Question: i need help for questions 3 and 4 thx E#11:15 98198 AM 33% FIN205 Assignment 1 - Fall 2019.docx (a) If the interest rate is

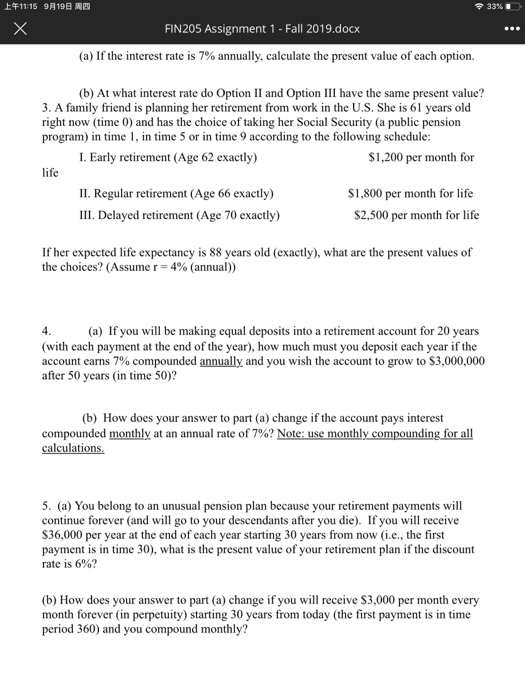

E#11:15 98198 AM 33% FIN205 Assignment 1 - Fall 2019.docx (a) If the interest rate is 7% annually, calculate the present value of each option. (b) At what interest rate do Option II and Option III have the same present value? 3. A family friend is planning her retirement from work in the U.S. She is 61 years old right now time 0) and has the choice of taking her Social Security (a public pension program) in time 1, in time 5 or in time 9 according to the following schedule: 1. Early retirement (Age 62 exactly) $1,200 per month for life II. Regular retirement (Age 66 exactly) $1,800 per month for life III. Delayed retirement (Age 70 exactly) $2,500 per month for life If her expected life expectancy is 88 years old (exactly), what are the present values of the choices? (Assume r=4% (annual)) 4. (a) If you will be making equal deposits into a retirement account for 20 years (with each payment at the end of the year), how much must you deposit each year if the account earns 7% compounded annually and you wish the account to grow to $3,000,000 after 50 years in time 50)? (b) How does your answer to part (a) change if the account pays interest compounded monthly at an annual rate of 7%? Note: use monthly compounding for all calculations. 5. (a) You belong to an unusual pension plan because your retirement payments will continue forever and will go to your descendants after you die). If you will receive S36,000 per year at the end of each year starting 30 years from now (i.c., the first payment is in time 30), what is the present value of your retirement plan if the discount rate is 6%? (b) How does your answer to part (a) change if you will receive $3,000 per month every month forever (in perpetuity) starting 30 years from today (the first payment is in time period 360) and you compound monthly? E#11:15 98198 AM 33% FIN205 Assignment 1 - Fall 2019.docx (a) If the interest rate is 7% annually, calculate the present value of each option. (b) At what interest rate do Option II and Option III have the same present value? 3. A family friend is planning her retirement from work in the U.S. She is 61 years old right now time 0) and has the choice of taking her Social Security (a public pension program) in time 1, in time 5 or in time 9 according to the following schedule: 1. Early retirement (Age 62 exactly) $1,200 per month for life II. Regular retirement (Age 66 exactly) $1,800 per month for life III. Delayed retirement (Age 70 exactly) $2,500 per month for life If her expected life expectancy is 88 years old (exactly), what are the present values of the choices? (Assume r=4% (annual)) 4. (a) If you will be making equal deposits into a retirement account for 20 years (with each payment at the end of the year), how much must you deposit each year if the account earns 7% compounded annually and you wish the account to grow to $3,000,000 after 50 years in time 50)? (b) How does your answer to part (a) change if the account pays interest compounded monthly at an annual rate of 7%? Note: use monthly compounding for all calculations. 5. (a) You belong to an unusual pension plan because your retirement payments will continue forever and will go to your descendants after you die). If you will receive S36,000 per year at the end of each year starting 30 years from now (i.c., the first payment is in time 30), what is the present value of your retirement plan if the discount rate is 6%? (b) How does your answer to part (a) change if you will receive $3,000 per month every month forever (in perpetuity) starting 30 years from today (the first payment is in time period 360) and you compound monthly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts