Question: I need help getting the correct answer for the questions in the picture. buy sell nation to .. son Forex Kan A. Interest Rate Parity

I need help getting the correct answer for the questions in the picture.

I need help getting the correct answer for the questions in the picture.

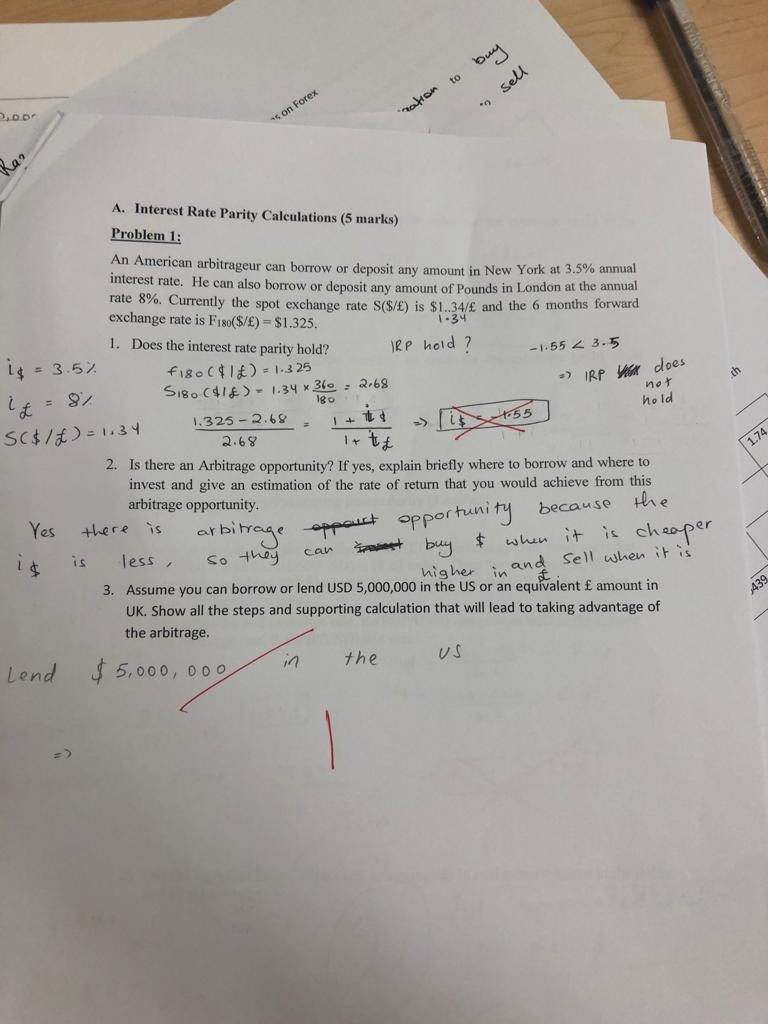

buy sell nation to .. son Forex Kan A. Interest Rate Parity Calculations (5 marks) Problem 1: An American arbitrageur can borrow or deposit any amount in New York at 3.5% annual interest rate. He can also borrow or deposit any amount of Pounds in London at the annua rate 8%. Currently the spot exchange rate S($/) is $1..34/ and the 6 months forward exchange rate is F180($/) = $1.325. 1. Does the interest rate parity hold? IRP hold? -1.55 23.5 fis.Ci) - 1.325 1.34 ro is = 3.5% if = 8% 5180 ($1&) - 1.34 x 360 = 2.68. = IRP V does not SC$ ) = 1.34 1.325 -2.68 29 .08 1 + TL 9 55 hold 2.68 . + td 2. Is there an Arbitrage opportunity? If yes, explain briefly where to borrow and where to invest and give an estimation of the rate of return that you would achieve from this arbitrage opportunity. Ves there is arbitrage arbitrage the oppout a appourt opportunity because it is less, so they can not buy $ when it is cheaper 3. Assume you can borrow or lend USD 5,000,000 in the US or an equivalent amount in higher in and sell when it is UK. Show all the steps and supporting calculation that will lead to taking advantage of the arbitrage. Lend $5,000,000 in the US

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts