Question: i need help in this one please somebody thats all the info they give 3. The current share price of Rolls-Royce Holdings plc (RR.L) is

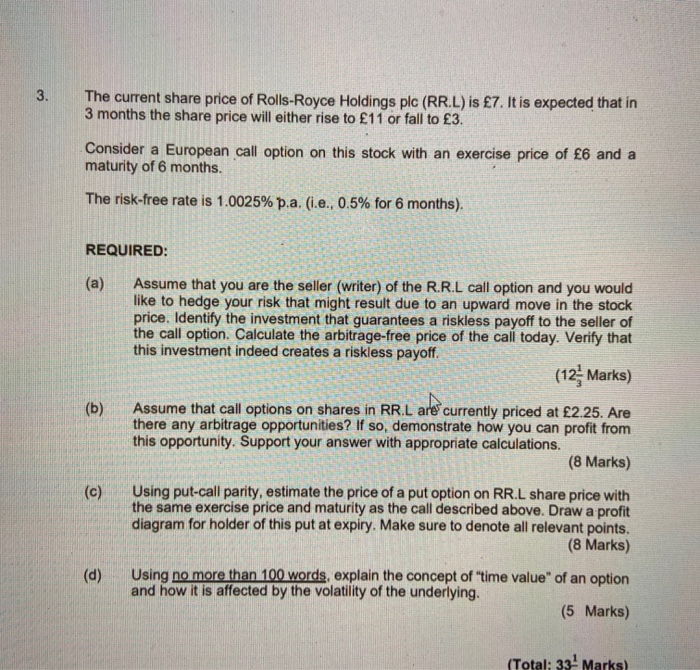

3. The current share price of Rolls-Royce Holdings plc (RR.L) is 7. It is expected that in 3 months the share price will either rise to 11 or fall to 3. Consider a European call option on this stock with an exercise price of 6 and a maturity of 6 months. The risk-free rate is 1.0025% p.a. (.e., 0.5% for 6 months). REQUIRED: (a) Assume that you are the seller (writer) of the R.R.L call option and you would like to hedge your risk that might result due to an upward move in the stock price. Identify the investment that guarantees a riskless payoff to the seller of the call option. Calculate the arbitrage-free price of the call today. Verify that this investment indeed creates a riskless payoff. (12. Marks) Assume that call options on shares in RR.L are currently priced at 2.25. Are there any arbitrage opportunities? If so, demonstrate how you can profit from this opportunity. Support your answer with appropriate calculations. (8 Marks) (b) (c) Using put-call parity, estimate the price of a put option on RR.L share price with the same exercise price and maturity as the call described above. Draw a profit diagram for holder of this put at expiry. Make sure to denote all relevant points. (8 Marks) Using no more than 100 words, explain the concept of time value of an option and how it is affected by the volatility of the underlying. (5 Marks) (d) (Total: 33 Marks) 3. The current share price of Rolls-Royce Holdings plc (RR.L) is 7. It is expected that in 3 months the share price will either rise to 11 or fall to 3. Consider a European call option on this stock with an exercise price of 6 and a maturity of 6 months. The risk-free rate is 1.0025% p.a. (.e., 0.5% for 6 months). REQUIRED: (a) Assume that you are the seller (writer) of the R.R.L call option and you would like to hedge your risk that might result due to an upward move in the stock price. Identify the investment that guarantees a riskless payoff to the seller of the call option. Calculate the arbitrage-free price of the call today. Verify that this investment indeed creates a riskless payoff. (12. Marks) Assume that call options on shares in RR.L are currently priced at 2.25. Are there any arbitrage opportunities? If so, demonstrate how you can profit from this opportunity. Support your answer with appropriate calculations. (8 Marks) (b) (c) Using put-call parity, estimate the price of a put option on RR.L share price with the same exercise price and maturity as the call described above. Draw a profit diagram for holder of this put at expiry. Make sure to denote all relevant points. (8 Marks) Using no more than 100 words, explain the concept of time value of an option and how it is affected by the volatility of the underlying. (5 Marks) (d) (Total: 33 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts