Question: i need help from 1-6 pleasw Homework #7 - Due 11:59pm Tuesday, December 10 Mortgage-backed securities, etc Each question is worth 1/2 points to the

i need help from 1-6 pleasw

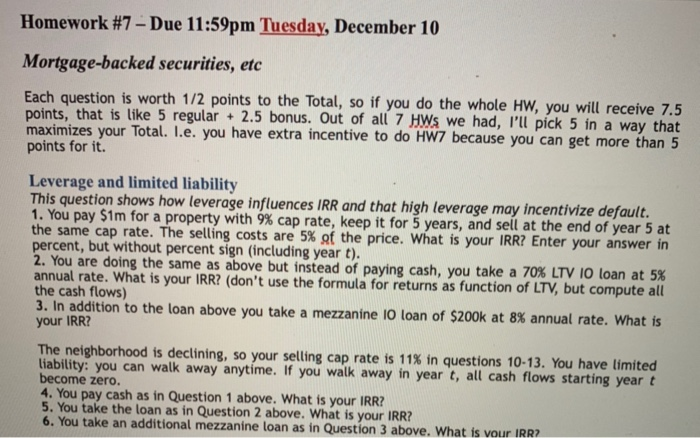

i need help from 1-6 pleaswHomework #7 - Due 11:59pm Tuesday, December 10 Mortgage-backed securities, etc Each question is worth 1/2 points to the Total, so if you do the whole HW, you will receive 7.5 points, that is like 5 regular + 2.5 bonus. Out of all 7 HWs we had, I'll pick 5 in a way that maximizes your Total. I.e. you have extra incentive to do HW7 because you can get more than 5 points for it. Leverage and limited liability This question shows how leverage influences IRR and that high leverage may incentivize default. 1. You pay $1m for a property with 9% cap rate, keep it for 5 years, and sell at the end of year 5 at the same cap rate. The selling costs are 5% of the price. What is your IRR? Enter your answer in percent, but without percent sign (including year t). 2. You are doing the same as above but instead of paying cash, you take a 70% LTV 10 loan at 5% annual rate. What is your IRR? (don't use the formula for returns as function of LTV, but compute all the cash flows) 3. In addition to the loan above you take a mezzanine 10 loan of $200k at 8% annual rate. What is your IRR? The neighborhood is declining, so your selling cap rate is 11% in questions 10-13. You have limited liability: you can walk away anytime. If you walk away in year t, all cash flows starting year t become zero. 4. You pay cash as in Question 1 above. What is your IRR? 5. You take the loan as in Question 2 above. What is your IRR? 6. You take an additional mezzanine loan as in Question 3 above. What is vour IRR2 Homework #7 - Due 11:59pm Tuesday, December 10 Mortgage-backed securities, etc Each question is worth 1/2 points to the Total, so if you do the whole HW, you will receive 7.5 points, that is like 5 regular + 2.5 bonus. Out of all 7 HWs we had, I'll pick 5 in a way that maximizes your Total. I.e. you have extra incentive to do HW7 because you can get more than 5 points for it. Leverage and limited liability This question shows how leverage influences IRR and that high leverage may incentivize default. 1. You pay $1m for a property with 9% cap rate, keep it for 5 years, and sell at the end of year 5 at the same cap rate. The selling costs are 5% of the price. What is your IRR? Enter your answer in percent, but without percent sign (including year t). 2. You are doing the same as above but instead of paying cash, you take a 70% LTV 10 loan at 5% annual rate. What is your IRR? (don't use the formula for returns as function of LTV, but compute all the cash flows) 3. In addition to the loan above you take a mezzanine 10 loan of $200k at 8% annual rate. What is your IRR? The neighborhood is declining, so your selling cap rate is 11% in questions 10-13. You have limited liability: you can walk away anytime. If you walk away in year t, all cash flows starting year t become zero. 4. You pay cash as in Question 1 above. What is your IRR? 5. You take the loan as in Question 2 above. What is your IRR? 6. You take an additional mezzanine loan as in Question 3 above. What is vour IRR2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts