Question: I need help filling out this excel sheet in order to find the answer for the problem The Pharoah Company produces parts for an electronic

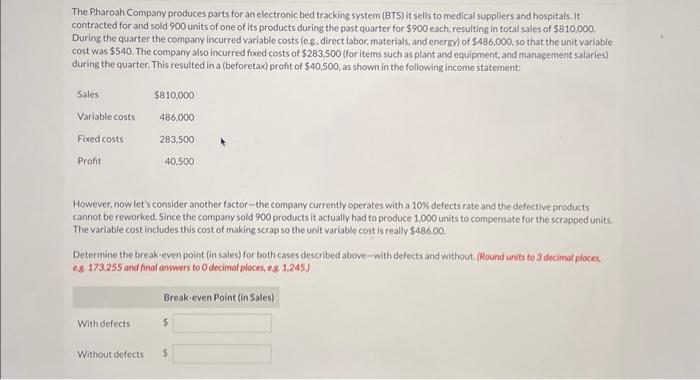

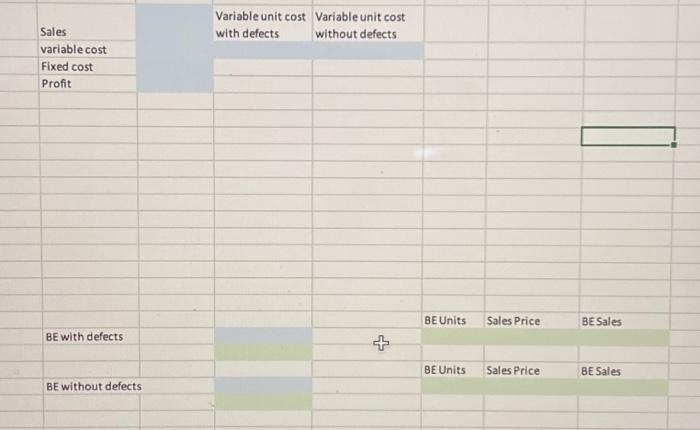

The Pharoah Company produces parts for an electronic bed tracking system (BTS) it sells to medical suppliers and hospitals. it contracted for and sold 900 units of one of its products during the past quarter for $900 each, resulting in total sales of $810,000. During the quarter the company incurred variable costs (eg. direct labor, materials, and energy) of $486,000, so that the unit variable cost was $540. The company also incurred fixed costs of $283,500 (for items such as plant and equipment, and management salaries) during the quarter. This resulted in a (beforetax) profit of $40,500, as shown in the following income statement: However, now let's consider another factor-the company currently operates with a 10% defects rate and the defective products cannot be reworked. Since the company sold 900 products it actually had to produce 1,000 units to compensate for the scrapped units. The variable cost includes this cost of making scrap so the unit variable cost is really $486.00. Determine the break-even point (in sales) for both cases described above-with defects and without. (Round units to 3 decimol places, es. 173.255 and final answers to 0 decimal places, es. 1.245. Variable unit cost Variable unit cost Sales with defects without defects variable cost Fixed cost Profit BE with defects BEUnits Sales Price BESales \{ BEUnits Salesprice BESales BE without defects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts