Question: I need help finding the Average Common Stockholders equity. I tried added the stock and retained earnings and divided it by 2, but the answer

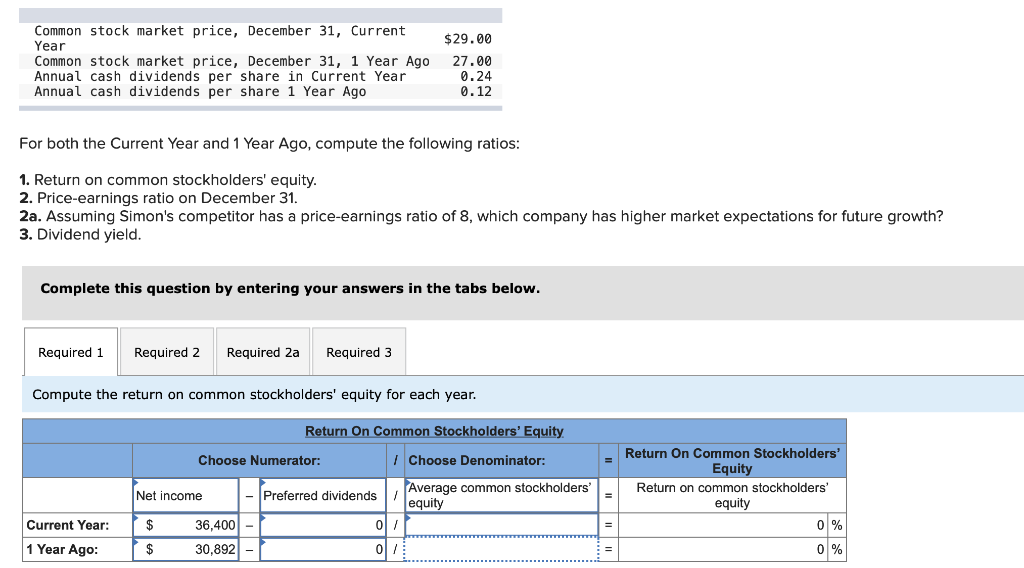

I need help finding the Average Common Stockholders equity. I tried added the stock and retained earnings and divided it by 2, but the answer is still coming out wrong.

I need help finding the Average Common Stockholders equity. I tried added the stock and retained earnings and divided it by 2, but the answer is still coming out wrong.

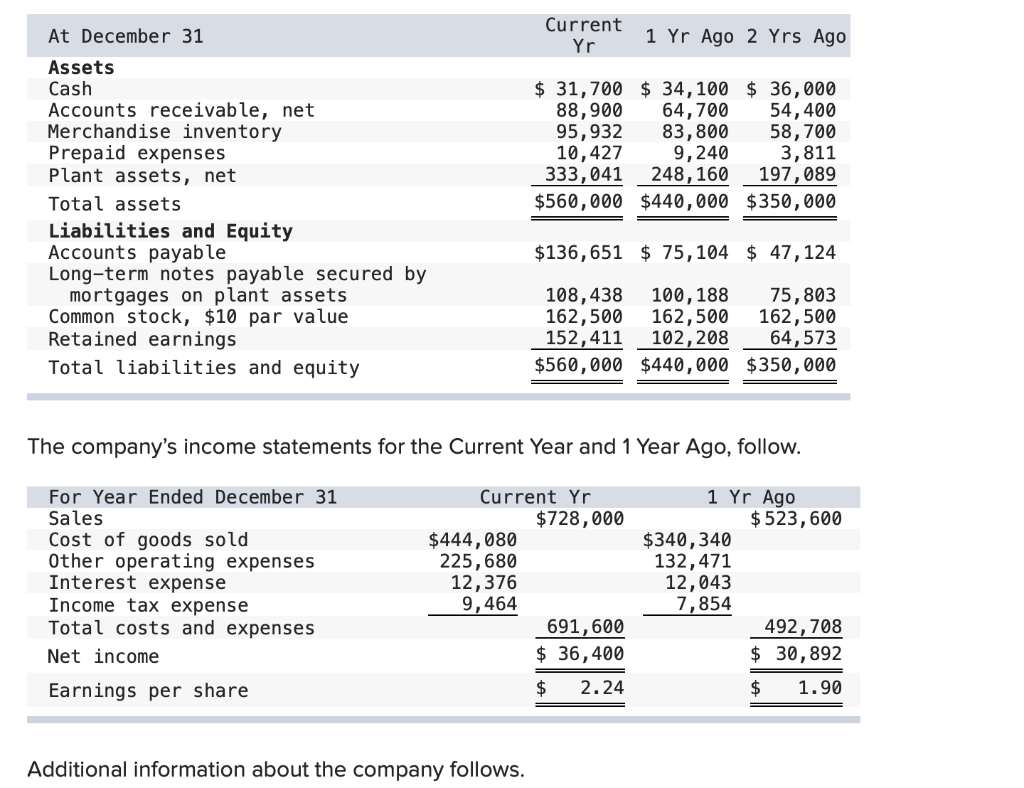

Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 31,700 $ 34,100 $ 36,000 88,900 64,700 54,400 95,932 83,800 58,700 10,427 9, 240 3,811 333, 041 248, 160 197,089 $560,000 $440,000 $350,000 $136,651 $ 75, 104 $ 47, 124 108,438 100,188 75,803 162,500 162,500 162,500 152,411 102, 208 64,573 $560,000 $440,000 $350,000 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Yr $728,000 $444,080 225,680 12,376 9,464 691,600 $ 36,400 1 Yr Ago $ 523,600 $340, 340 132,471 12,043 7,854 492,708 $ 30,892 $ 2.24 $ 1.90 Additional information about the company follows. Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago $29.00 27.00 0.24 0.12 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Price-earnings ratio on December 31. 2a. Assuming Simon's competitor has a price-earnings ratio of 8, which company has higher market expectations for future growth? 3. Dividend yield. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2a Required 3 Compute the return on common stockholders' equity for each year. Return On Common Stockholders' Equity Choose Numerator: I Choose Denominator: Net income - Preferred dividends Average common stockholders' equity = Return On Common Stockholders' Equity Return on common stockholders' equity 0 % 0 % 0 Current Year: 1 Year Ago: $ $ 36,400 30,892 01/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts