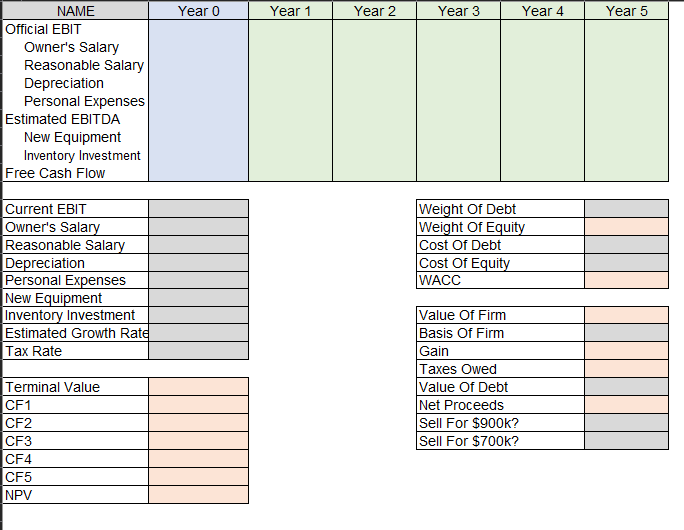

Question: I need help getting an explanation and how to input the proper formulas and where to get the info for the following case and answer

I need help getting an explanation and how to input the proper formulas and where to get the info for the following case and answer it on EXCEL! please put formulas

- Organic Micros was established 8 years ago by Mary Mendoza. The firm reported EBIT this year of $80,000. Mary typically reports about $2,000 in personal expenses through the firm each year. She also pays herself a salary of $60,000 despite the market rate for such a position being closer to $30,000.

- The firm currently reports $10,000 in depreciation expenses every year.

- The firm will need $25,000 of inventory replaced in year 1 and will also require the replacement of equipment during year 4 in an amount totaling $50,000.

- The firm currently has outstanding debt of $400,000. The firm has been historically financed in a way that 30% of funds are a result of debt financing. The cost of this debt financing is estimated to be 12% while the cost of equity financing is estimated at 22%.

- Mary originally invested $120,000 of her own funds in the firm which establishes a cost basis for the firm of $120,000. Mary typically falls in a tax bracket that results in a total tax rate of 40%.

- Based on the firm's maturity and the state of the industry, it is estimated the EBIT will increase by 9% each year for the next 5 years. Beyond this time frame,a reasonable estimate of growth is neither possible nor relevant.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts