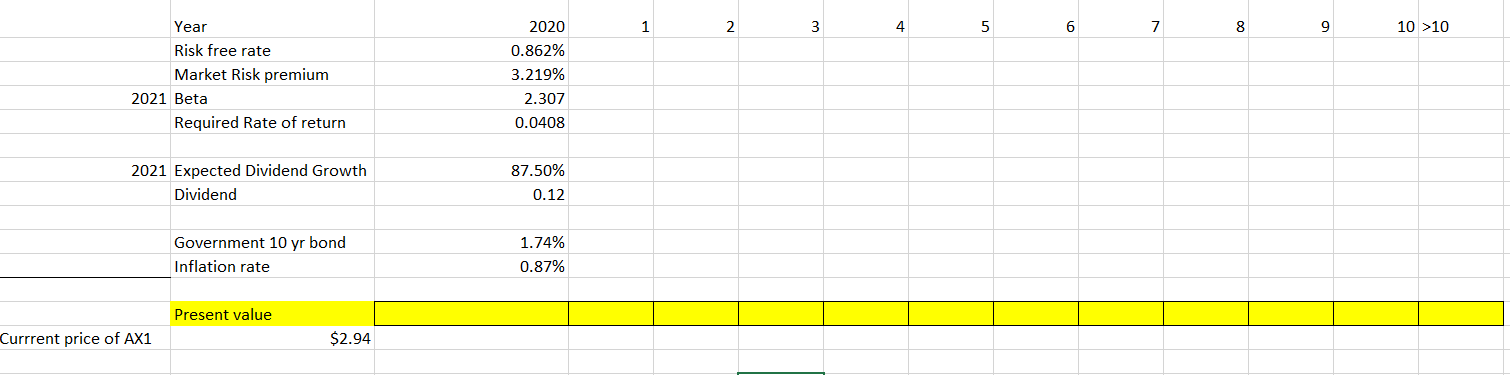

Question: I need help finding the intristic value, fill in the blanks of excel sheet, an example for Signapore airlines is attached below. 2020 1 2

I need help finding the intristic value, fill in the blanks of excel sheet, an example for Signapore airlines is attached below.

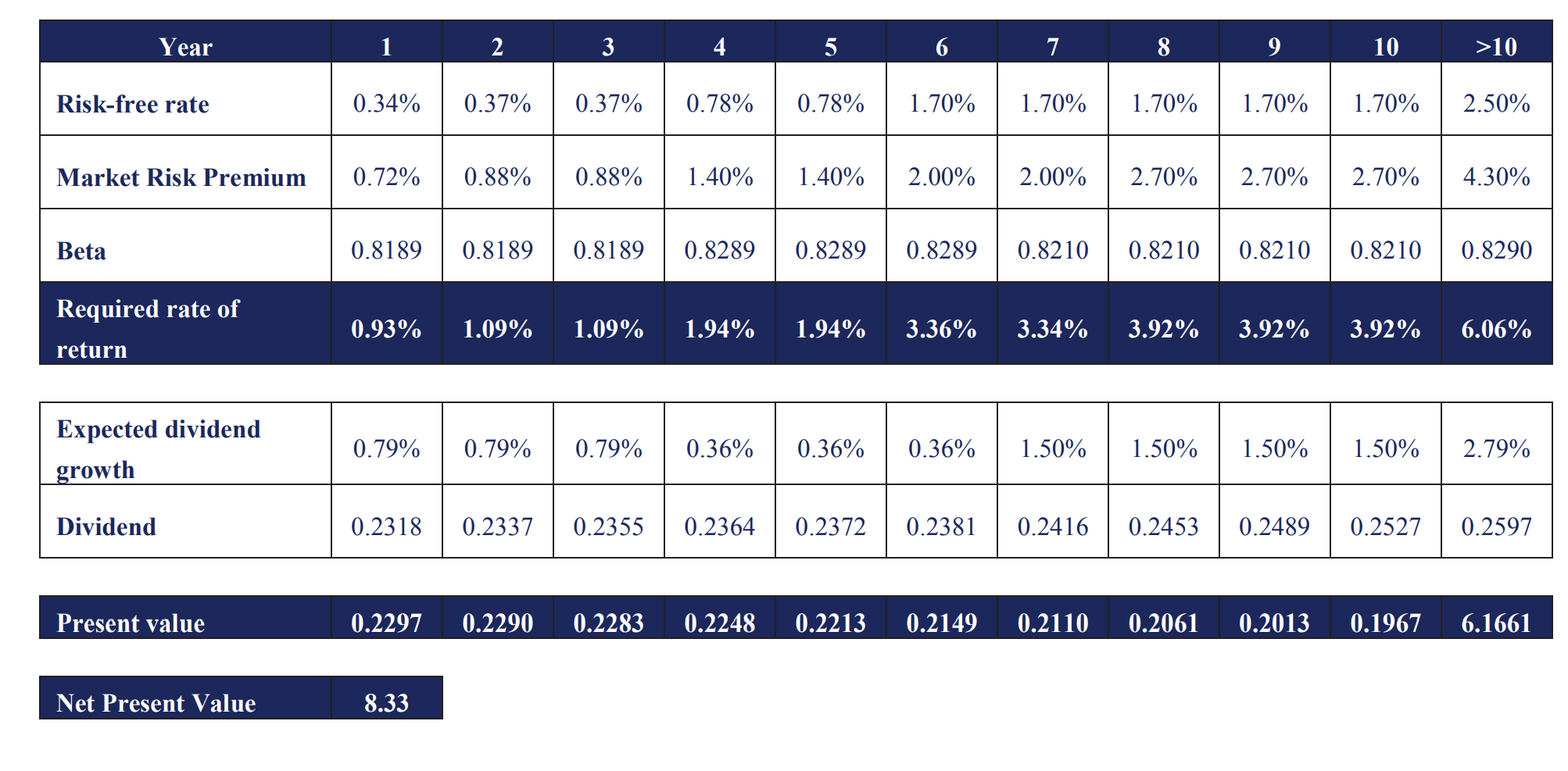

2020 1 2 3 4 5 6 7 8 9 10 >10 Year Risk free rate Market Risk premium 2021 Beta Required Rate of return 0.862% 3.219% 2.307 0.0408 2021 Expected Dividend Growth Dividend 87.50% 0.12 Government 10 yr bond Inflation rate 1.74% 0.87% Present value Currrent price of AX1 $2.94 Year 1 2 3 4 5 6 7. 8 9 10 >10 Risk-free rate 0.34% 0.37% 0.37% 0.78% 0.78% 1.70% 1.70% 1.70% 1.70% 1.70% 2.50% Market Risk Premium 0.72% 0.88% 0.88% 1.40% 1.40% 2.00% 2.00% 2.70% 2.70% 2.70% 4.30% Beta 0.8189 0.8189 0.8189 0.8289 0.8289 0.8289 0.8210 0.8210 0.8210 0.8210 0.8290 Required rate of 0.93% 1.09% 1.09% 1.94% 1.94% 3.36% 3.34% 3.92% 3.92% 3.92% 6.06% return Expected dividend growth 0.79% 0.79% 0.79% 0.36% 0.36% 0.36% 1.50% 1.50% 1.50% 1.50% 2.79% Dividend 0.2318 0.2337 0.2355 0.2364 0.2372 0.2381 0.2416 0.2453 0.2489 0.2527 0.2597 Present value 0.2297 0.2290 0.2283 0.2248 0.2213 0.2149 0.2110 0.2061 0.2013 0.1967 6.1661 Net Present Value 8.33 2020 1 2 3 4 5 6 7 8 9 10 >10 Year Risk free rate Market Risk premium 2021 Beta Required Rate of return 0.862% 3.219% 2.307 0.0408 2021 Expected Dividend Growth Dividend 87.50% 0.12 Government 10 yr bond Inflation rate 1.74% 0.87% Present value Currrent price of AX1 $2.94 Year 1 2 3 4 5 6 7. 8 9 10 >10 Risk-free rate 0.34% 0.37% 0.37% 0.78% 0.78% 1.70% 1.70% 1.70% 1.70% 1.70% 2.50% Market Risk Premium 0.72% 0.88% 0.88% 1.40% 1.40% 2.00% 2.00% 2.70% 2.70% 2.70% 4.30% Beta 0.8189 0.8189 0.8189 0.8289 0.8289 0.8289 0.8210 0.8210 0.8210 0.8210 0.8290 Required rate of 0.93% 1.09% 1.09% 1.94% 1.94% 3.36% 3.34% 3.92% 3.92% 3.92% 6.06% return Expected dividend growth 0.79% 0.79% 0.79% 0.36% 0.36% 0.36% 1.50% 1.50% 1.50% 1.50% 2.79% Dividend 0.2318 0.2337 0.2355 0.2364 0.2372 0.2381 0.2416 0.2453 0.2489 0.2527 0.2597 Present value 0.2297 0.2290 0.2283 0.2248 0.2213 0.2149 0.2110 0.2061 0.2013 0.1967 6.1661 Net Present Value 8.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts