Question: I need help getting the journal entries correct. Presented below are selected transactions for Pina Colada Company during February and March of the current year.

I need help getting the journal entries correct.

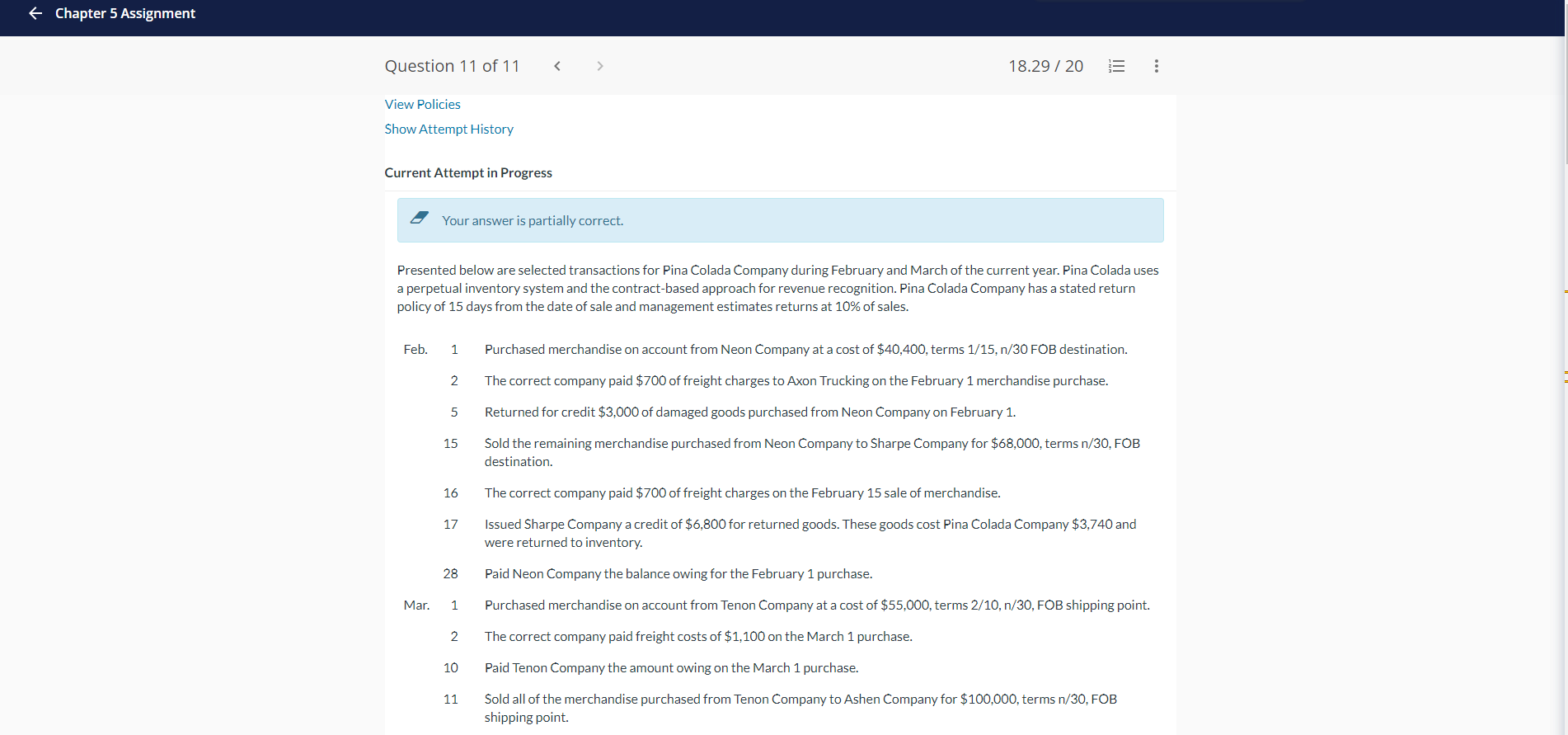

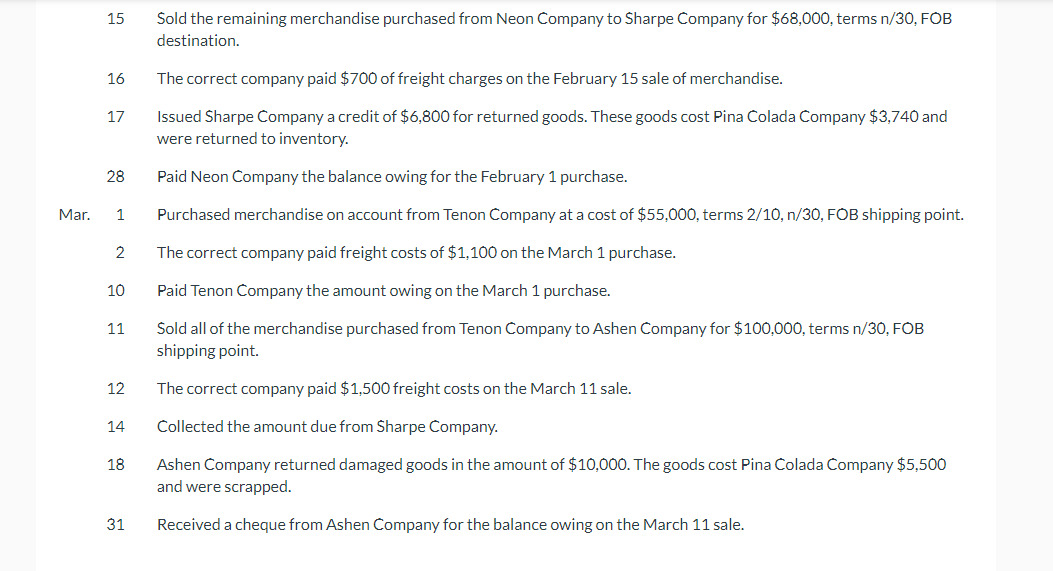

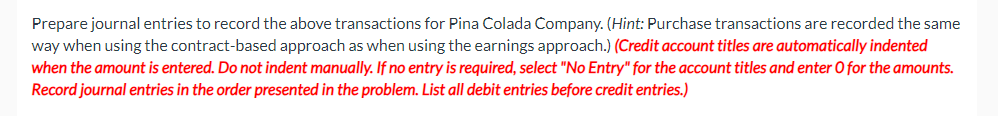

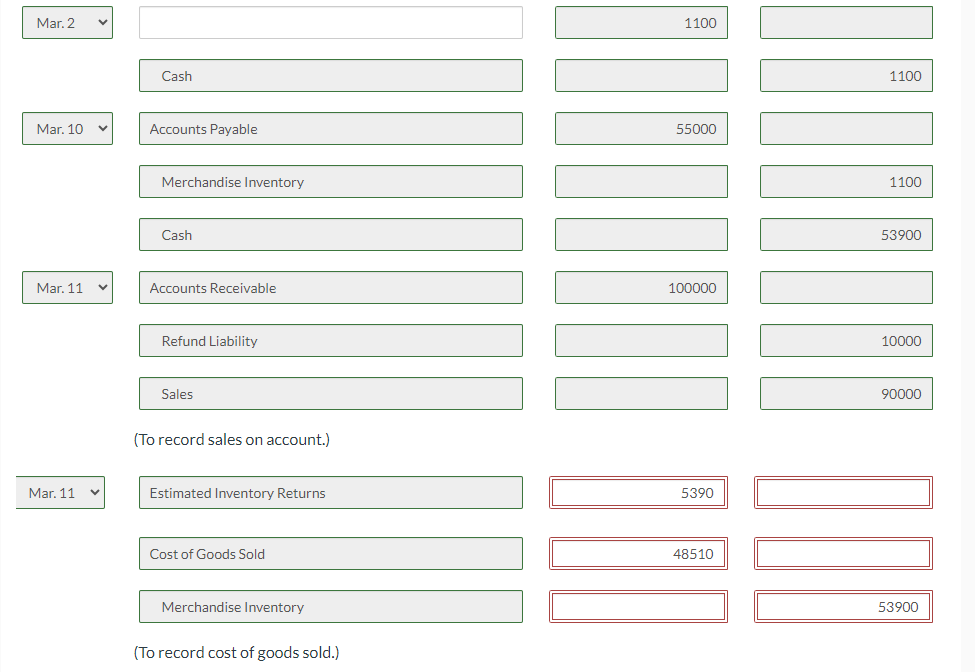

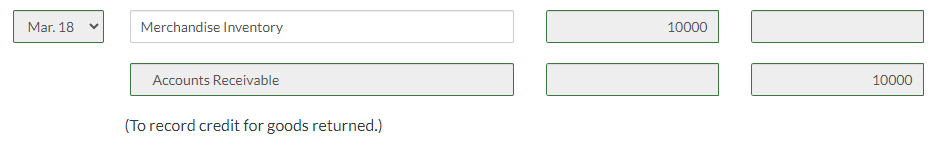

Presented below are selected transactions for Pina Colada Company during February and March of the current year. Pina Colada uses a perpetual inventory system and the contract-based approach for revenue recognition. Pina Colada Company has a stated return policy of 15 days from the date of sale and management estimates returns at 10% of sales. Feb. 1 Purchased merchandise on account from Neon Company at a cost of $40,400, terms 1/15,n/30 FOB destination. 2 The correct company paid $700 of freight charges to Axon Trucking on the February 1 merchandise purchase. 5 Returned for credit $3,000 of damaged goods purchased from Neon Company on February 1. 15 Sold the remaining merchandise purchased from Neon Company to Sharpe Company for $68,000, terms n/30, FOB destination. 16 The correct company paid $700 of freight charges on the February 15 sale of merchandise. 17 Issued Sharpe Company a credit of $6,800 for returned goods. These goods cost Pina Colada Company $3,740 and were returned to inventory. 28 Paid Neon Company the balance owing for the February 1 purchase. Mar. 1 Purchased merchandise on account from Tenon Company at a cost of $55,000, terms 2/10,n/30, FOB shipping point. 2 The correct company paid freight costs of $1,100 on the March 1 purchase. 10 Paid Tenon Company the amount owing on the March 1 purchase. 11 Sold all of the merchandise purchased from Tenon Company to Ashen Company for $100,000, terms n/30, FOB shipping point. 15 Sold the remaining merchandise purchased from Neon Company to Sharpe Company for $68,000, terms n/30, FOB destination. 16 The correct company paid $700 of freight charges on the February 15 sale of merchandise. 17 Issued Sharpe Company a credit of $6,800 for returned goods. These goods cost Pina Colada Company $3,740 and were returned to inventory. 28 Paid Neon Company the balance owing for the February 1 purchase. Mar. 1 Purchased merchandise on account from Tenon Company at a cost of $55,000, terms 2/10,n/30, FOB shipping point. 2 The correct company paid freight costs of $1,100 on the March 1 purchase. 10 Paid Tenon Company the amount owing on the March 1 purchase. 11 Sold all of the merchandise purchased from Tenon Company to Ashen Company for $100,000, terms n/30, FOB shipping point. 12 The correct company paid $1,500 freight costs on the March 11 sale. 14 Collected the amount due from Sharpe Company. 18 Ashen Company returned damaged goods in the amount of $10,000. The goods cost Pina Colada Company $5,500 and were scrapped. 31 Received a cheque from Ashen Company for the balance owing on the March 11 sale. Prepare journal entries to record the above transactions for Pina Colada Company. (Hint: Purchase transactions are recorded the same way when using the contract-based approach as when using the earnings approach.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Feb. 17 Accounts Receivable (To record credit for goods returned.) Feb. 17 Merchandise Inventory (To record cost of goods returned.) Mar. 2 Cash Mar. 10 Accounts Payable Merchandise Inventory Cash Mar.11 Accounts Receivable Refund Liability Sales (To record sales on account.) Cost of Goods Sold Merchandise Inventory (To record cost of goods sold.) Accounts Receivable (To record credit for goods returned.) 10000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts