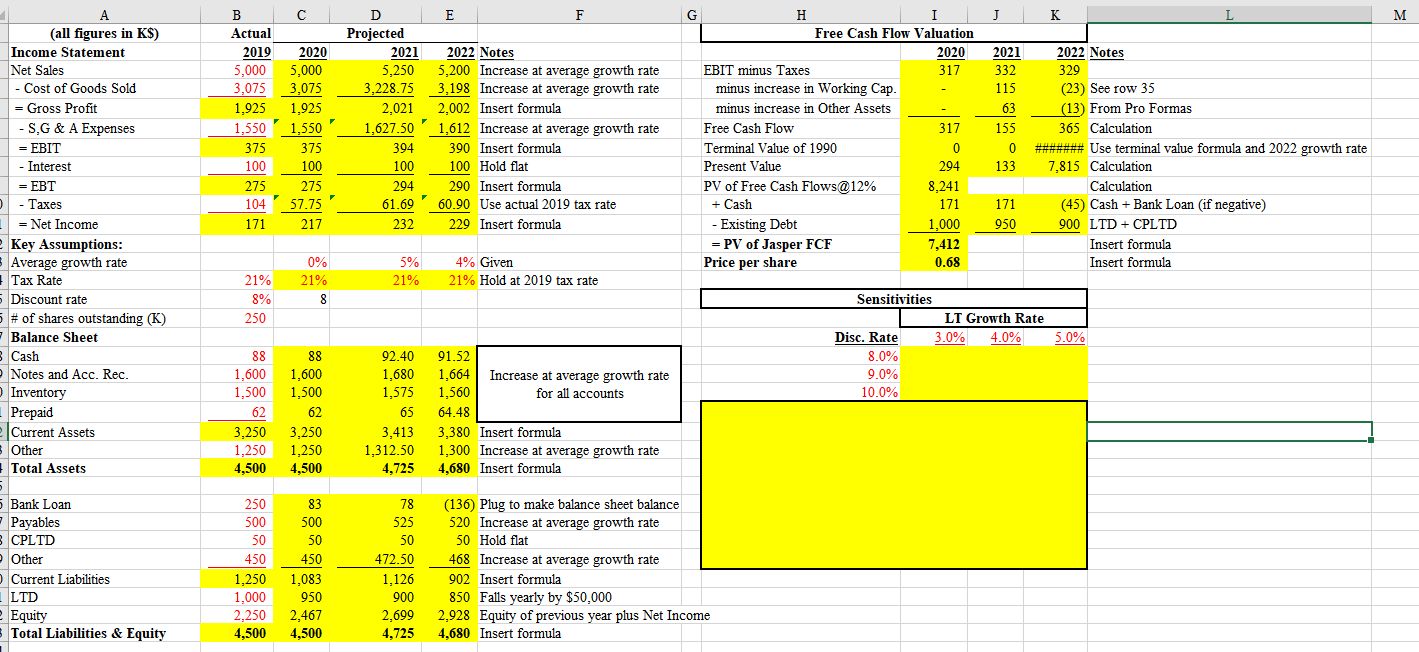

Question: I need help finding the Sensitivities at the bottom right of the excel sheet. Please add the excel formula used as well. C J K

I need help finding the Sensitivities at the bottom right of the excel sheet. Please add the excel formula used as well.

C J K 2021 317 332 115 B Actual 2019 5,000 3,075 1,925 1,550 375 100 275 104 171 D | Projected 2021 2022 Notes 5,250 5,200 Increase at average growth rate 3,228.75 3,198 Increase at average growth rate 2,021 2,002 Insert formula 1,627.50' 1,612 Increase at average growth rate Insert formula 100 100 Hold flat 294 290 Insert formula Use actual 2019 tax rate 232 229 Insert formula 317 2020 5,000 3,075 1,925 1,550 375 100 275 57.75 217 155 I Free Cash Flow Valuation 2020 EBIT minus Taxes minus increase in Working Cap. minus increase in Other Assets Free Cash Flow Terminal Value of 1990 Present Value PV of Free Cash Flows@12% 8,241 + Cash 171 - Existing Debt 1,000 = PV of Jasper FCF 7,412 Price per share 0.68 0 133 (all figures in KS) Income Statement Net Sales - Cost of Goods Sold = Gross Profit -SG & A Expenses = EBIT - Interest = EBT - Taxes = Net Income 2 Key Assumptions: Average growth rate Tax Rate 5 Discount rate 5 # of shares outstanding (K) - Balance Sheet Cash Notes and Acc. Rec. Inventory Prepaid 2 Current Assets Other Total Assets 2022 Notes 329 (23) See row 35 (13) From Pro Formas 365 Calculation ####### Use terminal value formula and 2022 growth rate 7,815 Calculation Calculation (45) Cash + Bank Loan (if negative) 900 LTD + CPLTD Insert formula Insert formula 294 171 950 0% 21% 5% 21% 4% Given 21% Hold at 2019 tax rate 21% 8% 250 5.0% Sensitivities LT Growth Rate Disc. Rate 3.0% 4.0% 8.0% 9.0% 10.0% 88 88 1,600 1,500 62 1,600 1,500 62 3,250 1,250 4,500 92.40 1,680 1,575 65 3,413 1.312.50 4,725 91.52 1,664 Increase at average growth rate 1,560 for all accounts 64.48 3,380 Insert formula 1,300 Increase at average growth rate 4,680 Insert formula 3,250 1,250 4,500 250 500 50 5 Bank Loan - Payables 3 CPLTD Other Current Liabilities - LTD e Equity Total Liabilities & Equity 83 500 50 450 1,083 950 2,467 4,500 78 525 50 472.50 1,126 450 1,250 1,000 2,250 4,500 (136) Plug to make balance sheet balance 520 Increase at average growth rate 50 Hold flat 468 Increase at average growth rate 902 Insert formula 850 Falls yearly by $50,000 2.928 Equity of previous year plus Net Income 4,680 Insert formula 2,699 4,725

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts