Question: i need help! Holly took a prospective client to dinner at a restaurant, and after agreeing to a business deal, they went to the theater.

i need help!

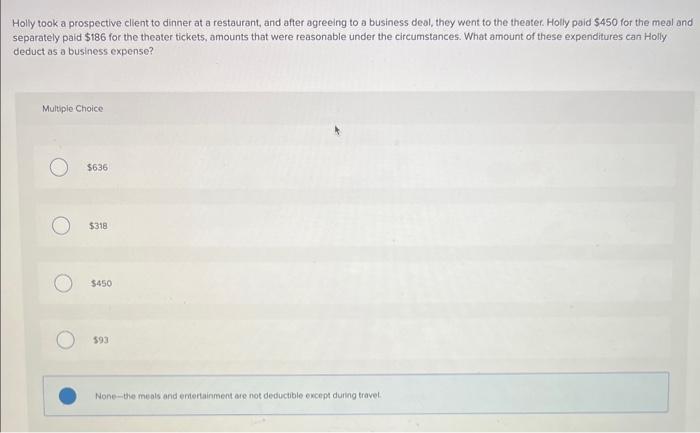

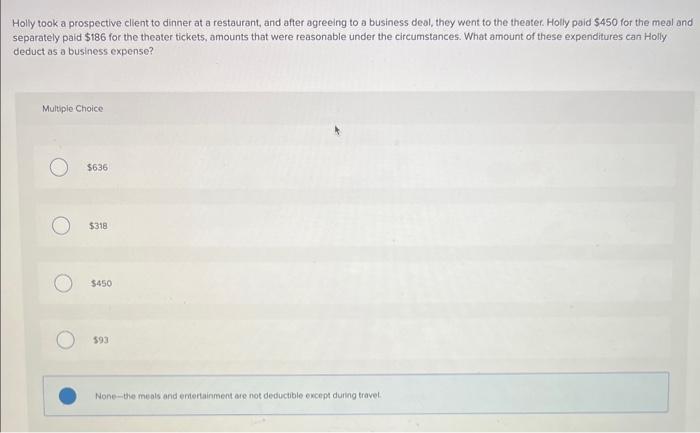

Holly took a prospective client to dinner at a restaurant, and after agreeing to a business deal, they went to the theater. Holly paid $450 for the meal and separately paid \$186 for the theater tickets, amounts that were reasonable under the circumstances. What amount of these expenditures can Holly deduct as a business expense? Multiple Choice $636 $318 $450 593 None-tie meals and entertainitnent are not deductible except during travel

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock