Question: I need help how to solve the problems to get the provided answers below. 21. Consider a five-year bond with a face value of $500000

I need help how to solve the problems to get the provided answers below.

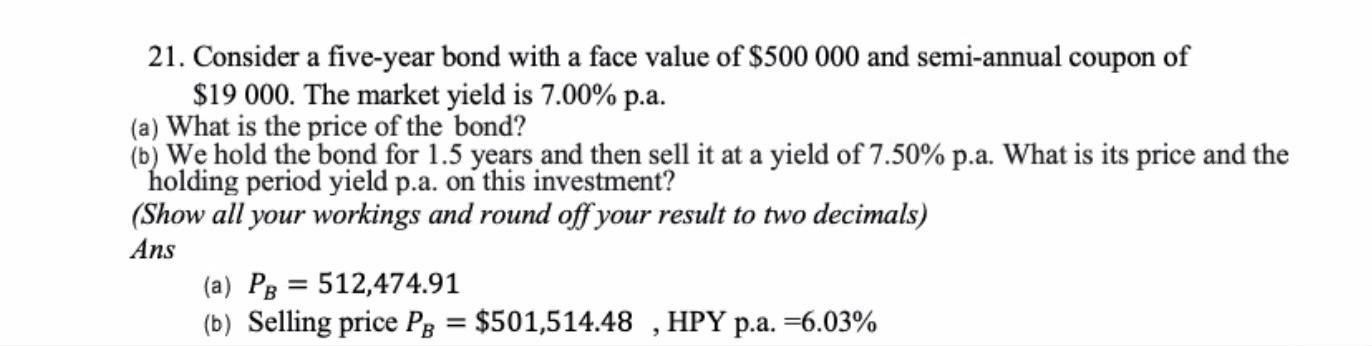

21. Consider a five-year bond with a face value of $500000 and semi-annual coupon of $19000. The market yield is 7.00% p.a. (a) What is the price of the bond? (b) We hold the bond for 1.5 years and then sell it at a yield of 7.50% p.a. What is its price and the holding period yield p.a. on this investment? (Show all your workings and round off your result to two decimals) Ans (a) PB=512,474.91 (b) Selling price PB=$501,514.48, HPY p.a. =6.03%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts