Question: I need help for no 2 2. Financial Planning and Growth The Kerispatih Company would like to see its sales grow at 20 percent for

I need help for no 2

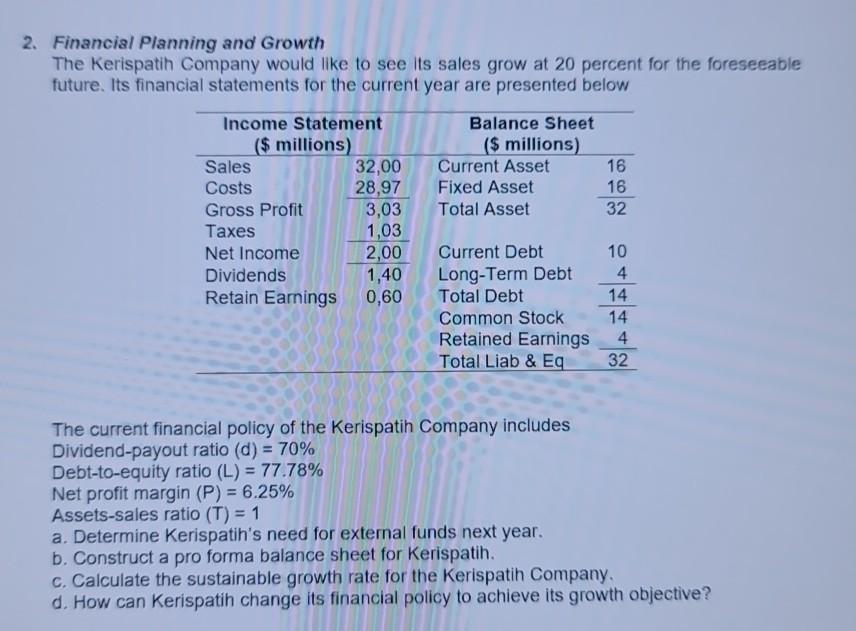

2. Financial Planning and Growth The Kerispatih Company would like to see its sales grow at 20 percent for the foreseeable future. Its financial statements for the current year are presented below Income Statement ($ millions) Sales 32,00 Costs 28,97 Gross Profit 3,03 Taxes 1,03 Net Income 2,00 Dividends 1,40 Retain Earnings 0,60 Balance Sheet ($ millions) Current Asset Fixed Asset Total Asset 16 16 32 Current Debt Long-Term Debt Total Debt Common Stock Retained Earnings Total Liab & Eq 10 4 14 14 4 32 The current financial policy of the Kerispatih Company includes Dividend-payout ratio (d) = 70% Debt-to-equity ratio (L) = 77.78% Net profit margin (P) = 6.25% Assets-sales ratio (T) = 1 a. Determine Kerispatih's need for external funds next year. b. Construct a pro forma balance sheet for Kerispatih. c. Calculate the sustainable growth rate for the Kerispatih Company. d. How can Kerispatih change its financial policy to achieve its growth objective

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts