Question: I need help in solving exercise 7 . Practical Application: Consider the following corporate and muni bond info from Thursday 2 / 1 1 /

I need help in solving exercise

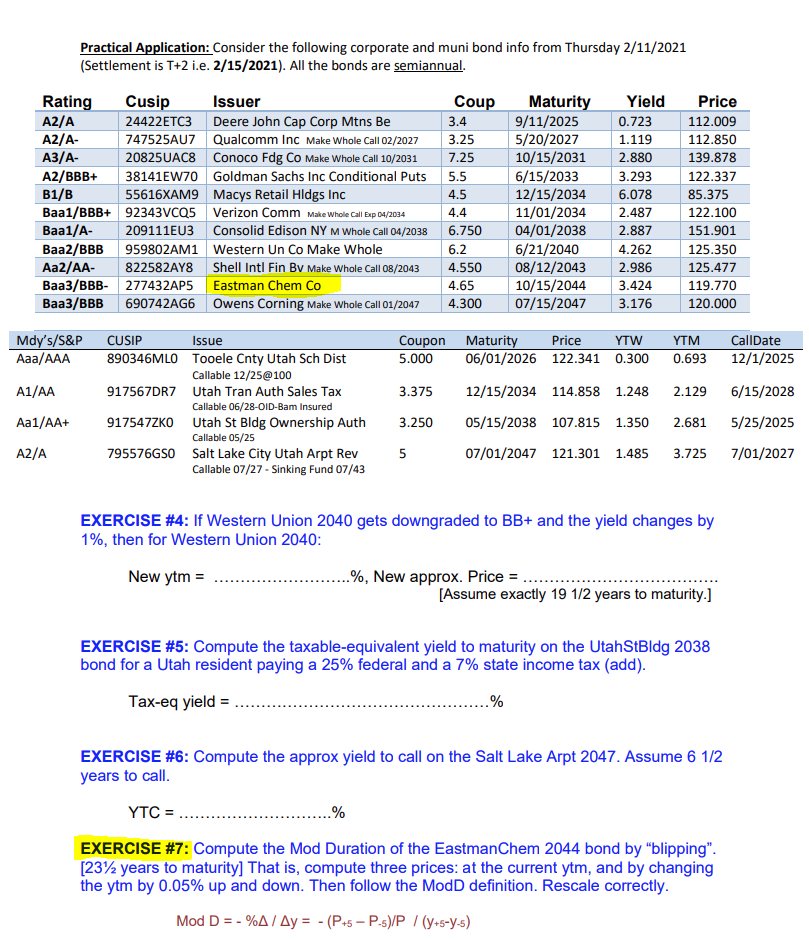

Practical Application: Consider the following corporate and muni bond info from Thursday

Settlement is T ie All the bonds are semiannual.

EXERCISE #: If Western Union gets downgraded to BB and the yield changes by

then for Western Union :

New

New approx. Price :

Assume exactly years to maturity.

EXERCISE #: Compute the taxableequivalent yield to maturity on the UtahStBldg

bond for a Utah resident paying a federal and a state income tax add

Taxeq yield

EXERCISE #: Compute the approx yield to call on the Salt Lake Arpt Assume

years to call.

EXERCISE #: Compute the Mod Duration of the EastmanChem bond by "blipping".

years to maturity That is compute three prices: at the current ytm and by changing

the ytm by up and down. Then follow the ModD definition. Rescale correctly.

ModD

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock