Question: i need help finding V0 please 4. The value of a company's equity is 3 millions and its equity volatility is 30 percent. The risk-free

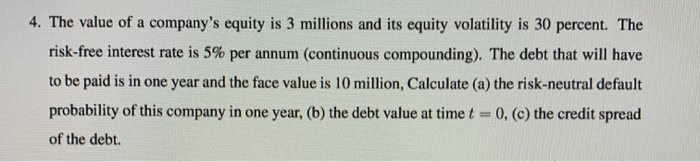

4. The value of a company's equity is 3 millions and its equity volatility is 30 percent. The risk-free interest rate is 5% per annum (continuous compounding). The debt that will have to be paid is in one year and the face value is 10 million, Calculate (a) the risk-neutral default probability of this company in one year, (b) the debt value at time t=0, (c) the credit spread of the debt. 4. The value of a company's equity is 3 millions and its equity volatility is 30 percent. The risk-free interest rate is 5% per annum (continuous compounding). The debt that will have to be paid is in one year and the face value is 10 million, Calculate (a) the risk-neutral default probability of this company in one year, (b) the debt value at time t=0, (c) the credit spread of the debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts