Question: I need help in this question. Please do it correctly and 100% and do not make any mistake. 1 The partnership agreement of Angela and

I need help in this question. Please do it correctly and 100% and do not make any mistake.

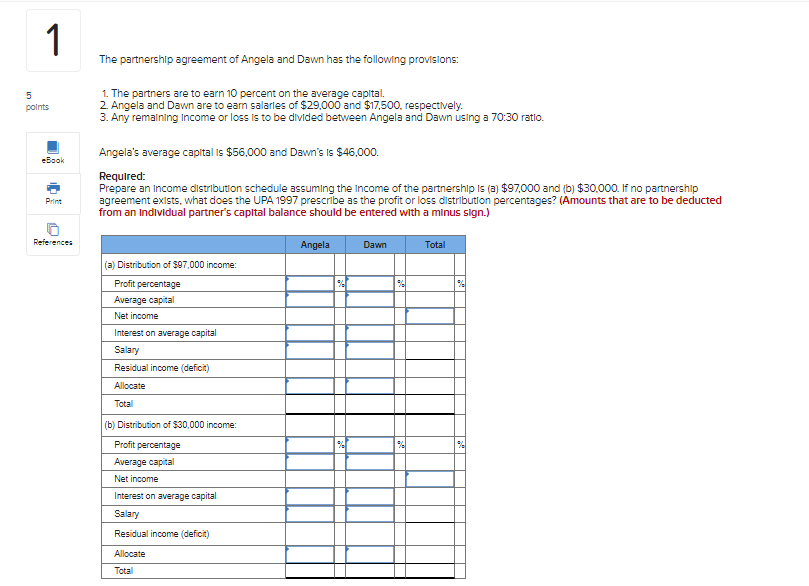

1 The partnership agreement of Angela and Dawn has the following provisions: 5 points 1. The partners are to earn 10 percent on the average capital. 2. Angela and Dawn are to eam salaries of $29,000 and $17.500, respectively. 3. Any remaining Income or loss is to be divided between Angela and Dawn using a 70:30 ratio. eBook Angela's average capital is $56,000 and Dawn's is $45,000. Required: Prepare an income distribution schedule assuming the income of the partnership is (a) $97.000 and (b) $30.000. If no partnership agreement exists, what does the UPA 1997 prescribe as the profit or loss distribution percentages? (Amounts that are to be deducted from an Individual partner's capital balance should be entered with a minus sign.) Print References Angela Dawn Total 40 (a) Distribution of $97.000 income: Profit percentage Average capital Net income Interest on average capital Salary Residual income (deficit) Allocate Total (6) Distribution of $30,000 income: Profit percentage Average capital Net income Interest on average capital Salary Residual income (deficit) Allocate Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts