Question: I need help finding the equity IRR/MOI and Project IRR/MOI, which are calculated after all the IRR hurdles are taken into account. I have tried

I need help finding the equity IRR/MOI and Project IRR/MOI, which are calculated after all the IRR hurdles are taken into account. I have tried a couple different models, but don't believe I have calculated the right percentages/multiples. So, I want to see how and what you guys get to compare. Thank you ahead of time. (ALL INFO IS ALSO WRITTEN BELOW)

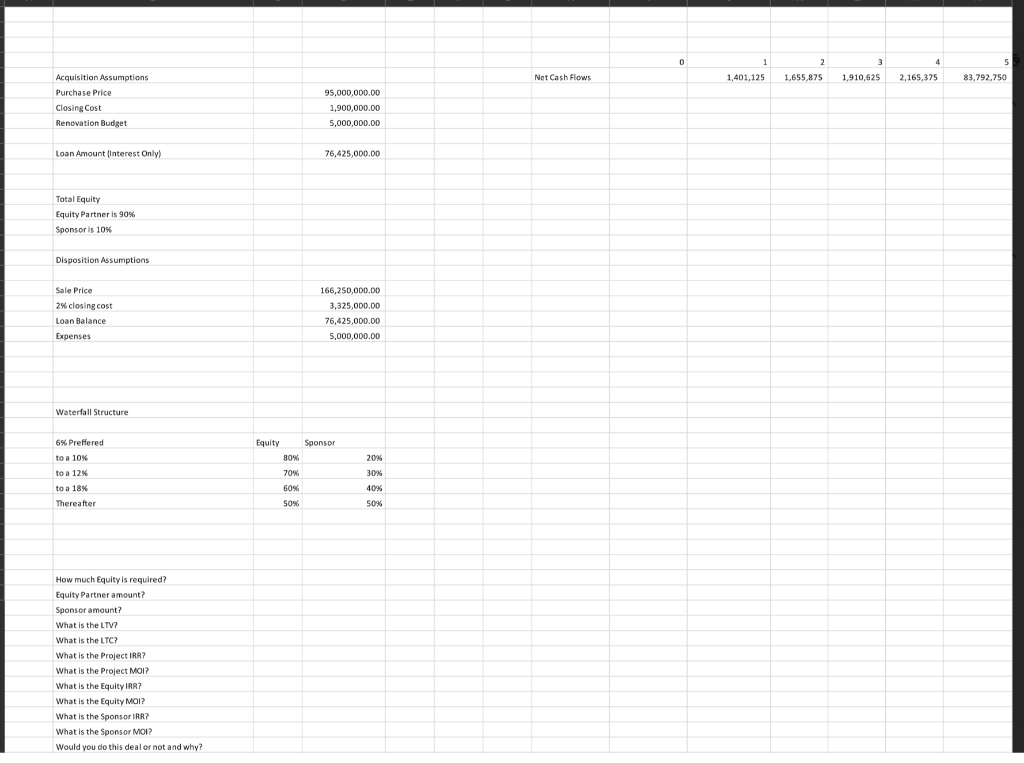

Data given in attached picture.

Purchase Price 95,000,000 Closing Costs: 1,900,000 Renovation Budget: 5,000,0000

Loan amount interest only: 76,425,000 . Total Equity: Equity Partner: 90% . Sponsor: 10%

Sale Price: 166,250,000 2% closing cost: 3,325,000 . Loan balance: 76,425,000 . Expenses: 5,000,000

Waterfall Structure: 6% Preferred . Equity Partner Sponsor

to a 10% 80% 20%

to a 12% 70% . 30%

to a 18% 60% . 40%

thereafter 50% 50%

Cash Flows given: Year 1= 1,401,125 . Year 2= . 1,655,875 . Year 3= 1,910,625 . Year 4= . 2,165,375 . Year 5= . 83,792,750

Acquisition Assumptions Net Cash Flows 1.401.125 1,655,875 1,910,625 2,165,375 83,792,750 Purchase Price 95.000.000.0o Closing Cost 1,900,000.00 Renovation Budget 5,000,000,00 Loan Amount (Interest Only) 76,425,000.00 Tatal Equity Equity Partner is 90 % Sponsor is 10% Disposition Assumptions Sale Price 166,250,000.00 2% closing cost 3,325,000.00 nce S.000.000.00 Expenses Waterfall Structure 6% Preffered Equity Sponsor to a 10% 80% 20% 30% to a 12% 70% 10% to a 18% 60% Thereafter 50% 50% How much Equity is required? Equity Partner amount? Sponsor amount? What is the LTV? What is the LTC? What is the Project IRR? What is the Project MOI? What is the Equity IRR? wSthe qulty Mal? What is the Sponsor MOI? Would you do this deal or not and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts