I need help finding the following. All supporting work is below and attached.

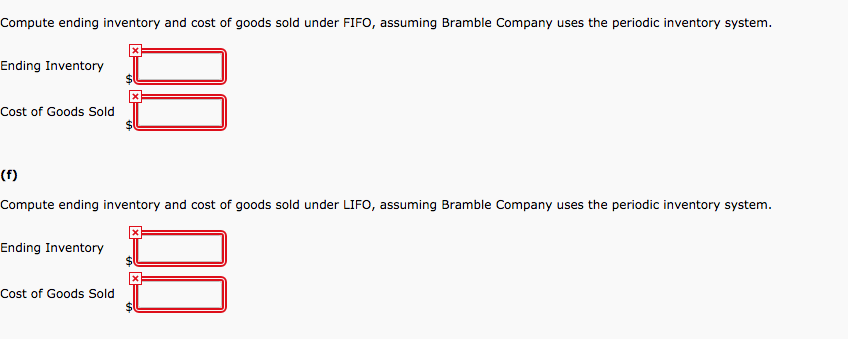

Compute ending inventory and cost of goods sold under FIFO, assuming Bramble Company uses the periodic inventory system.

Ending Inventory$

Cost of Goods Sold$

Compute ending inventory and cost of goods sold under LIFO, assuming Bramble Company uses the periodic inventory system.

Ending Inventory$

Cost of Goods Sold$

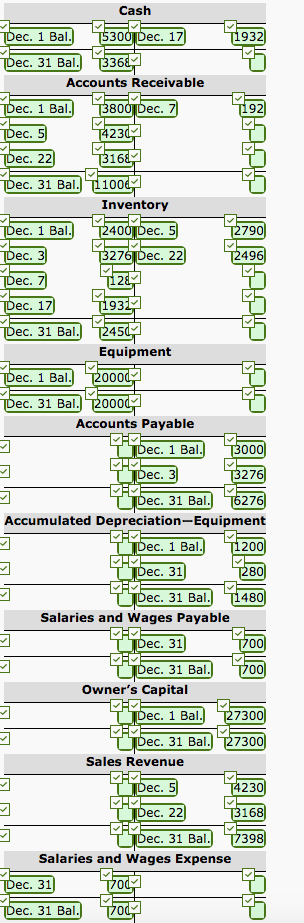

On December 1, 2020, Bramble Company had the account balances shown below.

Debit Credit

Cash $5,300 Accumulated Depreciation?Equipment $1,200

Accounts Receivable3,800 Accounts Payable 3,000

Inventory 2,400* Owner's Capital 27,300

Equipment 20,000

$31,500 $31,500

*(4,000 x $0.60)

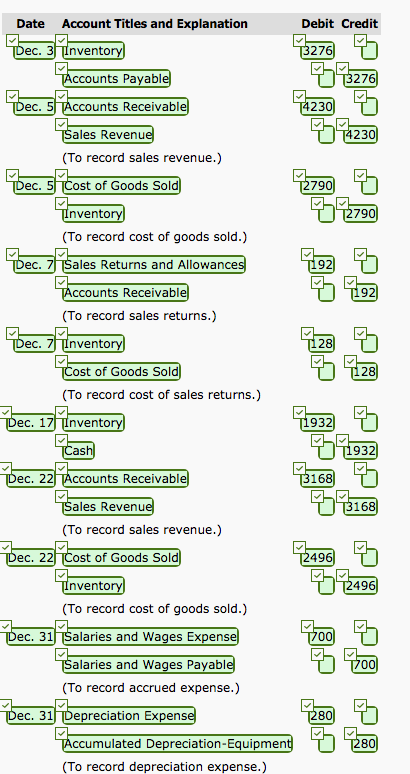

The following transactions occurred during December:

Dec. 3 Purchased 4,200 units of inventory on account at a cost of $0.78 per unit.

5 Sold 4,500 units of inventory on account for $0.94 per unit. (Bramble sold 4,000 of the $0.60 units and 500 of the $0.78.)

7 Granted the December 5 customer $192 credit for 200 units of inventory returned costing $128. These units were returned to inventory.

17 Purchased 2,300 units of inventory for cash at $0.84 each.

22 Sold 3,200 units of inventory on account for $0.99 per unit. (Bramble sold 3,200 of the $0.78 units.)

Adjustment data:

1.Accrued salaries payable $700.

2.Depreciation $280 per month.

Compute ending inventory and cost of goods sold under FIFO, assuming Bramble Company uses the periodic inventory system.

Ending Inventory$

Cost of Goods Sold$

Compute ending inventory and cost of goods sold under LIFO, assuming Bramble Company uses the periodic inventory system.

Ending Inventory$

Cost of Goods Sold$

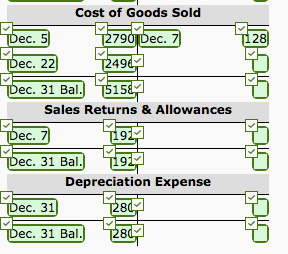

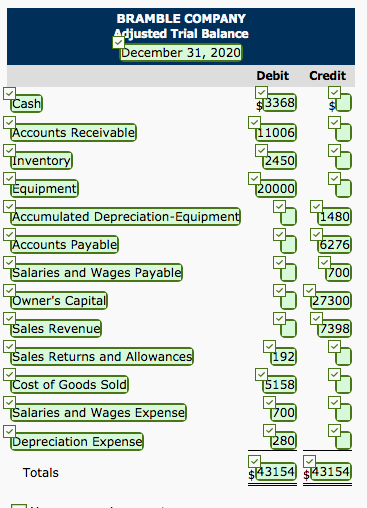

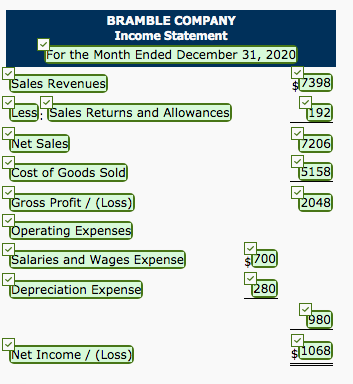

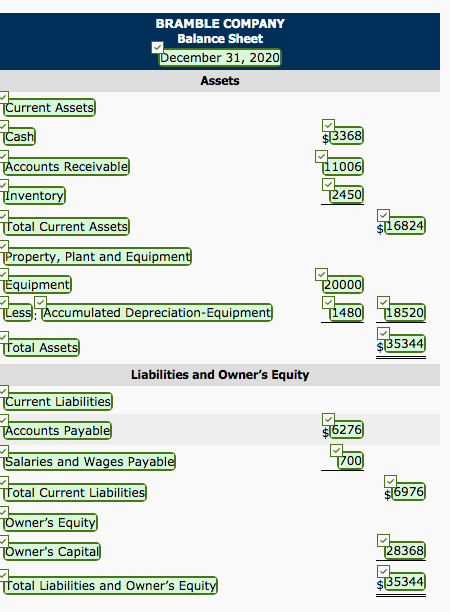

Date Account Titles and Explanation Debit Credit TDec. 3 Inventory 3276 Accounts Payable) 3276 Dec. 5 Accounts Receivable 14230 [Sales Revenue 4230 (To record sales revenue.) Dec. 5 Cost of Goods Sold 12790 Inventory 2790 (To record cost of goods sold.) Dec. 7 Sales Returns and Allowances 192 Accounts Receivable 192 (To record sales returns.) Dec. 7 Inventory 128 Cost of Goods Sold 128 (To record cost of sales returns.) Dec. 17 Inventory 1932 TCash 1932 Dec. 22 Accounts Receivable 13168 [Sales Revenue 3168 (To record sales revenue.) Dec. 22 Cost of Goods Sold 12496 Inventory 2496 (To record cost of goods sold.) Dec. 31 |Salaries and Wages Expense 700 [Salaries and Wages Payable 700 (To record accrued expense.) Dec. 31 Depreciation Expense 280 Accumulated Depreciation-Equipment 280 (To record depreciation expense.)\f\fBRAMBLE COMPANY Adjusted Trial Balance December 31, 2020 Debit Credit Cash 13368 Accounts Receivable 11006 Inventory [2450 Equipment 20000 Accumulated Depreciation-Equipment 1480 Accounts Payable 5276 Salaries and Wages Payable 1700 Owner's Capital 27300 Sales Revenue 7398 Sales Returns and Allowances 192 Cost of Goods Sold 5158 Salaries and Wages Expense 1700 Depreciation Expense 1280 Totals $3154 $43154BRAMBLE COMPANY Income Statement For the Month Ended December 31, 2020 Sales Revenues 7398 Less . Sales Returns and Allowances T192 Net Sales 17206 Cost of Goods Sold 15158 Gross Profit / (Loss) 12048 Operating Expenses Salaries and Wages Expense $700 Depreciation Expense 1280 1980 Net Income / (Loss) $ 1068BRAMBLE COMPANY Balance Sheet December 31, 2020 Assets Current Assets Cash $ 3368 Accounts Receivable 11006 Inventory T2450 Total Current Assets $ 16824 Property, Plant and Equipment Equipment 120000 Less : Accumulated Depreciation-Equipment T1480 18520 Total Assets $ 35344 Liabilities and Owner's Equity Current Liabilities Accounts Payable $ 6276 Salaries and Wages Payable 1700 Total Current Liabilities $ 6976 Owner's Equity Owner's Capital 28368 Total Liabilities and Owner's Equity $ 35344Compute ending inventory and cost of goods sold under FIFO, assuming Bramble Company uses the periodic inventory system. * Ending Inventory Cost of Goods Sold (f) Compute ending inventory and cost of goods sold under LIFO, assuming Bramble Company uses the periodic inventory system. * Ending Inventory Cost of Goods Sold