Question: I need help for Part 4 & 5 please! Show work so I can understand. Problem III (15 points) Here are the risk and return

I need help for Part 4 & 5 please!

Show work so I can understand.

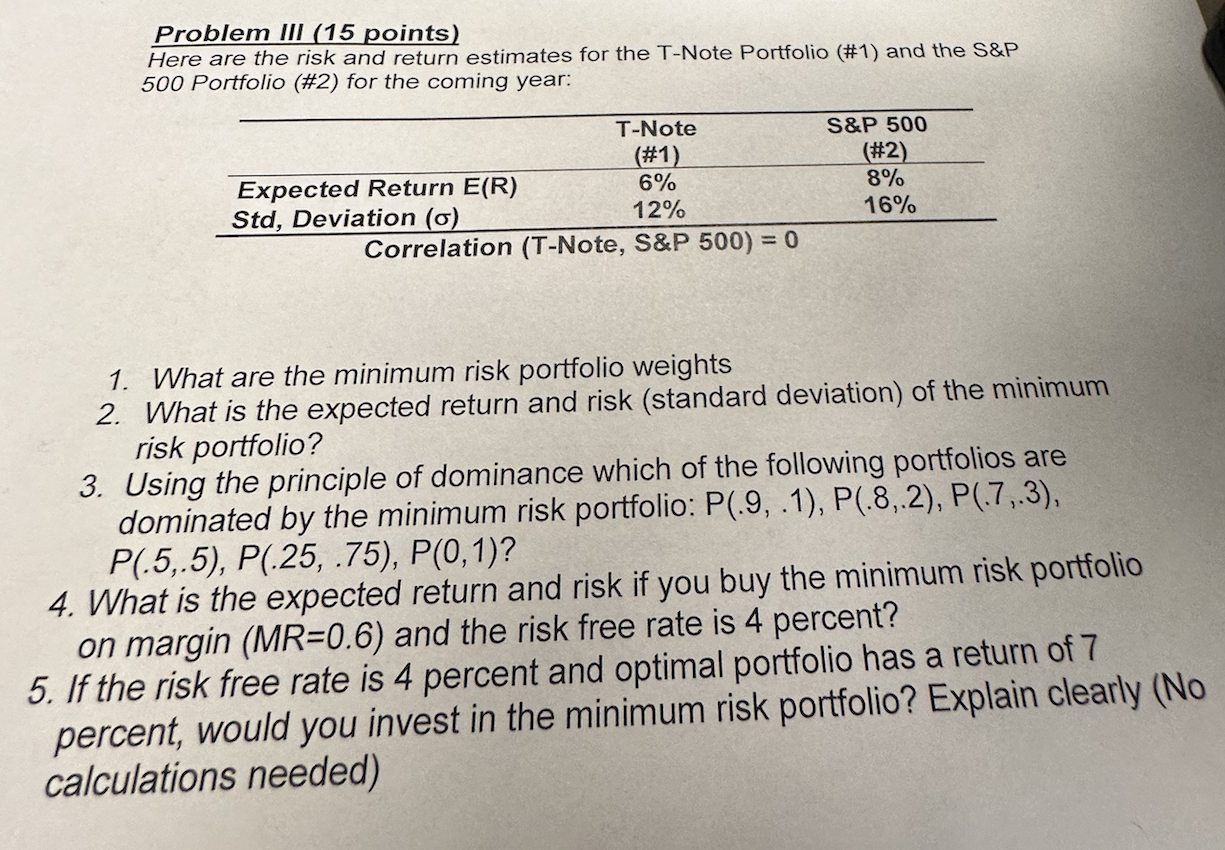

Problem III (15 points) Here are the risk and return estimates for the T-Note Portfolio (\#1) and the S\&P 500 Portfolio (\#2) for the coming year: 1. What are the minimum risk portfolio weights 2. What is the expected return and risk (standard deviation) of the minimum risk portfolio? 3. Using the principle of dominance which of the following portfolios are dominated by the minimum risk portfolio: P(.9,.1),P(.8,.2),P(.7,3), P(.5,.5),P(.25,.75),P(0,1)? 4. What is the expected return and risk if you buy the minimum risk portfolio on margin (MR=0.6) and the risk free rate is 4 percent? 5. If the risk free rate is 4 percent and optimal portfolio has a return of 7 percent, would you invest in the minimum risk portfolio? Explain clearly (No calculations needed)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts