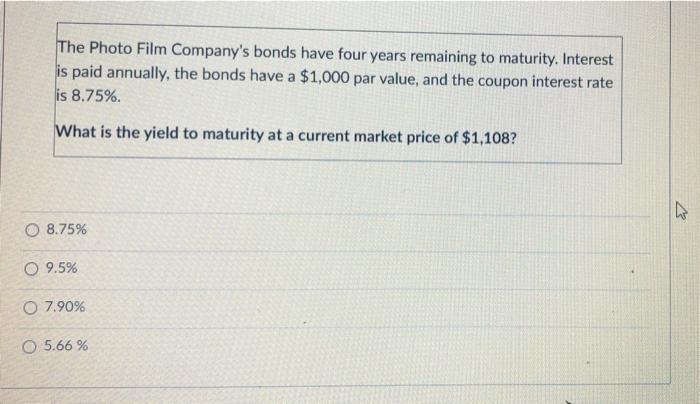

Question: i need help i am stuck on this 4 part problem The Photo Film Company's bonds have four years remaining to maturity. Interest is paid

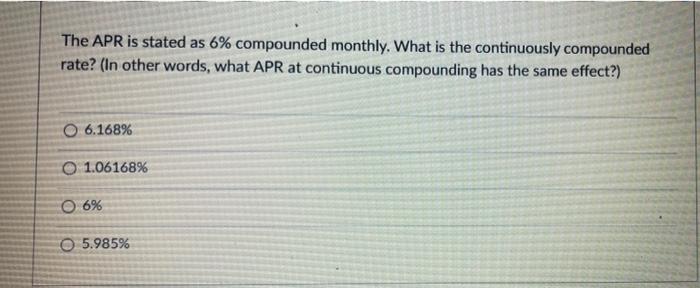

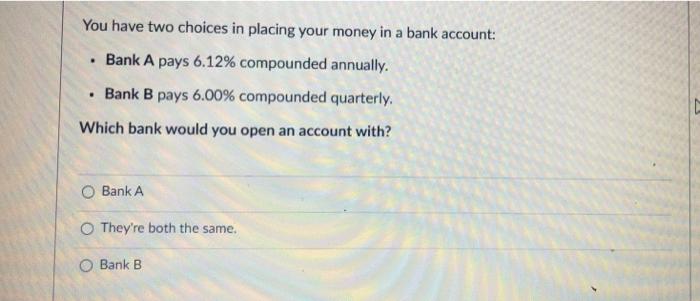

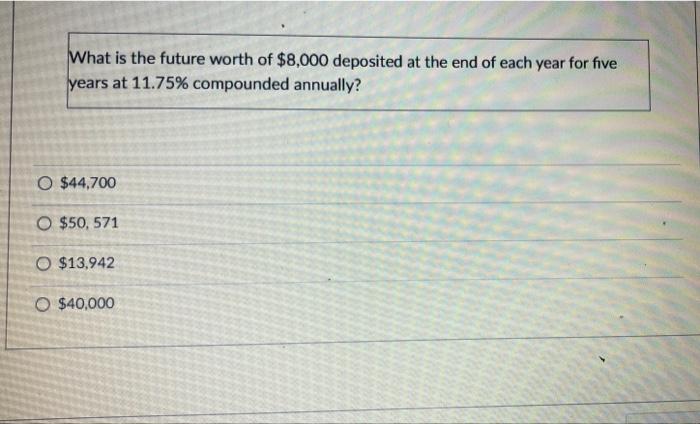

The Photo Film Company's bonds have four years remaining to maturity. Interest is paid annually, the bonds have a $1,000 par value, and the coupon interest rate is 8.75% What is the yield to maturity at a current market price of $1,108? 4 O 8.75% O 9.5% 0 7.90% O 5.66% The APR is stated as 6% compounded monthly. What is the continuously compounded rate? (In other words, what APR at continuous compounding has the same effect?) O 6.168% O 1.06168% O 6% O 5.985% . You have two choices in placing your money in a bank account: Bank A pays 6.12% compounded annually. Bank B pays 6.00% compounded quarterly Which bank would you open an account with? . C Bank A They're both the same. O Bank B What is the future worth of $8,000 deposited at the end of each year for five years at 11.75% compounded annually? O $44,700 O $50, 571 O $13,942 O $40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts