Question: I need help in these questions. Please do them fast and accurate and correct, i have only 30 minutes Answer both part (A) and (B)

I need help in these questions. Please do them fast and accurate and correct, i have only 30 minutes

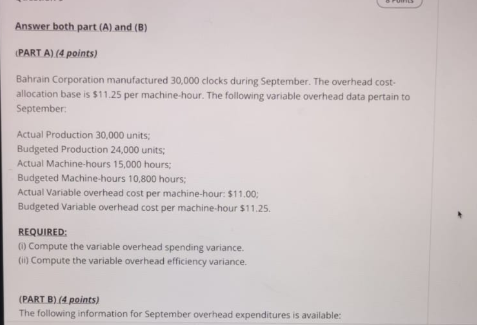

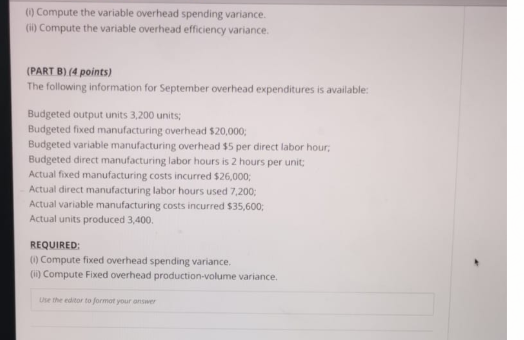

Answer both part (A) and (B) PART A) (4 points) Bahrain Corporation manufactured 30,000 clocks during September. The overhead cost- allocation base is $11.25 per machine hour. The following variable overhead data pertain to September Actual Production 30,000 units, Budgeted Production 24,000 units; Actual Machine-hours 15,000 hours: Budgeted Machine-hours 10,800 hours: Actual Variable overhead cost per machine-hour $11.00, Budgeted Variable overhead cost per machine hour $11.25 REQUIRED: Compute the variable overhead spending variance. (in) Compute the variable overhead efficiency variance. (PART B) (4 points) The following information for September overhead expenditures is available: (1) Compute the variable overhead spending variance. (1) Compute the variable overhead efficiency variance. (PART B) (4 points) The following information for September overhead expenditures is available: Budgeted output units 3,200 units; Budgeted fixed manufacturing overhead $20,000; Budgeted variable manufacturing overhead $5 per direct labor hour, Budgeted direct manufacturing labor hours is 2 hours per unit; Actual fixed manufacturing costs incurred $26,000; Actual direct manufacturing labor hours used 7,200; Actual variable manufacturing costs incurred $35,600; Actual units produced 3,400. REQUIRED: 0) Compute fixed overhead spending variance. (0) Compute Fixed overhead production-volume variance. Use the editor to formor your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts