Question: i need help i cant figure out the common equity and that goes into the next questin can you solve a and b The following

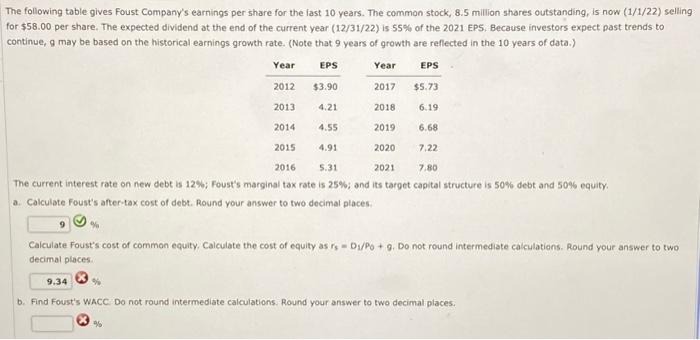

The following table gives Foust Company's earnings per share for the fast 10 years. The common stock, 8.5 million shares outstanding, is now ( 1/1/22 ) selling for $58.00 per share. The expected dividend at the end of the current year (12/31/22) is 55% of the 2021 EPS. Because investors expect past trends to continue, 9 may be based on the historical earnings growth rate. (Note that 9 years of growth are reflected in the 10 years of data.) The current interest rate on new debt is 12\%; Foust's marginal tax rate is 25%; and its target capital structure is 50% debt and 50%6 equity. a. Calculate Foust's after-tax cost of debt. Round your answer to two decimal places: Caiculate Foust's cost of common equity, Calculate the cost of equity as rss=D1//P0+9. Do not round intermediate calculatians. Round your answer to two decimal places: b. Find Foust's WACC Do not round intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts