Question: I need help! I need someone to explain where I went wrong on part B4 please!! I only need B4!! thank you :) Dakota Company

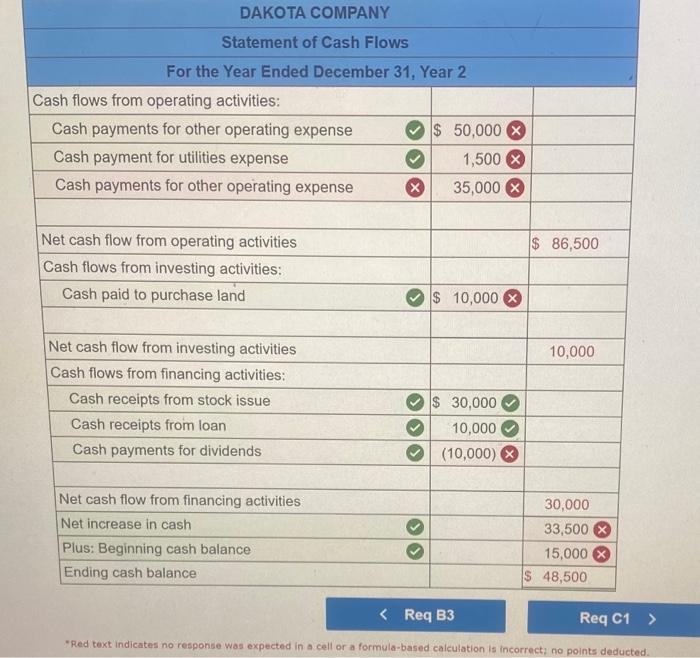

Dakota Company experienced the following events during Year 2 1. Acquired $30,000 cash from the issue of common stock 2. Paid $12,000 cash to purchase land. 3. Borrowed $10,000 cash 4. Provided services for $20,000 cash. 5. Paid $1,000 cash for utilities expense. 6. Paid $15,000 cash for other operating expenses 7. Paid a $2,000 cash dividend to the stockholders. 8. Determined that the market value of the land purchased in Event 2 is now $12,700. ces Required a. The January 1. Year 2. general ledger account balances are shown in the following accounting equation Record the eight events in the appropriate general ledger accounts. Record the amounts of revenue, expense, and dividends in the Retained Earnings column Provide the appropriate titles for these accounts in the last column of the table. The first event is shown as an example b-1. Prepare an income statement for the Year 2 accounting period b-2. Prepare a statement of changes in equity for the Year 2 accounting period, b-3. Prepare a year-end balance sheet for the Year 2 accounting period b-4. Prepare a statement of cash flows for the Year 2 accounting period. c-1. Determine the percentage of assets that were provided by retained earnings. c-2. Can you determine the cash in retained earnings? Complete this question by enterinnur DAKOTA COMPANY Statement of Cash Flows For the Year Ended December 31, Year 2 Cash flows from operating activities: Cash payments for other operating expense $ 50,000 X Cash payment for utilities expense 1,500 X Cash payments for other operating expense x 35,000 X $ 86,500 Net cash flow from operating activities Cash flows from investing activities: Cash paid to purchase land $ 10,000 X 10,000 Net cash flow from investing activities Cash flows from financing activities: Cash receipts from stock issue Cash receipts from loan Cash payments for dividends $ 30,000 10,000 (10,000) Net cash flow from financing activities Net increase in cash Plus: Beginning cash balance Ending cash balance 30,000 33,500 X 15,000 X 48,500 * Red text indicates no response was expected in a cell or a formula-based calculation is incorrect: no points deducted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts