Question: I need help getting the last parts PLEASE HELP!! Issues in Capital Budgeting a. Developing a spreadsheet model, and using it to find the project's

I need help getting the last parts PLEASE HELP!!

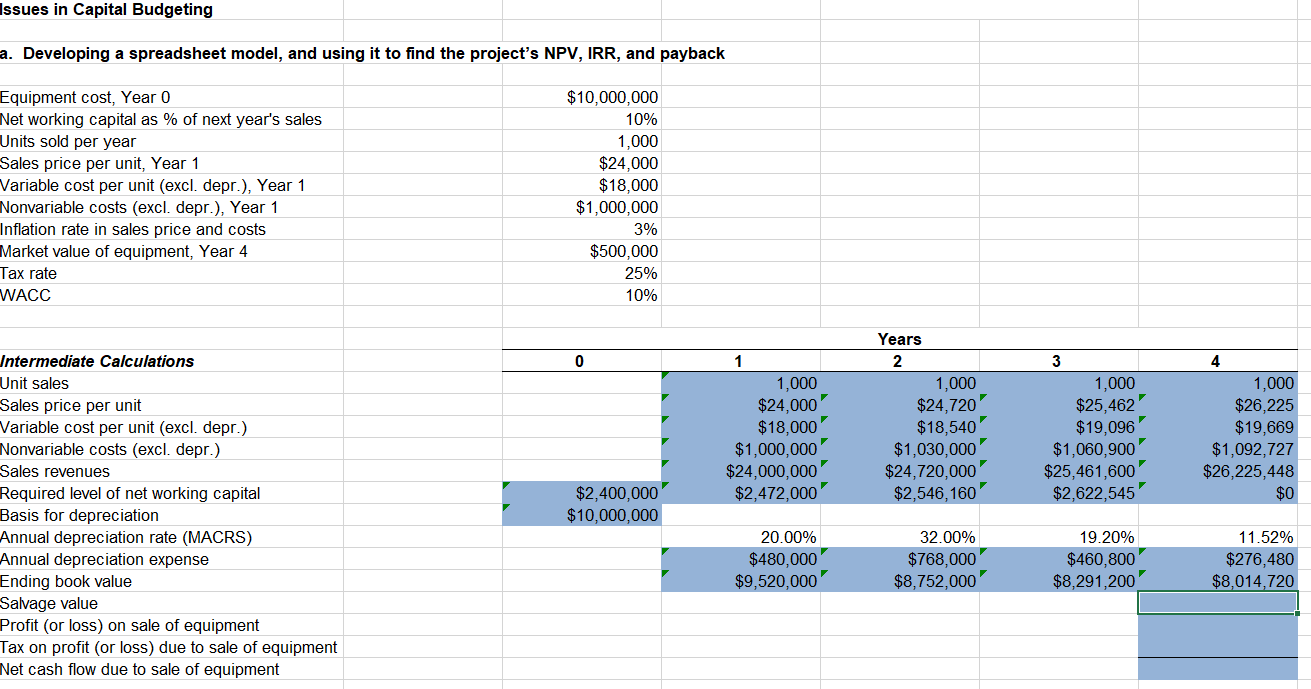

Issues in Capital Budgeting a. Developing a spreadsheet model, and using it to find the project's NPV, IRR, and payback Equipment cost, Year O Net working capital as % of next year's sales Units sold per year Sales price per unit, Year 1 Variable cost per unit (excl. depr.), Year 1 Nonvariable costs (excl. depr.), Year 1 Inflation rate in sales price and costs Market value of equipment, Year 4 Tax rate WACC $10,000,000 10% 1,000 $24,000 $18,000 $1,000,000 3% $500,000 25% 10% 0 1 1,000 $24,000 $18,000 $1,000,000 $24,000,000 $2,472,000 Years 2 1,000 $24,720 $18,540 $1,030,000 $24,720,000 $2,546,160 1,000 $25,462 $19,096 $1,060,900 $25,461,600" $2,622,545 4 1,000 $26,225 $19,669 $1,092,727 $26,225,448 $0 Intermediate Calculations Unit sales Sales price per unit Variable cost per unit (excl. depr.) Nonvariable costs (excl. depr.) Sales revenues Required level of net working capital Basis for depreciation Annual depreciation rate (MACRS) Annual depreciation expense Ending book value Salvage value Profit (or loss) on sale of equipment Tax on profit (or loss) due to sale of equipment Net cash flow due to sale of equipment $2,400,000 $10,000,000 20.00% $480,000 $9,520,000 32.00% $768,000 $8,752,000 19.20% $460,800 $8,291,200 11.52% $276,480 $8,014,720

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts