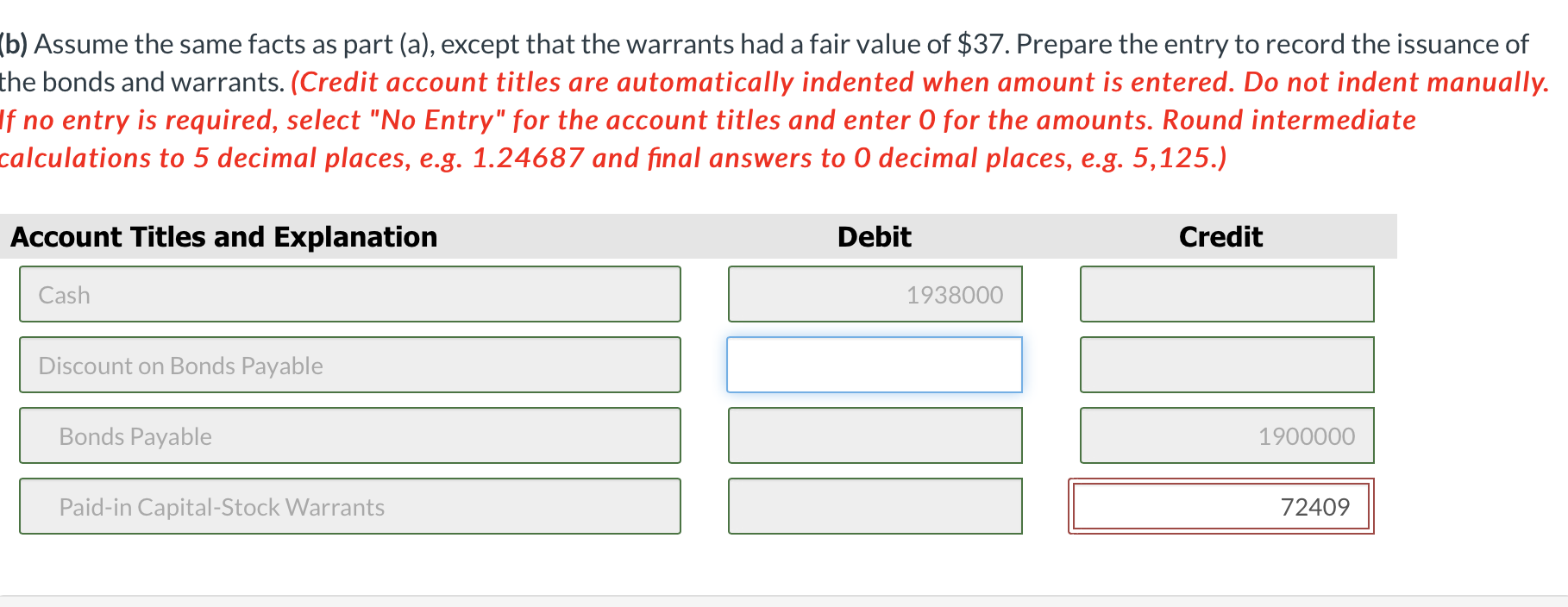

Question: I need help figuring out part (b) : The discount on bonds payable amount and paid in capital stock warrants amount On May 1, 2020,

I need help figuring out part (b) : The discount on bonds payable amount and paid in capital stock warrants amount

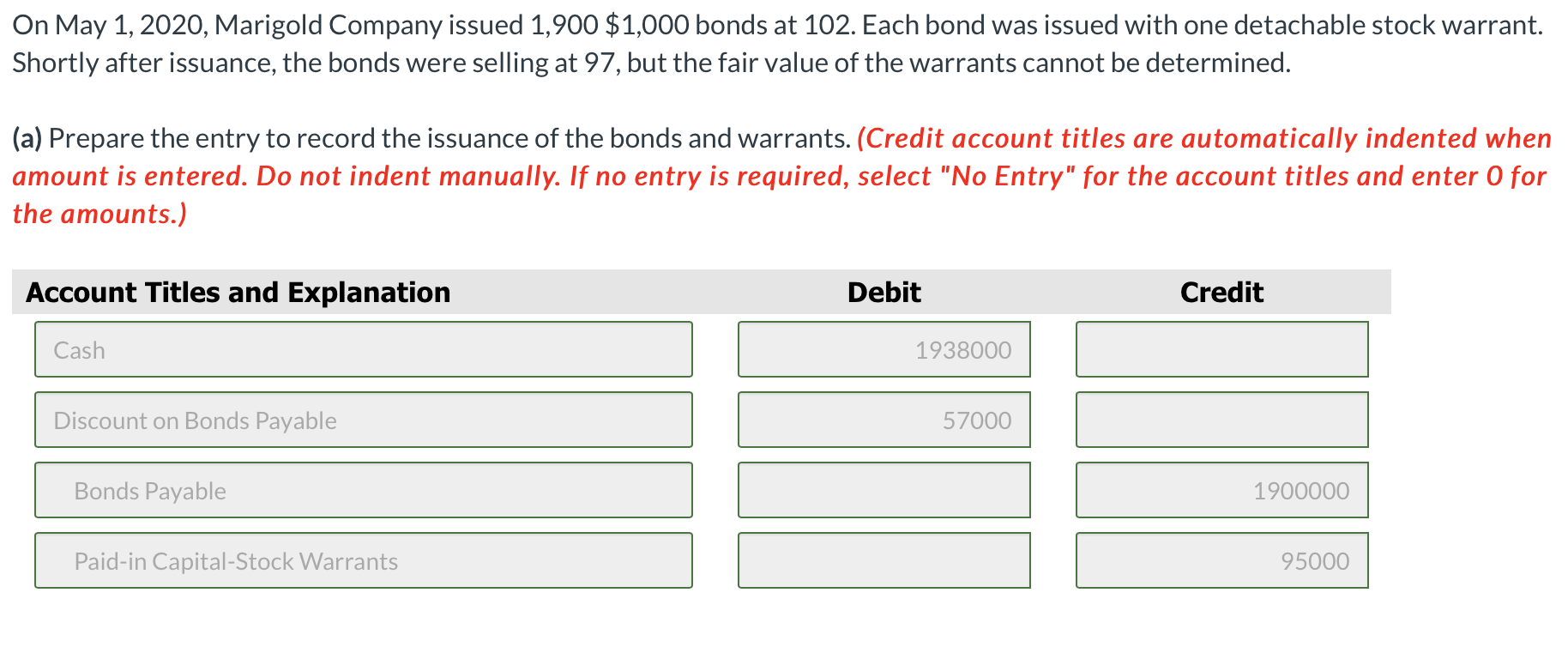

On May 1, 2020, Marigold Company issued 1,900 $1,000 bonds at 102. Each bond was issued with one detachable stock warrant. Shortly after issuance, the bonds were selling at 97, but the fair value of the warrants cannot be determined. (a) Prepare the entry to record the issuance of the bonds and warrants. (Credit account titles are automatically indented when amount is entered. Do not indent manually. lf no entry is required, select "No Entry" for the account tities and enter 0 for the amounts.) Account Titles and Explanation Debit Credit Cash 1938000 Discount on Bonds Payable 57000 Bonds Payable 1900000 Paid-in CapitalStock Warrants 95000 (b) Assume the same facts as pa rt (a), except that the warrants had a fair value of $37. Prepare the entry to record the issuance of the bonds and warrants. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round intermediate calculations to 5 decimal places, e.g. 1.24687 and nal answers to 0 decimal places, (2.3. 5,125.) Account Titles and Explanation Debit Credit Cash ' I 1938000 | I | Bonds Payable ':| 1900000 Paidin Ca pitalStock Warrants ':| 72409

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts