Question: I need help in this, Please do it correctly and do not make any mistake please. Please do it perfectly You have just started a

I need help in this, Please do it correctly and do not make any mistake please. Please do it perfectly

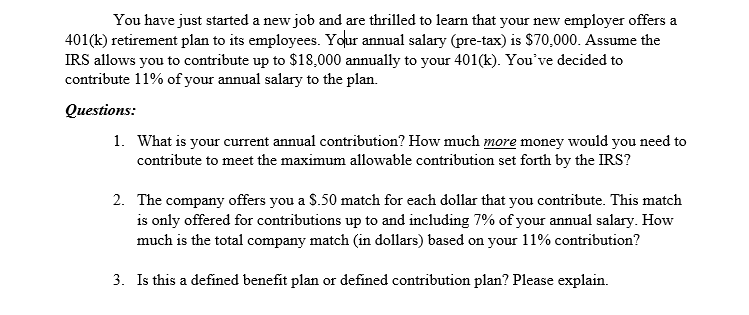

You have just started a new job and are thrilled to learn that your new employer offers a 401(k) retirement plan to its employees. Your annual salary (pre-tax) is $70,000. Assume the IRS allows you to contribute up to $18,000 annually to your 401(k). You've decided to contribute 11% of your annual salary to the plan. Questions: 1. What is your current annual contribution? How much more money would you need to contribute to meet the maximum allowable contribution set forth by the IRS? 2. The company offers you a $.50 match for each dollar that you contribute. This match is only offered for contributions up to and including 7% of your annual salary. How much is the total company match (in dollars) based on your 11% contribution? 3. Is this a defined benefit plan or defined contribution plan? Please explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts