Question: I need help in solving the below 3 questions (possibly using ACC 310 methods) Thanks! 3. Assume a company pays delinquent property taxes totaling $3,000

I need help in solving the below 3 questions (possibly using ACC 310 methods) Thanks!

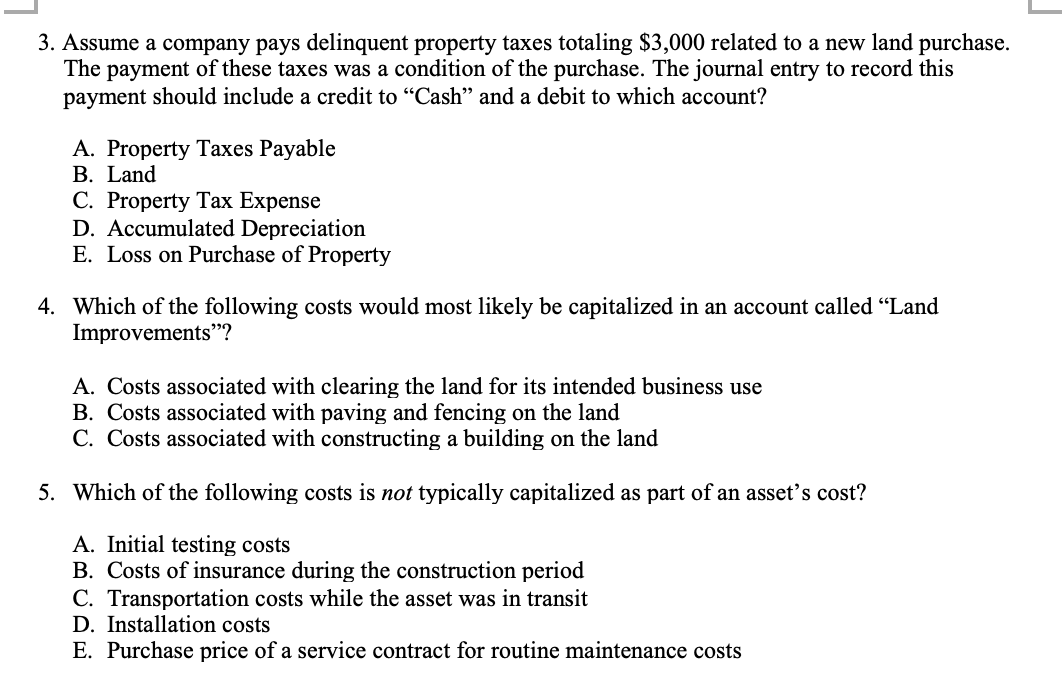

3. Assume a company pays delinquent property taxes totaling $3,000 related to a new land purchase The payment of these taxes was a condition of the purchase. The journal entry to record this payment should include a credit to "Cash" and a debit to which account? A. Property Taxes Payable B. Land C. Property Tax Expense D. Accumulated Depreciation E. Loss on Purchase of Property 4. Which of the following costs would most likely be capitalized in an account called "Land Improvements"? A. Costs associated with clearing the land for its intended business use B. Costs associated with paving and fencing on the land C. Costs associated with constructing a building on the land 5. Which of the following costs is not typically capitalized as part of an asset's cost? A. Initial testing costs B. Costs of insurance during the construction period C. Transportation costs while the asset was in transit D. Installation costs E. Purchase price of a service contract for routine maintenance costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts