Question: I need help for this question 15. An insuran so the present value of the obligation is $10,000. The company's portfolio manager wishes to obligation

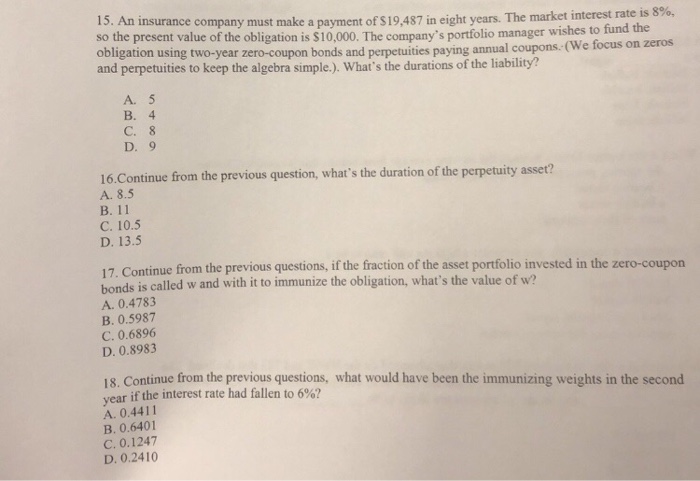

15. An insuran so the present value of the obligation is $10,000. The company's portfolio manager wishes to obligation using two-year zero-coupon bonds and perpetuities paying annual coupons.-(We focus ce company must make a payment of S 19,487 in eight years. The market interest rate is 8%, fund the and perpetuities to keep the algebra simple.). What's the durations of the liability" A. 5 B. 4 C. 8 D. 9 16.Continue from the previous question, what's the duration of the perpetuity asset? A. 8.5 C. 10.5 D. 13.5 7. Continue from the previous questions, if the fraction of the asset portfolio invested in the zero-coupon bonds is called w and with it to immunize the obligation, what's the value of w? A. 0.4783 B. 0.5987 C. 0.6896 D. 0.8983 18. Continue from the previous questions, what would have been the immunizing weights in the second year if the interest rate had fallen to 6%? A. 0.4411 B. 0.6401 C. 0.1247 D. 0.2410

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts