Question: I need help finding these. We are told to use checkpoint but I just need the Internal Revenue Code that goes with these! 2. Olney

I need help finding these. We are told to use checkpoint but I just need the Internal Revenue Code that goes with these!

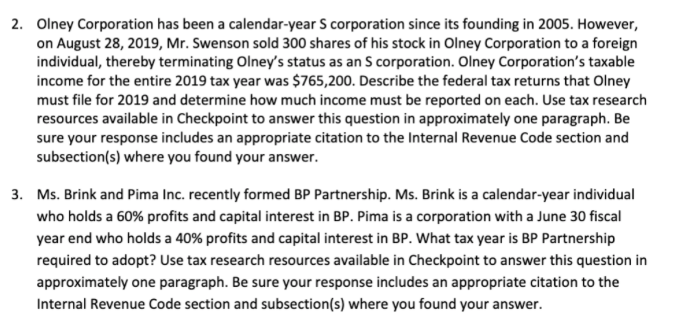

2. Olney Corporation has been a calendar-year S corporation since its founding in 2005. However, on August 28, 2019, Mr. Swenson sold 300 shares of his stock in Olney Corporation to a foreign individual, thereby terminating Olney's status as an S corporation. Olney Corporation's taxable income for the entire 2019 tax year was $765,200. Describe the federal tax returns that Olney must file for 2019 and determine how much income must be reported on each. Use tax research resources available in Checkpoint to answer this question in approximately one paragraph. Be sure your response includes an appropriate citation to the Internal Revenue Code section and subsection(s) where you found your answer. 3. Ms. Brink and Pima Inc. recently formed BP Partnership. Ms. Brink is a calendar-year individual who holds a 60% profits and capital interest in BP. Pima is a corporation with a June 30 fiscal year end who holds a 40% profits and capital interest in BP. What tax year is BP Partnership required to adopt? Use tax research resources available in Checkpoint to answer this question in approximately one paragraph. Be sure your response includes an appropriate citation to the Internal Revenue Code section and subsection(s) where you found your answer. 2. Olney Corporation has been a calendar-year S corporation since its founding in 2005. However, on August 28, 2019, Mr. Swenson sold 300 shares of his stock in Olney Corporation to a foreign individual, thereby terminating Olney's status as an S corporation. Olney Corporation's taxable income for the entire 2019 tax year was $765,200. Describe the federal tax returns that Olney must file for 2019 and determine how much income must be reported on each. Use tax research resources available in Checkpoint to answer this question in approximately one paragraph. Be sure your response includes an appropriate citation to the Internal Revenue Code section and subsection(s) where you found your answer. 3. Ms. Brink and Pima Inc. recently formed BP Partnership. Ms. Brink is a calendar-year individual who holds a 60% profits and capital interest in BP. Pima is a corporation with a June 30 fiscal year end who holds a 40% profits and capital interest in BP. What tax year is BP Partnership required to adopt? Use tax research resources available in Checkpoint to answer this question in approximately one paragraph. Be sure your response includes an appropriate citation to the Internal Revenue Code section and subsection(s) where you found your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts