Question: I need help in these two questions and also check the first one which i did You have just started a new job and are

I need help in these two questions and also check the first one which i did

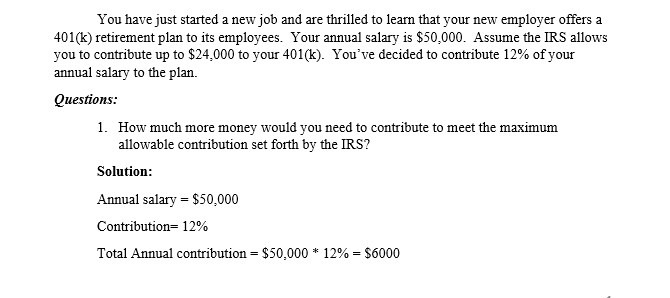

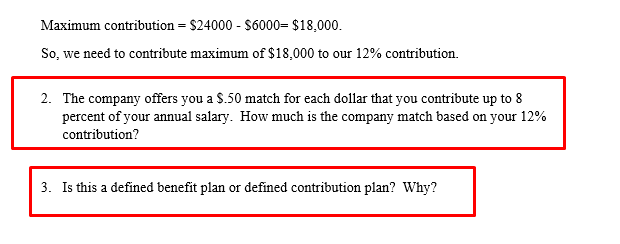

You have just started a new job and are thrilled to learn that your new employer offers a 401(k) retirement plan to its employees. Your annual salary is $50,000. Assume the IRS allows you to contribute up to $24,000 to your 401(k). You've decided to contribute 12% of your annual salary to the plan. Questions: 1. How much more money would you need to contribute to meet the maximum allowable contribution set forth by the IRS? Solution: Annual salary = $50,000 Contribution=12% Total Annual contribution = $50,000 * 12% = $6000 Maximum contribution = $24000 - $6000= $18,000. So, we need to contribute maximum of $18,000 to our 12% contribution. 2. The company offers you a $.50 match for each dollar that you contribute up to 8 percent of your annual salary. How much is the company match based on your 12% contribution? 3. Is this a defined benefit plan or defined contribution plan? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts