Question: i need help finding the general journal, ledger accounts, trial balance income statement, statement of stock holder equity, balance sheet, and closing entries from this

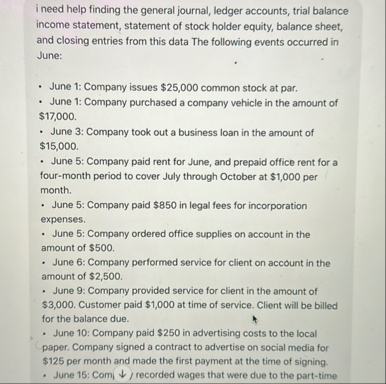

i need help finding the general journal, ledger accounts, trial balance income statement, statement of stock holder equity, balance sheet, and closing entries from this data The following events occurred in June:

June : Company issues $ common stock at par.

June : Company purchased a company vehicle in the amount of $

June : Company took out a business loan in the amount of $

June : Company paid rent for June, and prepaid office rent for a fourmonth period to cover July through October at $ per month.

June : Company paid $ in legal fees for incorporation expenses.

June : Company ordered office supplies on account in the amount of $

June : Company performed service for client on account in the amount of $

June : Company provided service for client in the amount of $ Customer paid $ at time of service. Client will be billed for the balance due.

June : Company paid $ in advertising costs to the local paper. Company signed a contract to advertise on social media for $ per month and made the first payment at the time of signing.

June : ComPany recorded wages that were due to the parttime

employee in the amount of $ This amount will be paid on June

June : Company prepaid business insurance to cover July through December at the rate of $ per month.

June : Company paid wages that were due to the parttime employee from the period ending June

June : Company paid for repairs on an HVAC unit of $

June : Customer paid balance due from June service in the amount of $

June : Company provided service to client in the amount of $ Client paid at the time of service.

June : Company paid balance due for office supplies purchase on June

June : Company performed service for client on account in the amount of $

June : Company received utility bill for the month of June in the amount of $ and recorded the expense. This bill will not be paid until July.

June : It is the last day of the pay period. Company owes the parttime worker $ for the June through June pay period. This amount will be paid on July

June : Record depreciation on vehicle at $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock